Question: XYZ Ltd currently operates three projects. The each project is expected to generate a cash inflow every year forever. The cash inflows of each project

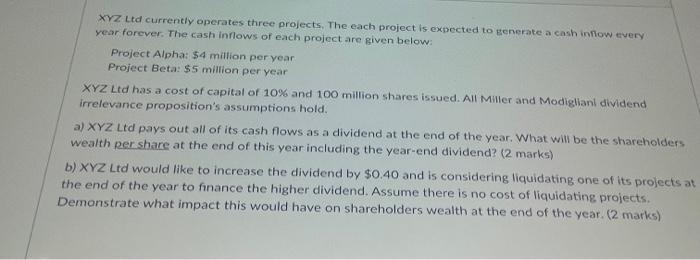

XYZ Ltd currently operates three projects. The each project is expected to generate a cash inflow every year forever. The cash inflows of each project are given below: Project Alpha: $4 million per year Project Beta: $5 million per year XYZ Ltd has a cost of capital of 10% and 100 million shares issued. All Miller and Modigliani dividend irrelevance proposition's assumptions hold. a) XYZ Ltd pays out all of its cash flows as a dividend at the end of the year. What will be the shareholders wealth per share at the end of this year including the year-end dividend? (2 marks) b) XYZ Ltd would like to increase the dividend by $0.40 and is considering liquidating one of its projects at the end of the year to finance the higher dividend. Assume there is no cost of liquidating projects. Demonstrate what impact this would have on shareholders wealth at the end of the year. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts