Question: Yabba Dabba Do Case Homework- Please help, I would greatly appreciate it and will definitely rate you!!! Account Options Journal Entry Format CORRECTED TRIAL BALANCE

Yabba Dabba Do Case Homework- Please help, I would greatly appreciate it and will definitely rate you!!!

Account Options

Journal Entry Format

Journal Entry Format

CORRECTED TRIAL BALANCE FOR ADJUSTING JOURNAL ENTRY HELP!!!

CORRECTED TRIAL BALANCE FOR ADJUSTING JOURNAL ENTRY HELP!!!

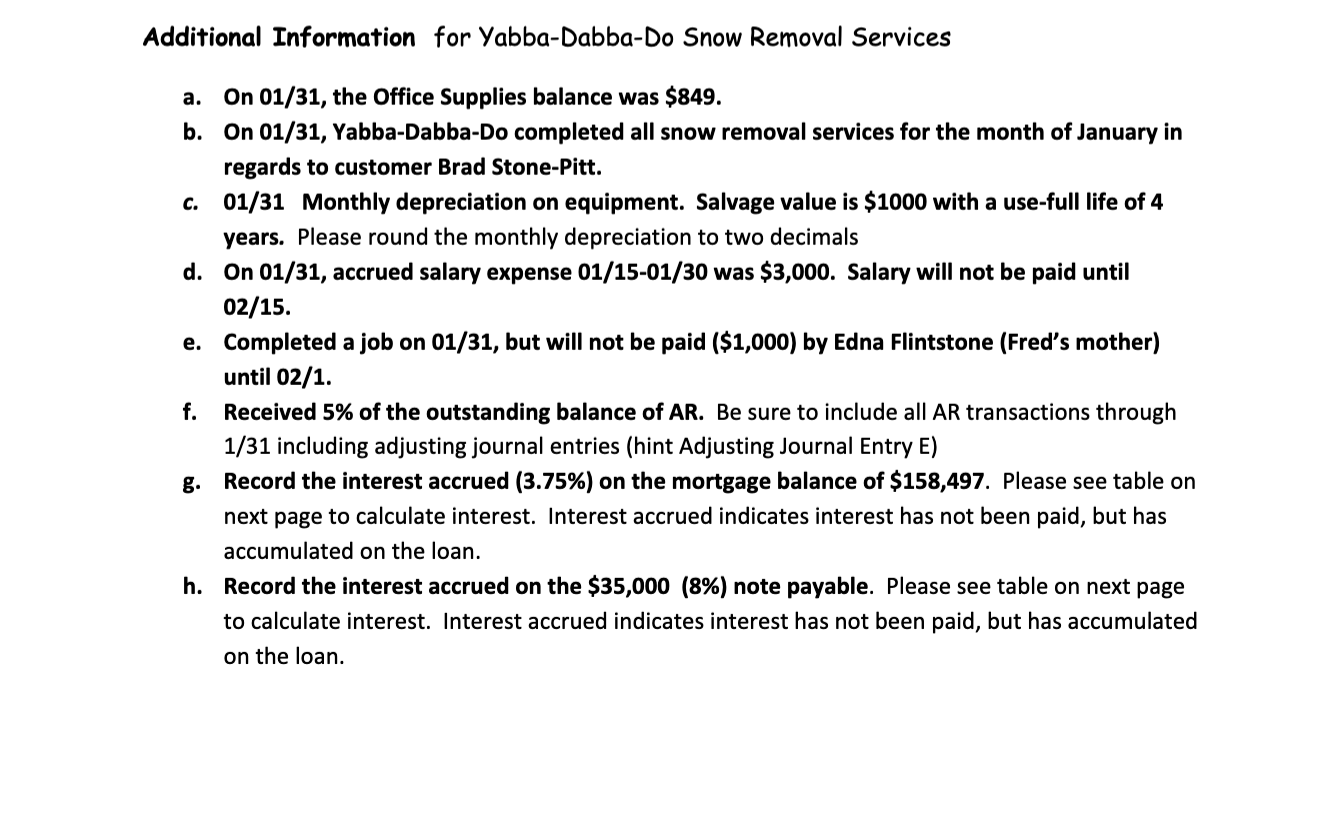

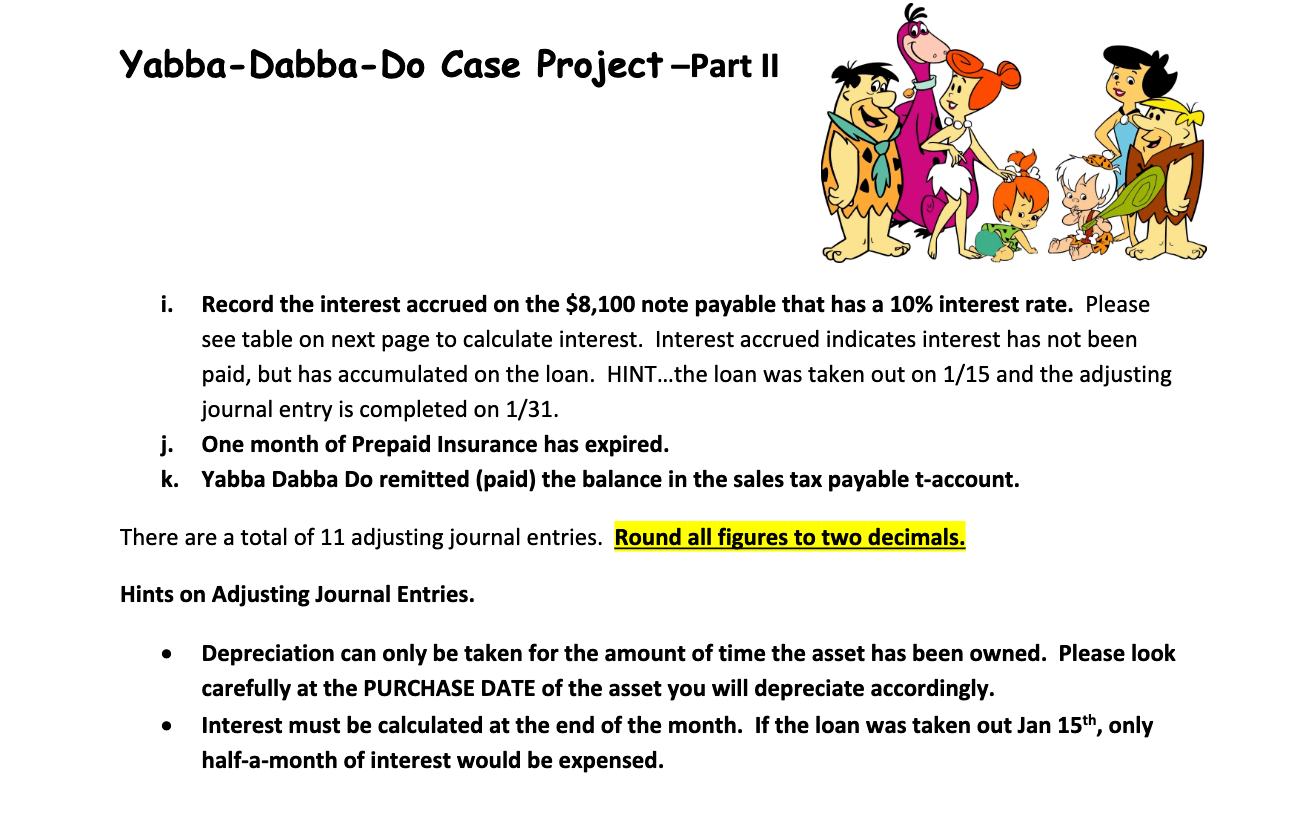

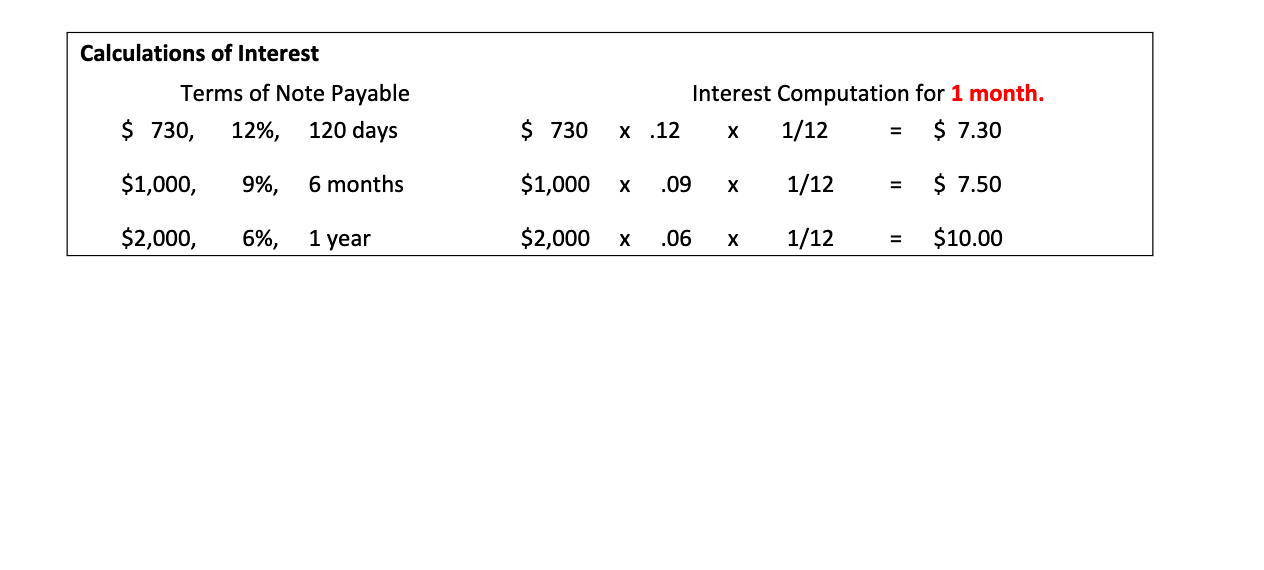

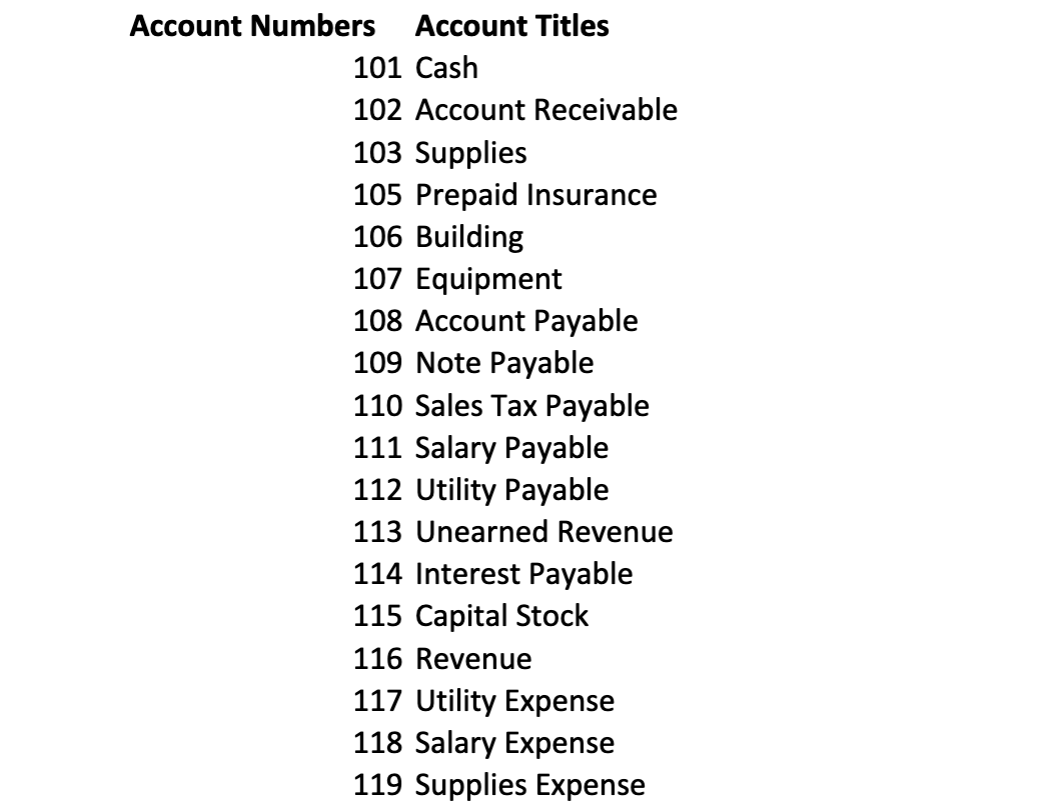

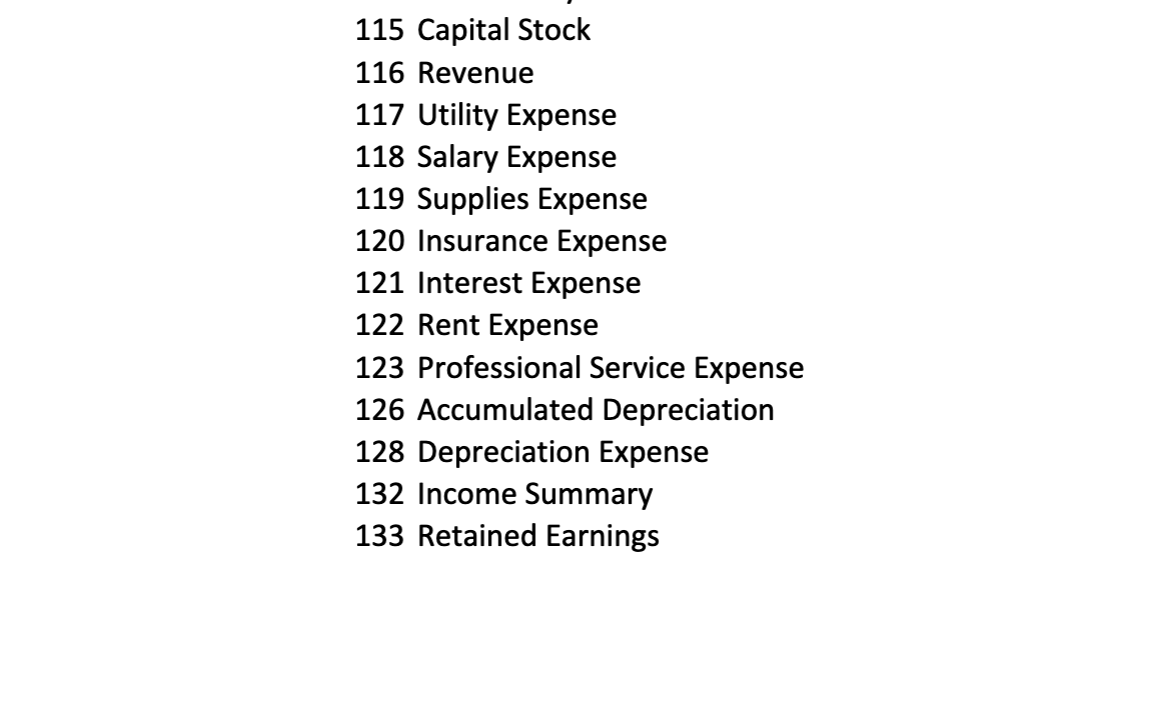

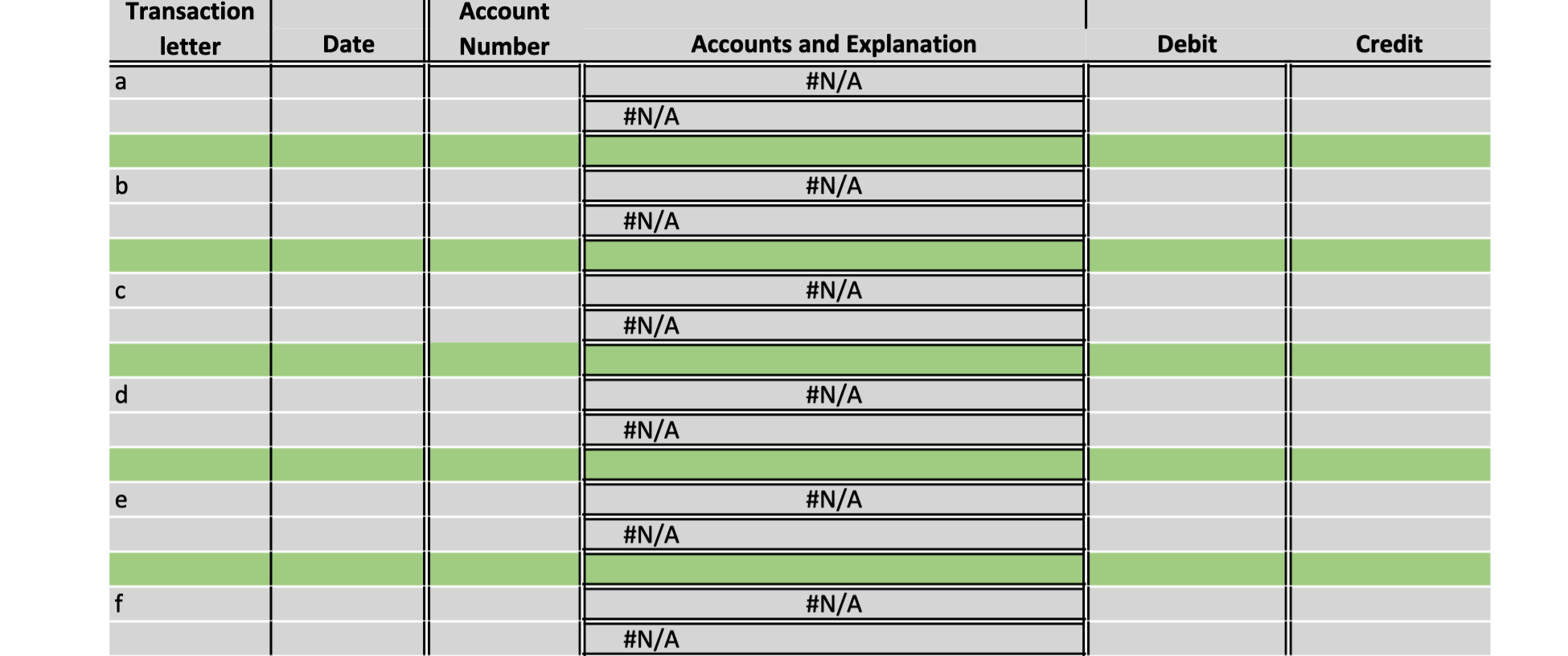

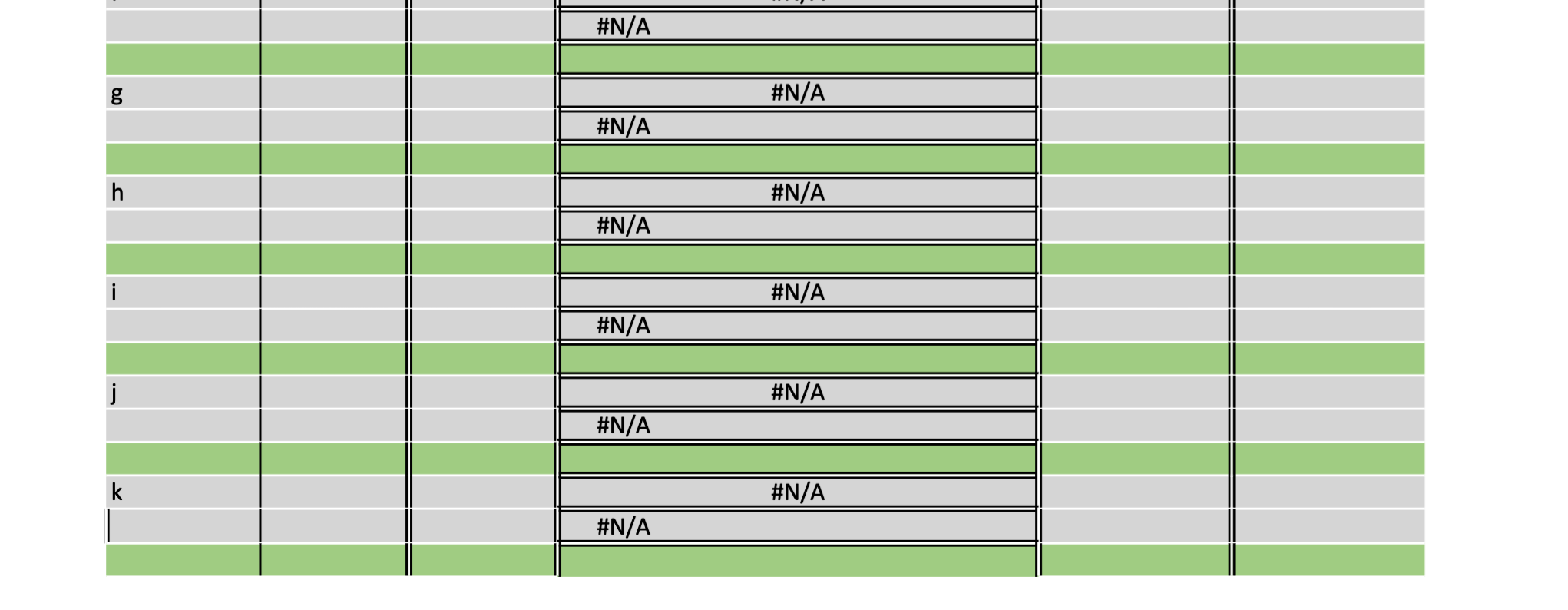

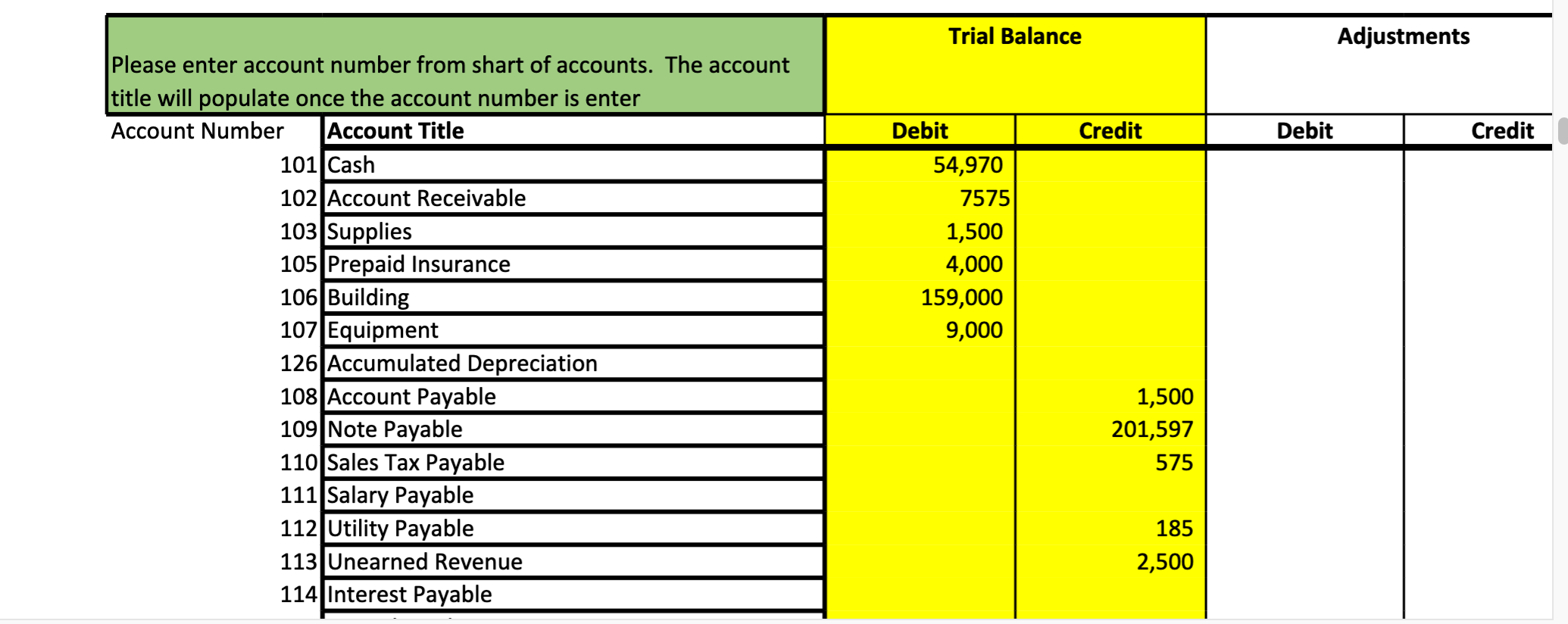

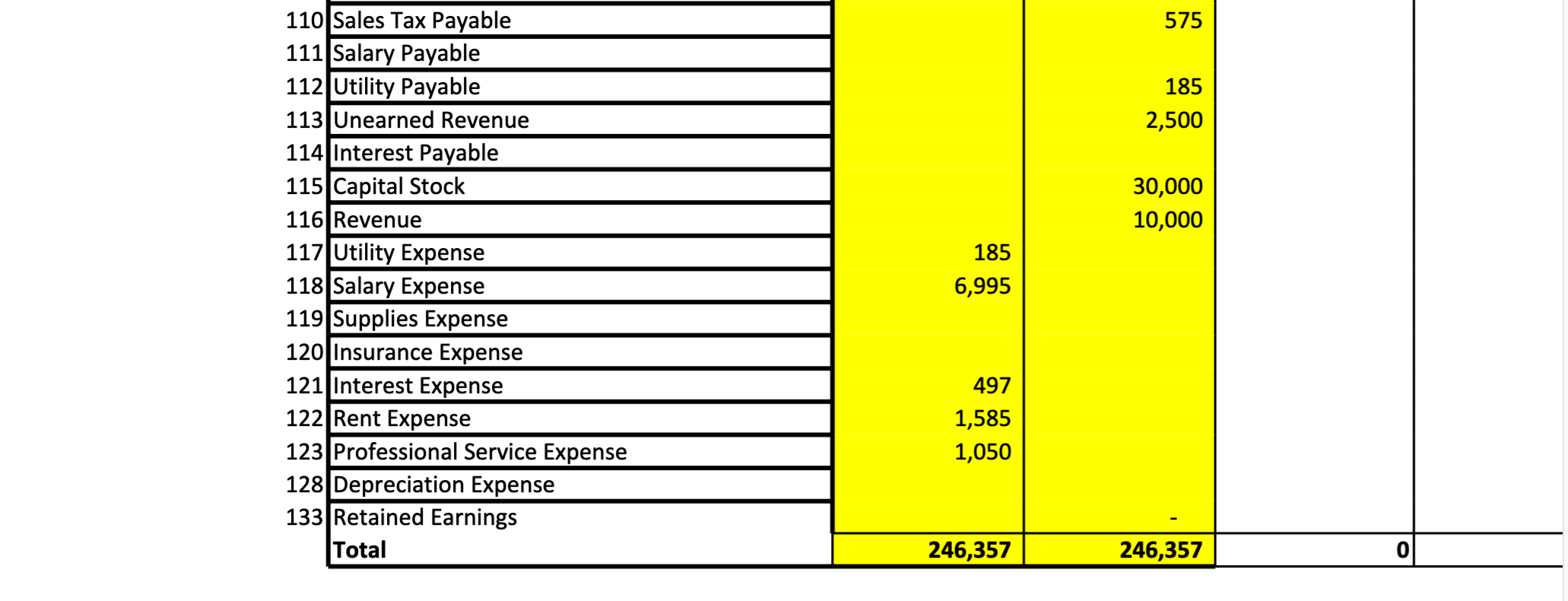

Yabba-Dabba-Do Case Project -Part II REQUIREMENTS: 1. Complete adjusting journal entries FOR THE MONTH OF JANUARY. Descriptions are not needed. 2. Update T-Accounts with adjusting journal entries. Please balance the T-accounts (again) after you post the adjusting journal entries. 3. Create an Adjusted Trial Balance FOR THE MONTH OF JANUARY 4. Prepare the Financial Statements (Income Statement, Statement of Retained Earnings, and CLASSIFIED Balance Sheet) FOR THE MONTH OF JANUARY. Please format correctly and use examples from your book. 5. Write the Closing Entries & Update T-Accounts 6. Please round to two decimals. 7. Steps 1-9 must be completed in Excel template located on Canvas Additional Information for Yabba-Dabba-Do Snow Removal Services a. On 01/31, the Office Supplies balance was $849. b. On 01/31, Yabba-Dabba-Do completed all snow removal services for the month of January in regards to customer Brad Stone-Pitt. C. 01/31 Monthly depreciation on equipment. Salvage value is $1000 with a use-full life of 4 years. Please round the monthly depreciation to two decimals d. On 01/31, accrued salary expense 01/15-01/30 was $3,000. Salary will not be paid until 02/15. e. Completed a job on 01/31, but will not be paid ($1,000) by Edna Flintstone (Fred's mother) until 02/1. f. Received 5% of the outstanding balance of AR. Be sure to include all AR transactions through 1/31 including adjusting journal entries (hint Adjusting Journal Entry E) g. Record the interest accrued (3.75%) on the mortgage balance of $158,497. Please see table on next page to calculate interest. Interest accrued indicates interest has not been paid, but has accumulated on the loan. h. Record the interest accrued on the $35,000 (8%) note payable. Please see table on next page to calculate interest. Interest accrued indicates interest has not been paid, but has accumulated on the loan. Yabba-Dabba-Do Case Project -Part II i. Record the interest accrued on the $8,100 note payable that has a 10% interest rate. Please see table on next page to calculate interest. Interest accrued indicates interest has not been paid, but has accumulated on the loan. HINT...the loan was taken out on 1/15 and the adjusting journal entry is completed on 1/31. j. One month of Prepaid Insurance has expired. k. Yabba Dabba Do remitted (paid) the balance in the sales tax payable t-account. There are a total of 11 adjusting journal entries. Round all figures to two decimals. Hints on Adjusting Journal Entries. Depreciation can only be taken for the amount of time the asset has been owned. Please look carefully at the PURCHASE DATE of the asset you will depreciate accordingly. Interest must be calculated at the end of the month. If the loan was taken out Jan 15th, only half-a-month of interest would be expensed. Calculations of Interest Terms of Note Payable $ 730, 12%, 120 days Interest Computation for 1 month. 1/12 $ 7.30 $ 730 X .12 $1,000, 9%, 6 months $1,000 .09 1/12 = $ 7.50 $2,000, 6%, 1 year $2,000 X .06 1/12 $10.00 Account Numbers Account Titles 101 Cash 102 Account Receivable 103 Supplies 105 Prepaid Insurance 106 Building 107 Equipment 108 Account Payable 109 Note Payable 110 Sales Tax Payable 111 Salary Payable 112 Utility Payable 113 Unearned Revenue 114 Interest Payable 115 Capital Stock 116 Revenue 117 Utility Expense 118 Salary Expense 119 Supplies Expense 115 Capital Stock 116 Revenue 117 Utility Expense 118 Salary Expense 119 Supplies Expense 120 Insurance Expense 121 Interest Expense 122 Rent Expense 123 Professional Service Expense 126 Accumulated Depreciation 128 Depreciation Expense 132 Income Summary 133 Retained Earnings Transaction letter Account Number Date Debit Credit Accounts and Explanation #N/A a #N/A b #N/A #N/A #N/A #N/A d #N/A #N/A #N/A #N/A f #N/A #N/A #N/A g #N/A #N/A h. #N/A #N/A i #N/A #N/A j #N/A #N/A k #N/A #N/A Trial Balance Adjustments Credit Debit Credit Please enter account number from shart of accounts. The account title will populate once the account number is enter Account Number Account Title 101 Cash 102 Account Receivable 103 Supplies 105 Prepaid Insurance 106 Building 107 Equipment 126 Accumulated Depreciation 108 Account Payable 109 Note Payable 110 Sales Tax Payable 111 Salary Payable 112 Utility Payable 113 Unearned Revenue 114 Interest Payable Debit 54,970 7575 1,500 4,000 159,000 9,000 1,500 201,597 575 185 2,500 575 185 2,500 30,000 10,000 110 Sales Tax Payable 111 Salary Payable 112 Utility Payable 113 Unearned Revenue 114|Interest Payable 115 Capital Stock 116 Revenue 117 Utility Expense 118 Salary Expense 119 Supplies Expense 120 Insurance Expense 121 Interest Expense 122 Rent Expense 123 Professional Service Expense 128 Depreciation Expense 133 Retained Earnings Total 185 6,995 497 1,585 1,050 246,357 246,357 0 Please create your own T-accounts on this page. Yabba Dabba Do Snow Removal Yabba Dabba Do Snow Removal Income Statement Month End January 31, 2022 Statement of Retained Earnings Month End January 31, 2022 Yabba Dabba Do Snow Removal Balance Sheet January 31, 2022 Date Debit Credit Account Number Accounts and Explanation #N/A #N/A To close Revenue #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A To Close Expense Accounts #N/A #N/A To Close Income Summary Yabba-Dabba-Do Case Project -Part II REQUIREMENTS: 1. Complete adjusting journal entries FOR THE MONTH OF JANUARY. Descriptions are not needed. 2. Update T-Accounts with adjusting journal entries. Please balance the T-accounts (again) after you post the adjusting journal entries. 3. Create an Adjusted Trial Balance FOR THE MONTH OF JANUARY 4. Prepare the Financial Statements (Income Statement, Statement of Retained Earnings, and CLASSIFIED Balance Sheet) FOR THE MONTH OF JANUARY. Please format correctly and use examples from your book. 5. Write the Closing Entries & Update T-Accounts 6. Please round to two decimals. 7. Steps 1-9 must be completed in Excel template located on Canvas Additional Information for Yabba-Dabba-Do Snow Removal Services a. On 01/31, the Office Supplies balance was $849. b. On 01/31, Yabba-Dabba-Do completed all snow removal services for the month of January in regards to customer Brad Stone-Pitt. C. 01/31 Monthly depreciation on equipment. Salvage value is $1000 with a use-full life of 4 years. Please round the monthly depreciation to two decimals d. On 01/31, accrued salary expense 01/15-01/30 was $3,000. Salary will not be paid until 02/15. e. Completed a job on 01/31, but will not be paid ($1,000) by Edna Flintstone (Fred's mother) until 02/1. f. Received 5% of the outstanding balance of AR. Be sure to include all AR transactions through 1/31 including adjusting journal entries (hint Adjusting Journal Entry E) g. Record the interest accrued (3.75%) on the mortgage balance of $158,497. Please see table on next page to calculate interest. Interest accrued indicates interest has not been paid, but has accumulated on the loan. h. Record the interest accrued on the $35,000 (8%) note payable. Please see table on next page to calculate interest. Interest accrued indicates interest has not been paid, but has accumulated on the loan. Yabba-Dabba-Do Case Project -Part II i. Record the interest accrued on the $8,100 note payable that has a 10% interest rate. Please see table on next page to calculate interest. Interest accrued indicates interest has not been paid, but has accumulated on the loan. HINT...the loan was taken out on 1/15 and the adjusting journal entry is completed on 1/31. j. One month of Prepaid Insurance has expired. k. Yabba Dabba Do remitted (paid) the balance in the sales tax payable t-account. There are a total of 11 adjusting journal entries. Round all figures to two decimals. Hints on Adjusting Journal Entries. Depreciation can only be taken for the amount of time the asset has been owned. Please look carefully at the PURCHASE DATE of the asset you will depreciate accordingly. Interest must be calculated at the end of the month. If the loan was taken out Jan 15th, only half-a-month of interest would be expensed. Calculations of Interest Terms of Note Payable $ 730, 12%, 120 days Interest Computation for 1 month. 1/12 $ 7.30 $ 730 X .12 $1,000, 9%, 6 months $1,000 .09 1/12 = $ 7.50 $2,000, 6%, 1 year $2,000 X .06 1/12 $10.00 Account Numbers Account Titles 101 Cash 102 Account Receivable 103 Supplies 105 Prepaid Insurance 106 Building 107 Equipment 108 Account Payable 109 Note Payable 110 Sales Tax Payable 111 Salary Payable 112 Utility Payable 113 Unearned Revenue 114 Interest Payable 115 Capital Stock 116 Revenue 117 Utility Expense 118 Salary Expense 119 Supplies Expense 115 Capital Stock 116 Revenue 117 Utility Expense 118 Salary Expense 119 Supplies Expense 120 Insurance Expense 121 Interest Expense 122 Rent Expense 123 Professional Service Expense 126 Accumulated Depreciation 128 Depreciation Expense 132 Income Summary 133 Retained Earnings Transaction letter Account Number Date Debit Credit Accounts and Explanation #N/A a #N/A b #N/A #N/A #N/A #N/A d #N/A #N/A #N/A #N/A f #N/A #N/A #N/A g #N/A #N/A h. #N/A #N/A i #N/A #N/A j #N/A #N/A k #N/A #N/A Trial Balance Adjustments Credit Debit Credit Please enter account number from shart of accounts. The account title will populate once the account number is enter Account Number Account Title 101 Cash 102 Account Receivable 103 Supplies 105 Prepaid Insurance 106 Building 107 Equipment 126 Accumulated Depreciation 108 Account Payable 109 Note Payable 110 Sales Tax Payable 111 Salary Payable 112 Utility Payable 113 Unearned Revenue 114 Interest Payable Debit 54,970 7575 1,500 4,000 159,000 9,000 1,500 201,597 575 185 2,500 575 185 2,500 30,000 10,000 110 Sales Tax Payable 111 Salary Payable 112 Utility Payable 113 Unearned Revenue 114|Interest Payable 115 Capital Stock 116 Revenue 117 Utility Expense 118 Salary Expense 119 Supplies Expense 120 Insurance Expense 121 Interest Expense 122 Rent Expense 123 Professional Service Expense 128 Depreciation Expense 133 Retained Earnings Total 185 6,995 497 1,585 1,050 246,357 246,357 0 Please create your own T-accounts on this page. Yabba Dabba Do Snow Removal Yabba Dabba Do Snow Removal Income Statement Month End January 31, 2022 Statement of Retained Earnings Month End January 31, 2022 Yabba Dabba Do Snow Removal Balance Sheet January 31, 2022 Date Debit Credit Account Number Accounts and Explanation #N/A #N/A To close Revenue #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A To Close Expense Accounts #N/A #N/A To Close Income Summary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts