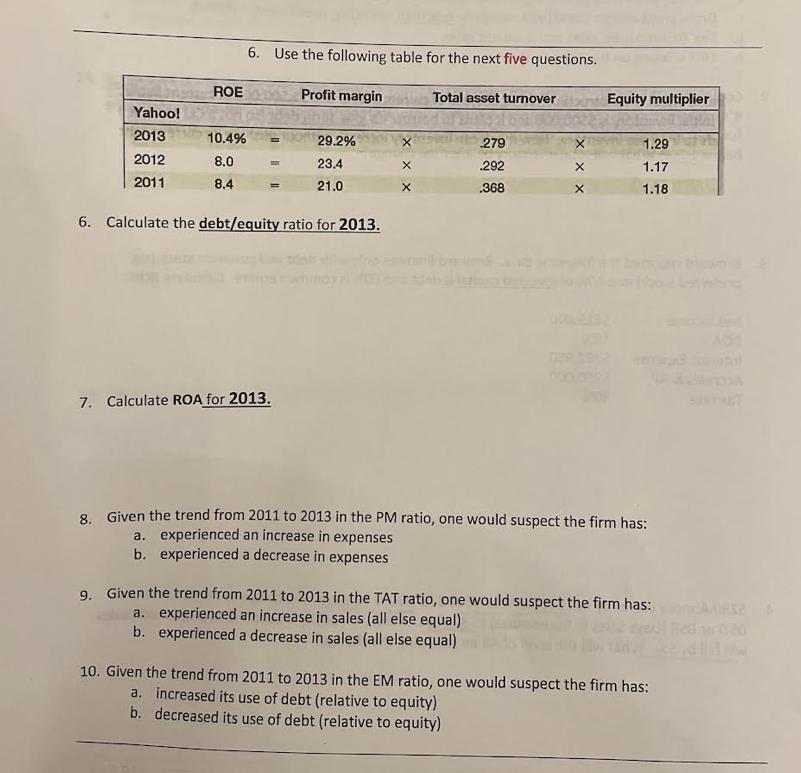

Question: Yahoo! 2013 2012 2011 ROE 10.4% 8.0 8.4 6. Use the following table for the next five questions. Profit margin SHO 29.2% 23.4 21.0

Yahoo! 2013 2012 2011 ROE 10.4% 8.0 8.4 6. Use the following table for the next five questions. Profit margin SHO 29.2% 23.4 21.0 6. Calculate the debt/equity ratio for 2013. 7. Calculate ROA for 2013. X Total asset turnover 279 .292 .368 X X Equity multiplier 1.29 1.17 1.18 8. Given the trend from 2011 to 2013 in the PM ratio, one would suspect the firm has: a. experienced an increase in expenses b. experienced a decrease in expenses 9. Given the trend from 2011 to 2013 in the TAT ratio, one would suspect the firm has: a. experienced an increase in sales (all else equal) b. experienced a decrease in sales (all else equal) 10. Given the trend from 2011 to 2013 in the EM ratio, one would suspect the firm has: a. increased its use of debt (relative to equity) b. decreased its use of debt (relative to equity)

Step by Step Solution

3.44 Rating (144 Votes )

There are 3 Steps involved in it

6 To calculate the debtequity ratio for 2013 we need the equity multiplier which is given in the tab... View full answer

Get step-by-step solutions from verified subject matter experts