Question: YB Long tent CengageNOW2 Online teachin X + akeAssignment/takeAssignment Main.do?inprogress true eBook Calculator Measures of liquidity, Solvency and Profitability The comparative financial statements of Marshall

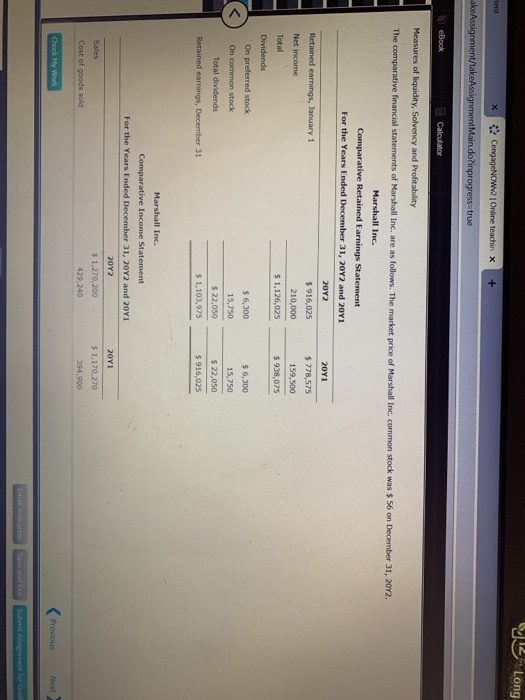

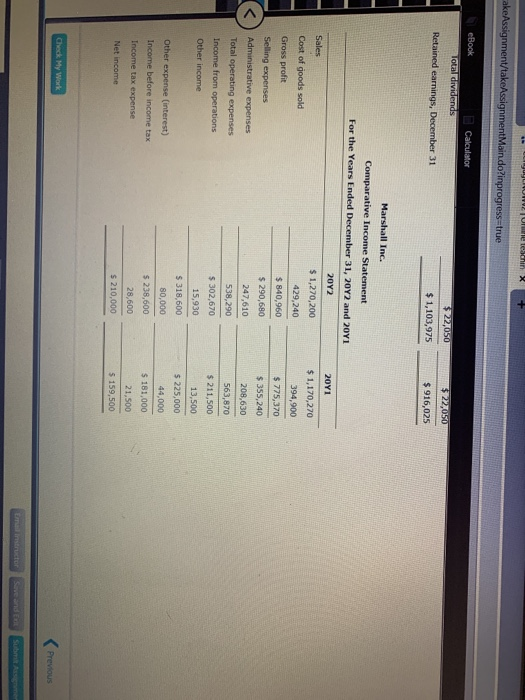

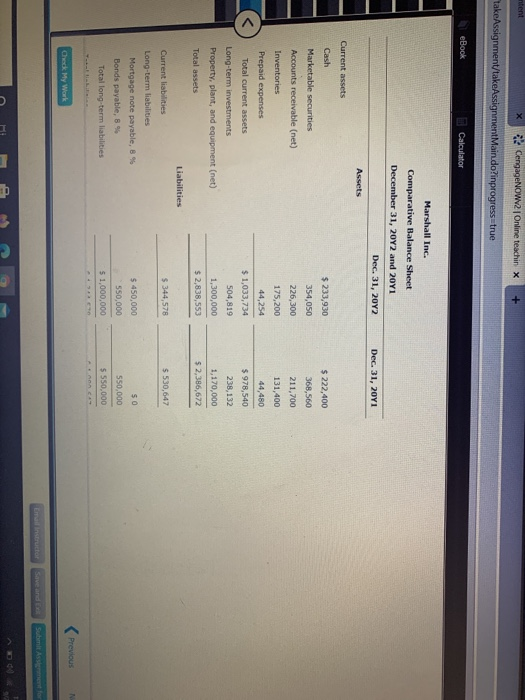

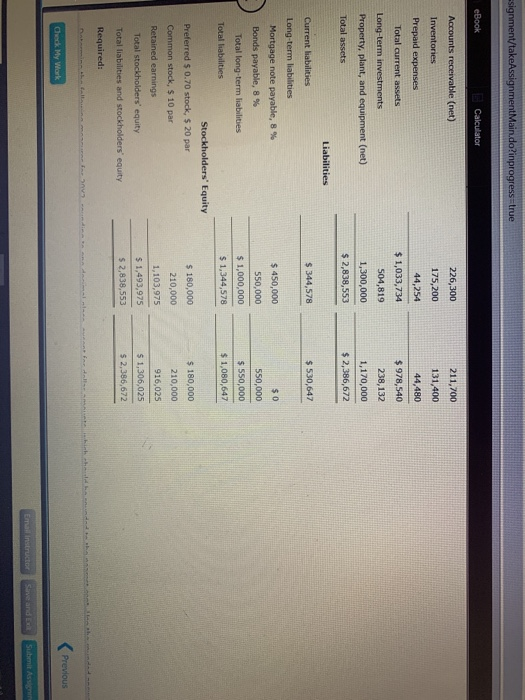

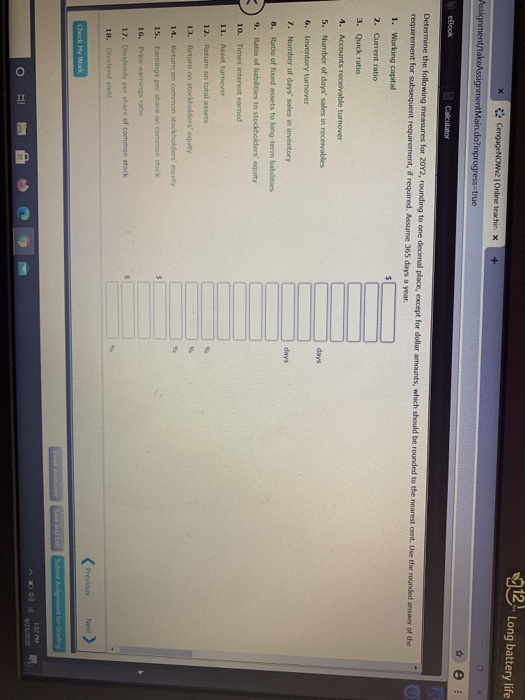

YB Long tent CengageNOW2 Online teachin X + akeAssignment/takeAssignment Main.do?inprogress true eBook Calculator Measures of liquidity, Solvency and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall Inc, common stock was $ 56 on December 31, 2012 Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 2012 and 2011 2012 Retained earnings, January 1 $ 916,025 Net income 210,000 Total $ 1,126,025 2011 $ 778,575 159,500 $938,075 Dividends On preferred stock $ 6,300 15,750 On common stock Total dividends $ 6,300 15,750 $ 22,050 $916,025 $ 22,050 $ 1,103,975 Retained earnings, December 31 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 2012 and 2011 2012 2011 Sales $ 1,170,270 $ 1,270,200 429,240 Cost of goods sold 394,900 Check My World Previous Next mal instructor Submit Assignment for Go yuyuWIU eachin X + cakeAssignment/takeAssignmentMain.do?inprogress true eBook Total dividends Calculator $22,050 Retained earnings, December 31 $22,050 $1,103,975 $ 916,025 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 2012 and 2041 2012 2011 Sales $ 1,170,270 394,900 $ 775,370 $ 355,240 Cost of goods sold Gross profit Selling expenses Administrative expenses Total operating expenses Income from operations Other income 208,630 $ 1,270,200 429,240 $ 840,960 $ 290,680 247,610 538,290 $ 302,670 15,930 S 318,600 80,000 $ 238,600 28,600 $ 210,000 563,870 $ 211,500 13,500 $ 225,000 Other expense (interest) Income before income tax Income tax expense 44,000 $ 181,000 21,500 5 159,500 Net income Check My Work Previous ntent CengageNOWV2 Online teachin X + takeAssignment/takeAssignment Main.do?inprogress=true eBook Calculator Marshall Inc. Comparative Balance Sheet December 31, 2012 and 2041 Dec 31, 2012 Assets Dec 31, 2011 Current assets Cash $ 222,400 Marketable securities $ 233,930 354,050 368,560 Accounts receivable (net) Inventories 226,300 175,200 44,254 211,700 131,400 44,480 $ 978,540 $1,033,734 504,819 Prepaid expenses Total current assets Long-term investments Property, plant, and equipment (net) Total assets Liabilities 1,300,000 $ 2,838,553 238,132 1,170,000 $ 2,386,672 $ 344,578 $530,647 Current liabilities Long-term liabilities Mortgage note payable, 8 % Bonds payable, 8 % Total long-term liabilities $ 450,000 550,000 $0 550.000 5 550,000 5 1,000,000 Previous Check My Work Save and Submit Ass for signment/takeAssignmentMain.do?inprogress true eBook Calculator Accounts receivable (net) 226,300 211,700 131,400 44,480 Inventories Prepaid expenses Total current assets Long-term investments Property, plant, and equipment (net) 175,200 44,254 $ 1,033,734 504,819 1,300,000 $ 2,838,553 $ 978,540 238,132 1,170,000 $ 2,386,672 Total assets Liabilities Current liabilities $ 344,578 $530,647 $0 Long-term liabilities Mortgage note payable, 8 % Bonds payable, 8 % Total long-term liabilities $ 450,000 550,000 $ 1,000,000 $ 1,344,578 550,000 $ 550,000 $ 1,080,647 Total liabilities Stockholders' Equity Preferred $ 0.70 stock, $ 20 par Common stock, $ 10 par Retained earnings Total stockholders' equity $ 180,000 210,000 1,103,975 $ 1,493,975 $ 2,838,553 $ 180,000 210,000 916,025 $ 1,306,025 $ 2,386,672 Total liabilities and stockholders' equity Required: Previous Check My Work Email instructor Submit Assi 912 Long battery life CengageNOWV2 Online teachin X Assignment/take Assignment Main.do?inprogress true e eBook Calculator Determine the following measures for 2012, rounding to one decimal place, except for dollar amounts, which should be rounded to the nearest cent. Use the rounded answer of the requirement for subsequent requirement, if required. Assume 365 days a year. 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days' sales in receivables days 6. Inventory turnover 7. Number of days' sales in inventory days 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders' equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Retum on stockholders' equity 14. Return on common stockholders' equity 15. Earnings per share on common stock $ 16. Price-earnings ratio 17. Dividends per share of common stock 5 18. Dividend yield Previous Next Check My Work Save and Stent for

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts