Question: Y ou are evaluating two mutually exclusive projects with the following net cash flows: Project X Project Y Year Cash Flow Cash Flow 0 -$

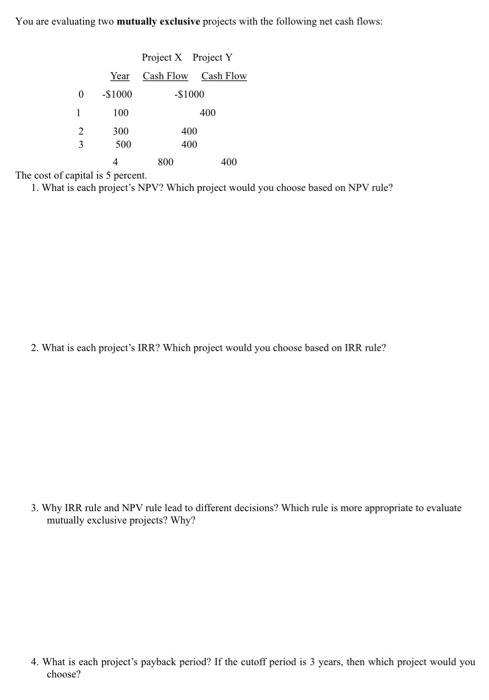

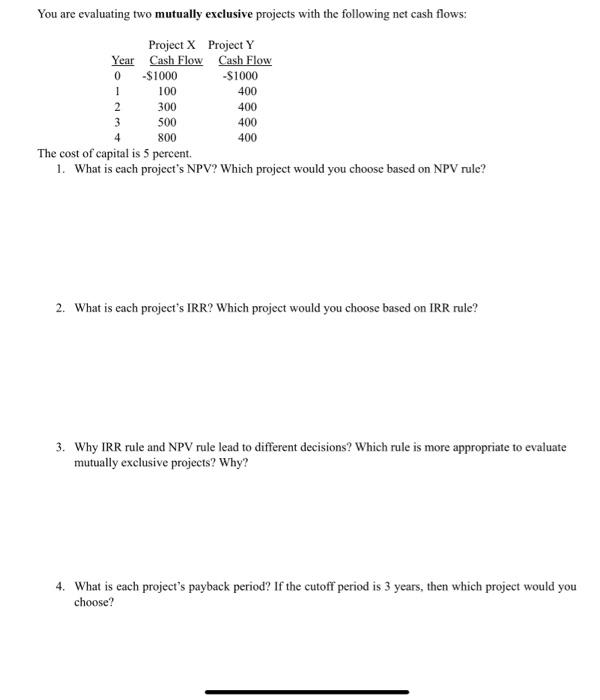

You are evaluating two mutually exclusive projects with the following net cash flows:

Project X Project Y

Year Cash Flow Cash Flow

0 -$1000 -$1000

1 100 400

2 300 400

3 500 400

4 800 400

The cost of capital is 5 percent.

You are evaluating two mutually exclusive projects with the following net cash flows: Project X Project Y Year Cash Flow Cash Flow 0 -S1000 -S1000 1 100 400 2 300 400 3 500 400 800 400 The cost of capital is 5 percent. 1. What is each project's NPV? Which project would you choose based on NPV rule? 4 2. What is each project's IRR? Which project would you choose based on IRR rule? 3. Why IRR rule and NPV rule lead to different decisions? Which rule is more appropriate to evaluate mutually exclusive projects? Why? 4. What is each project's payback period? If the cutoff period is 3 years, then which project would you choose? You are evaluating two mutually exclusive projects with the following net cash flows: Project X Project Y Year Cash Flow Cash Flow 0 -$1000 -$1000 1 100 400 2 300 400 3 500 400 800 400 The cost of capital is 5 percent. 1. What is cach project's NPV? Which project would you choose based on NPV rule? 4 2. What is each project's IRR? Which project would you choose based on IRR rule? 3. Why IRR rule and NPV rule lead to different decisions? Which rule is more appropriate to evaluate mutually exclusive projects? Why? 4. What is each project's payback period? If the cutoff period is 3 years, then which project would you choose

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts