Question: ' XYZ Ltd plans to do a share offering for its expansion to the international market. The net amount required for the expansion is $46

'

'

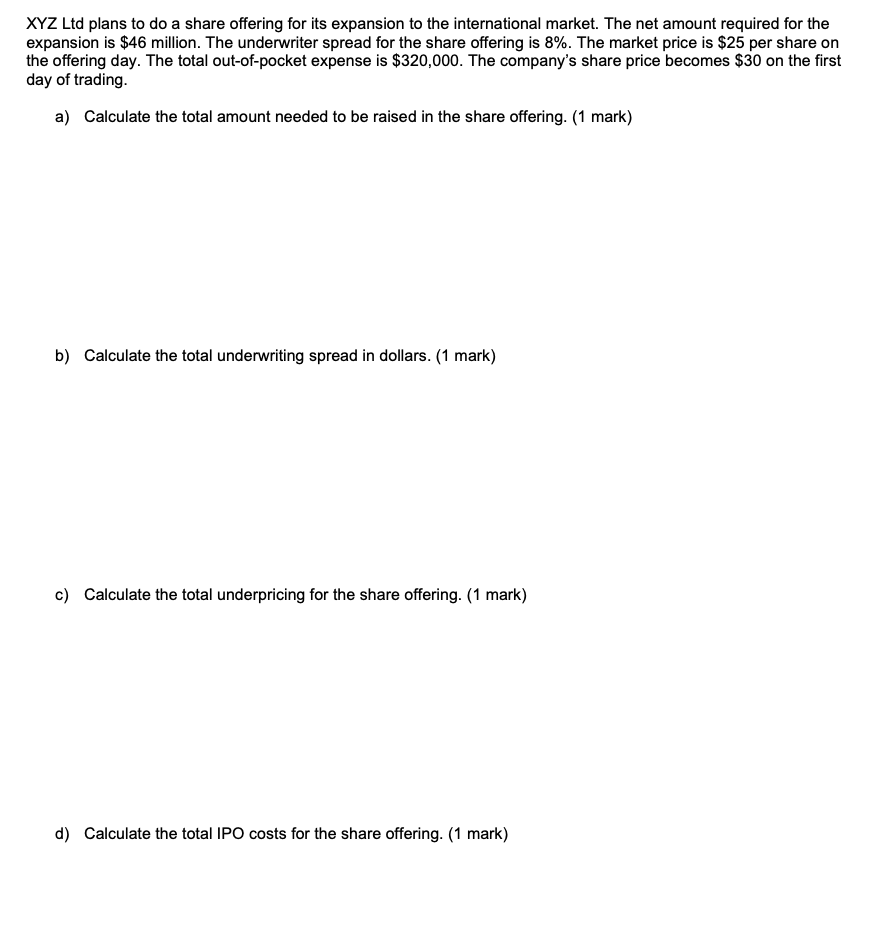

XYZ Ltd plans to do a share offering for its expansion to the international market. The net amount required for the expansion is $46 million. The underwriter spread for the share offering is 8%. The market price is $25 per share on the offering day. The total out-of-pocket expense is $320,000. The company's share price becomes $30 on the first day of trading. a) Calculate the total amount needed to be raised in the share offering. (1 mark) b) Calculate the total underwriting spread in dollars. (1 mark) c) Calculate the total underpricing for the share offering. (1 mark) d) Calculate the total IPO costs for the share offering. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts