Question: Y4-7 Please answer clearly and quickly - Thank you! Required information [The following information applies to the questions displayed below.] Porto's Bakery installs a computerized

Y4-7

![following information applies to the questions displayed below.] Porto's Bakery installs a](https://s3.amazonaws.com/si.experts.images/answers/2024/07/66a27b26a3030_39066a27b2641e92.jpg)

Please answer clearly and quickly - Thank you!

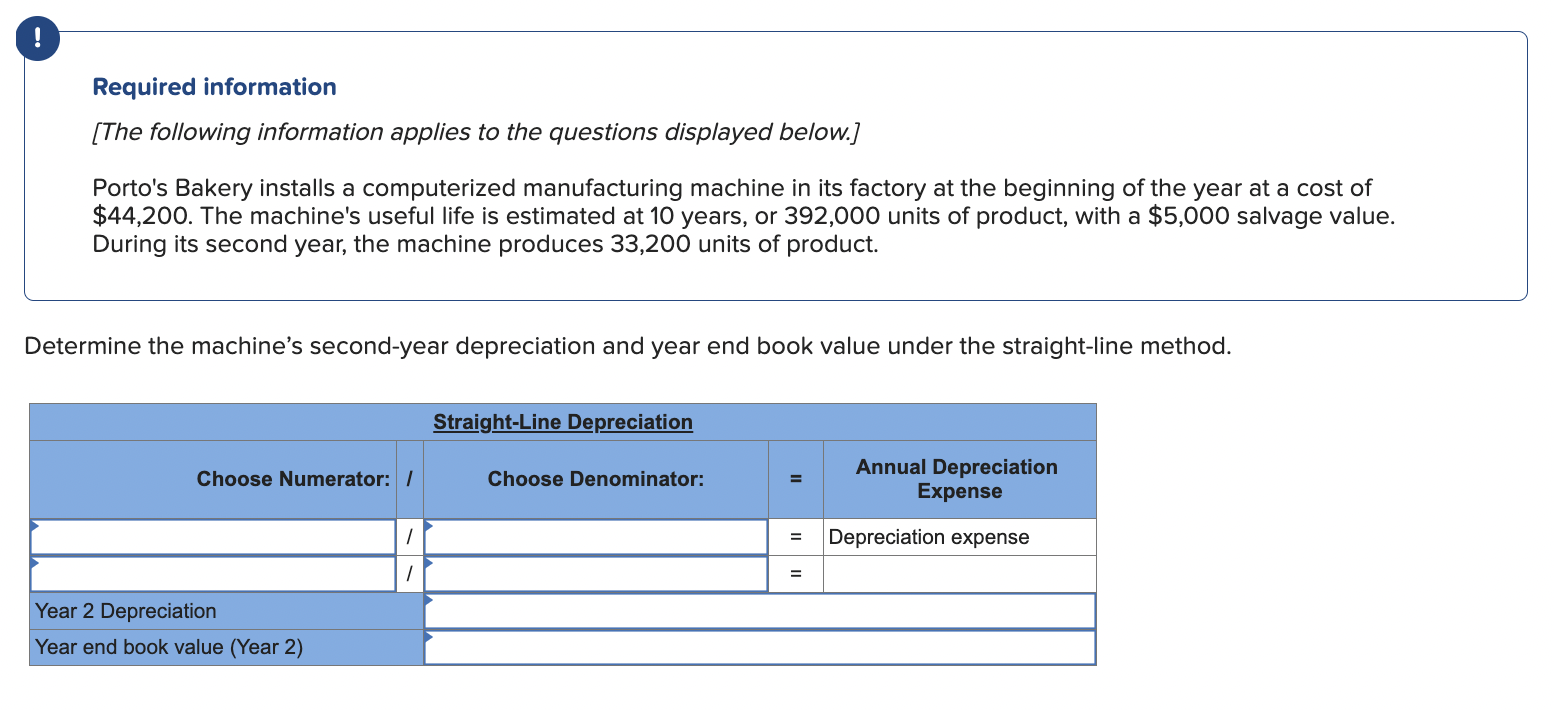

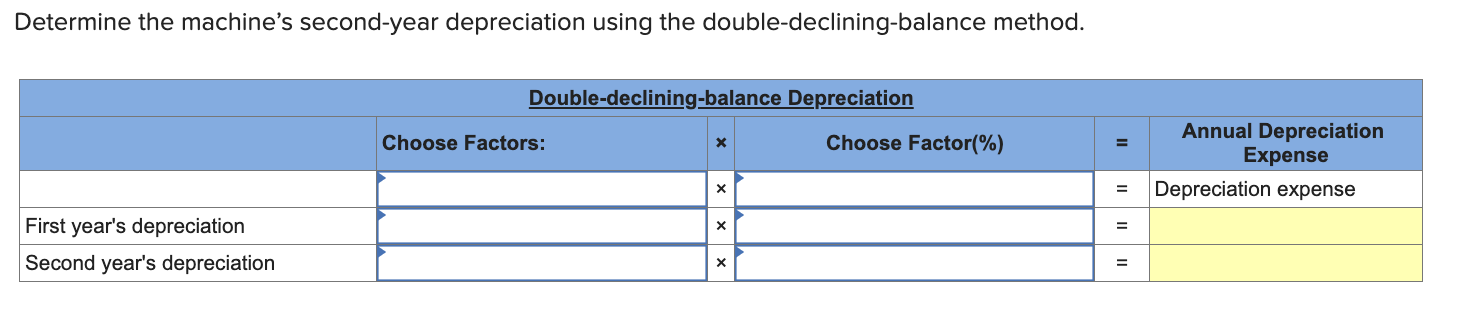

Required information [The following information applies to the questions displayed below.] Porto's Bakery installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $44,200. The machine's useful life is estimated at 10 years, or 392,000 units of product, with a $5,000 salvage value. During its second year, the machine produces 33,200 units of product. etermine the machine's second-year depreciation and year end book value under the straight-line method. Determine the machine's second-year depreciation using the units-of-production method. Determine the machine's second-year depreciation using the double-declining-balance method. \begin{tabular}{|l|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Double-declining-balance Depreciation } \\ & Choose Factors: & & Choose Factor(\%) & = & AnnualDepreciationExpense \\ \hline & & & & Depreciation expense \\ \hline & & & & \\ \hline First year's depreciation & & & & \\ \hline Second year's depreciation & & & \\ \hline \end{tabular} Required information [The following information applies to the questions displayed below.] Porto's Bakery installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $44,200. The machine's useful life is estimated at 10 years, or 392,000 units of product, with a $5,000 salvage value. During its second year, the machine produces 33,200 units of product. etermine the machine's second-year depreciation and year end book value under the straight-line method. Determine the machine's second-year depreciation using the units-of-production method. Determine the machine's second-year depreciation using the double-declining-balance method. \begin{tabular}{|l|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ Double-declining-balance Depreciation } \\ & Choose Factors: & & Choose Factor(\%) & = & AnnualDepreciationExpense \\ \hline & & & & Depreciation expense \\ \hline & & & & \\ \hline First year's depreciation & & & & \\ \hline Second year's depreciation & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts