Question: Year 0 1 2 3 4 5 Return Alpha Sum Tracking Error Information Ratio Portfolio Benchmark Portfolio Benchmark Difference Return Return Index Index 16% 9%

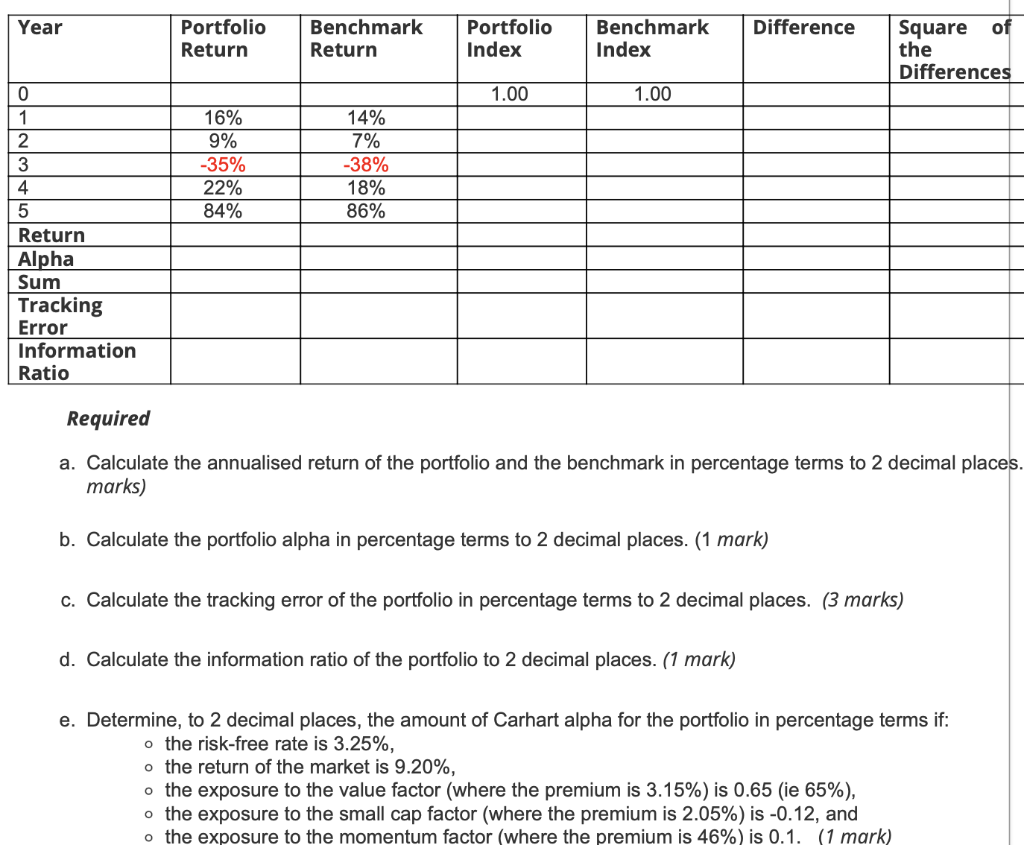

Year 0 1 2 3 4 5 Return Alpha Sum Tracking Error Information Ratio Portfolio Benchmark Portfolio Benchmark Difference Return Return Index Index 16% 9% -35% 22% 84% 14% 7% -38% 18% 86% 1.00 Required a. Calculate the annualised return the portfolio and the marks) 1.00 mark in percentage terms to b. Calculate the portfolio alpha in percentage terms to 2 decimal places. (1 mark) Square of the Differences d. Calculate the information ratio of the portfolio to 2 decimal places. (1 mark) decimal places. c. Calculate the tracking error of the portfolio in percentage terms to 2 decimal places. (3 marks) e. Determine, to 2 decimal places, the amount of Carhart alpha for the portfolio in percentage terms if: o the risk-free rate is 3.25%, o the return of the market is 9.20%, o the exposure to the value factor (where the premium is 3.15%) is 0.65 (ie 65%), o the exposure to the small cap factor (where the premium is 2.05%) is -0.12, and o the exposure to the momentum factor (where the premium is 46%) is 0.1. (1 mark) Year 0 1 2 3 4 5 Return Alpha Sum Tracking Error Information Ratio Portfolio Benchmark Portfolio Benchmark Difference Return Return Index Index 16% 9% -35% 22% 84% 14% 7% -38% 18% 86% 1.00 Required a. Calculate the annualised return the portfolio and the marks) 1.00 mark in percentage terms to b. Calculate the portfolio alpha in percentage terms to 2 decimal places. (1 mark) Square of the Differences d. Calculate the information ratio of the portfolio to 2 decimal places. (1 mark) decimal places. c. Calculate the tracking error of the portfolio in percentage terms to 2 decimal places. (3 marks) e. Determine, to 2 decimal places, the amount of Carhart alpha for the portfolio in percentage terms if: o the risk-free rate is 3.25%, o the return of the market is 9.20%, o the exposure to the value factor (where the premium is 3.15%) is 0.65 (ie 65%), o the exposure to the small cap factor (where the premium is 2.05%) is -0.12, and o the exposure to the momentum factor (where the premium is 46%) is 0.1. (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts