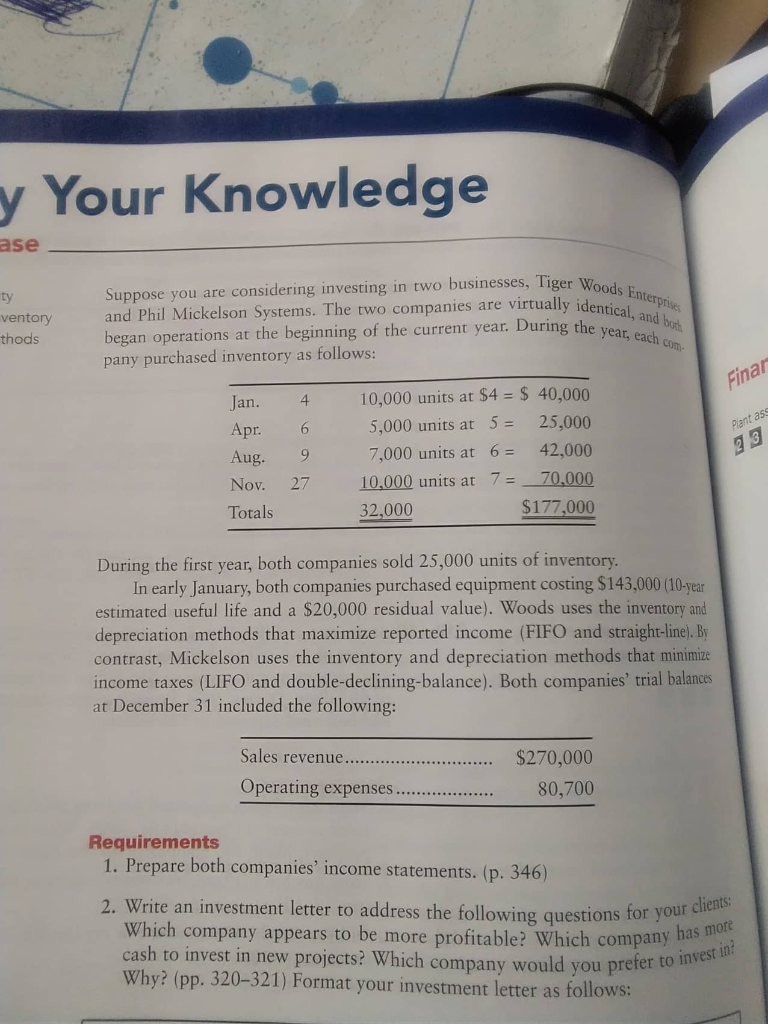

Question: y Your Knowledge ase ty ventory thods Suppose you are considering investing in two businesses, Tiger W and Phil Mickelson Systems. The two companies are

y Your Knowledge ase ty ventory thods Suppose you are considering investing in two businesses, Tiger W and Phil Mickelson Systems. The two companies are virtually iden began operations at the beginning of the current year. During the pany purchased inventory as follows identical, and bo year, each com Finar Jan. 4 10,000 units at $4 S 40,000 Apr. 6 Aug. 9 Nov. 27 10,000 units at 7-70.000 Totals 5,000 units at 525,000 7,000 units at 6 42,000 3 32,000 $177,000 During the first year, both companies sold 25,000 units of inventory In early January, both companies purchased equipment costing $143,000 (10-year estimated useful life and a $20,000 residual value). Woods uses the inventory and depreciation methods that maximize reported income (FIFO and straight-line). By contrast, Mickelson uses the inventory and depreciation methods that minimize income taxes (LIFO and double-declining-balance). Both companies' trial balances at December 31 included the following: $270,000 1. Prepare both companies' income statements. (p. 346) 2. Write an investment letter to address the following questions for yo hent letter to address the following questions for yo Which company appears to be more profitable? Which company has cash to invest in new projects? Which company would you prefer to Why? (pp. 320-321) Format your investment letter as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts