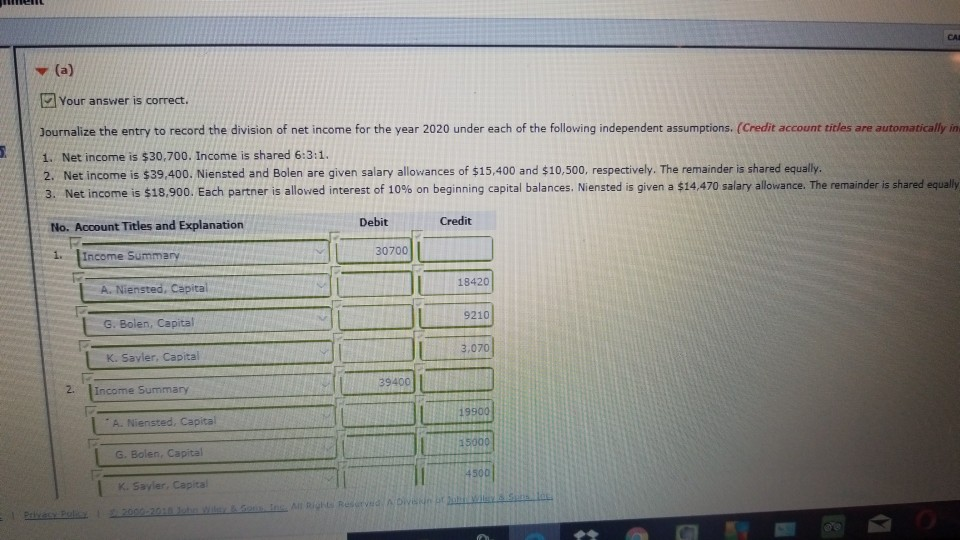

Question: y (a) Your answer is correct. Journalize the entry to record the division of net income for the year 2020 under each of the following

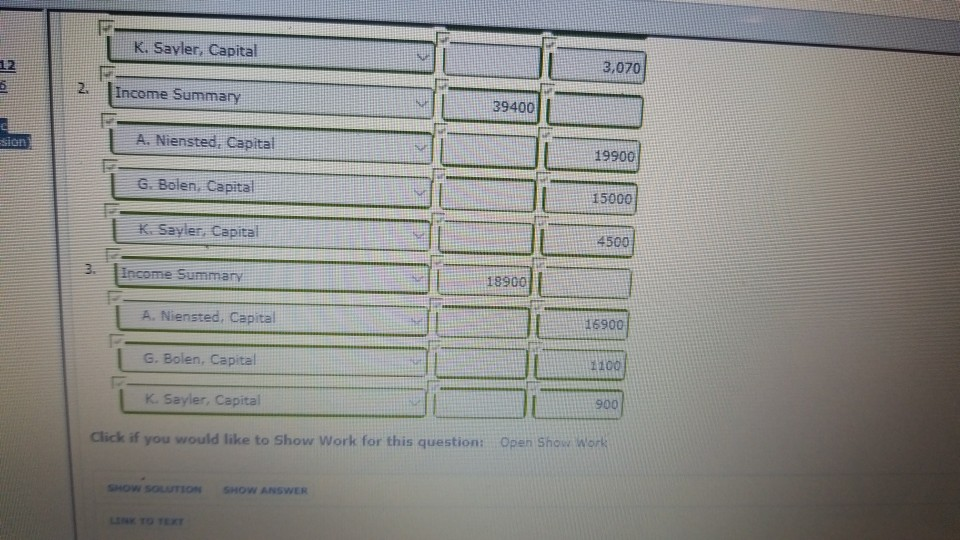

y (a) Your answer is correct. Journalize the entry to record the division of net income for the year 2020 under each of the following independent assumptions. (Credit account titles are automatically in 1. Net income is $30,700. Income is shared 6:3:1 2. Net income is $39,400. Niensted and Bolen are given salary allowances of $15,400 and $10,500, respectively. The remainder is shared equally. 3. Net income is $18.900. Each partner is allowed interest of 10% on beginning capital ba ances es e S given a S 4 470 s y elo an e The emai ders share equal No. Account Titles and Explanation Debit Credit 1. Income Summary 30700 A. Niensted, Capital G. Bolen, Capital K. Savler, Capital 18420 9210 3,070 2. Income Summary 39400 19900 A. Niensted, Capita G. Bolen, Capital K. Sayler, Capital 15000 4500 Rights Re K. Savler, Capital 3,070 12 2 Income Summary 39400 19e A. Niensted, Capital G, Bolen, Capital K Sayler, Capita 19900 sion 15000 4500 3. Income Summary 18900 16900 A. Niensted, Capital G. Bolen, Capital K. Sayler, Capital 1100 900 Open Show Work Click if you would like to Show Work for this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts