Question: Y9 It seems the already existing solution to this question has some errors regarding the use of semi-annual rates. Please can I get a clear

Y9

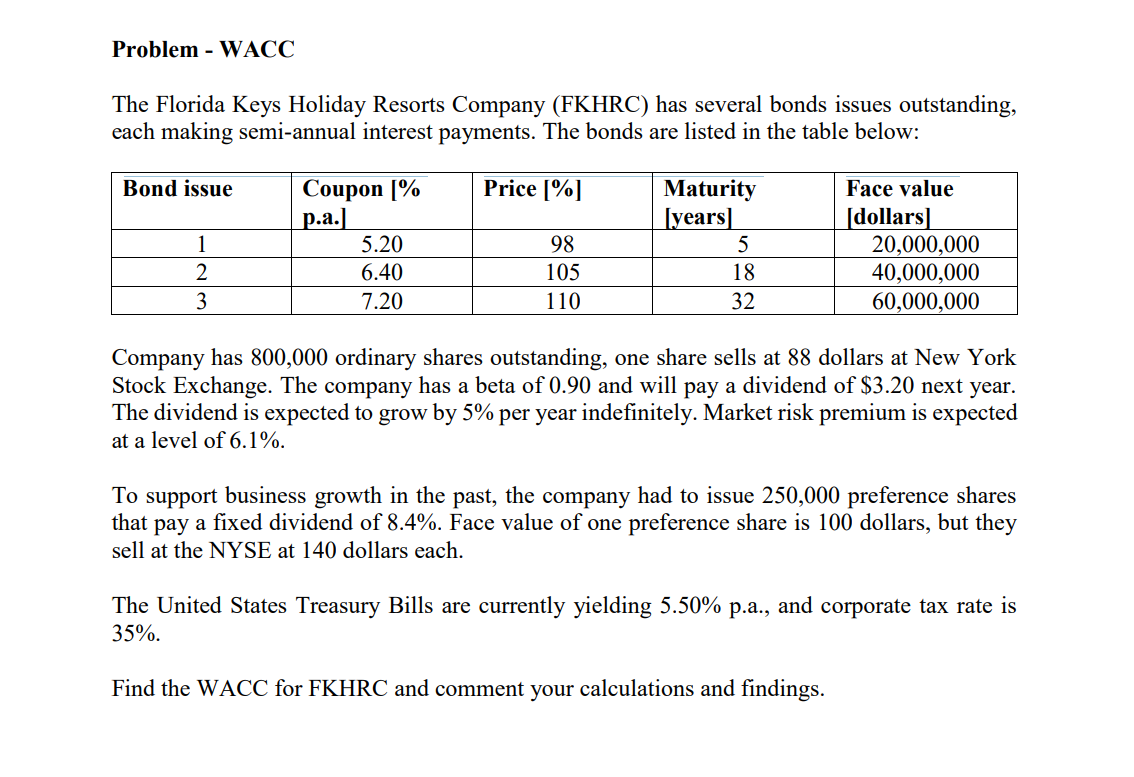

It seems the already existing solution to this question has some errors regarding the use of semi-annual rates. Please can I get a clear solution with explanation?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock