Question: y work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return

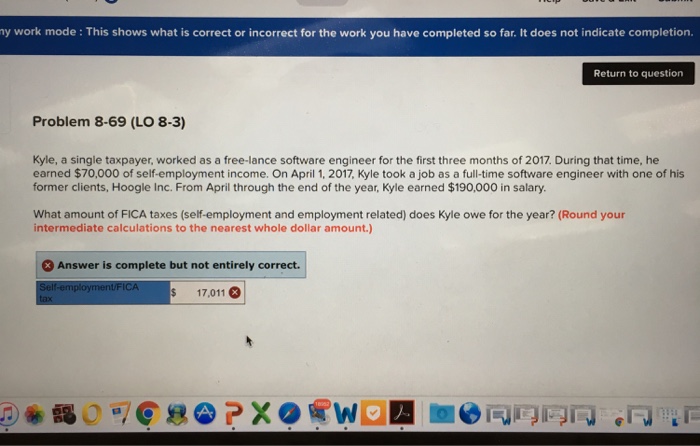

y work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Return to question Problem 8-69 (LO 8-3) Kyle, a single taxpayer, worked as a free-lance software engineer for the first three months of 2017. During that time, he earned $70,000 of self-employment income. On April 1, 2017, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Inc. From April through the end of the year, Kyle earned $190,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? (Round your intermediate calculations to the nearest whole dollar amount.) 3 Answer is complete but not entirely correct. 17,011 @ @?Xe w n . .i

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts