Question: Y8 Problem 2: The records for Tiger Corp. show these data for 2026: Financial income before tax is $945,000. . Tax-exempt interest of $12,000 was

Y8

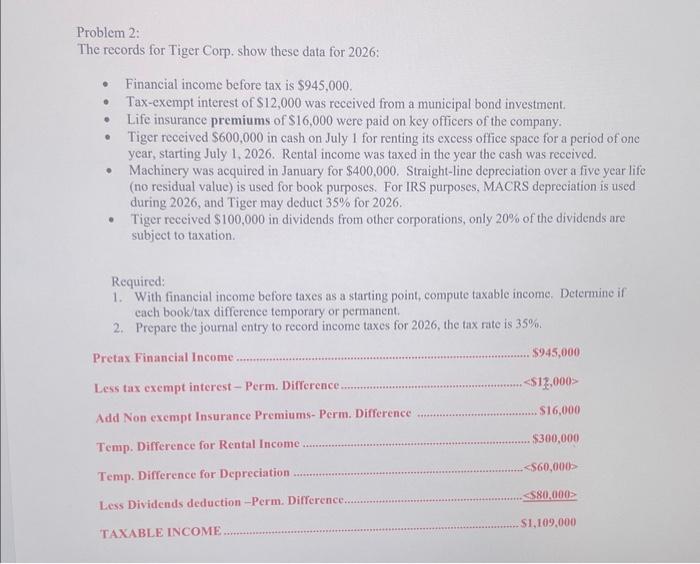

Problem 2: The records for Tiger Corp. show these data for 2026: Financial income before tax is $945,000. . Tax-exempt interest of $12,000 was received from a municipal bond investment. . Life insurance premiums of $16,000 were paid on key officers of the company. Tiger received $600,000 in cash on July 1 for renting its excess office space for a period of one year, starting July 1, 2026. Rental income was taxed in the year the cash was received. Machinery was acquired in January for $400.000. Straight-line depreciation over a five year life (no residual value) is used for book purposes. For IRS purposes, MACRS depreciation is used during 2026, and Tiger may deduct 35% for 2026. . Tiger received $100,000 in dividends from other corporations, only 20% of the dividends are subject to taxation. Required: 1. With financial income before taxes as a starting point, compute taxable income. Determine if each book/tax difference temporary or permanent. 2. Prepare the journal entry to record income taxes for 2026, the tax rate is 35%. Pretax Financial Income.... team. $945,000 Less tax exempt interest - Perm. Difference.......... .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts