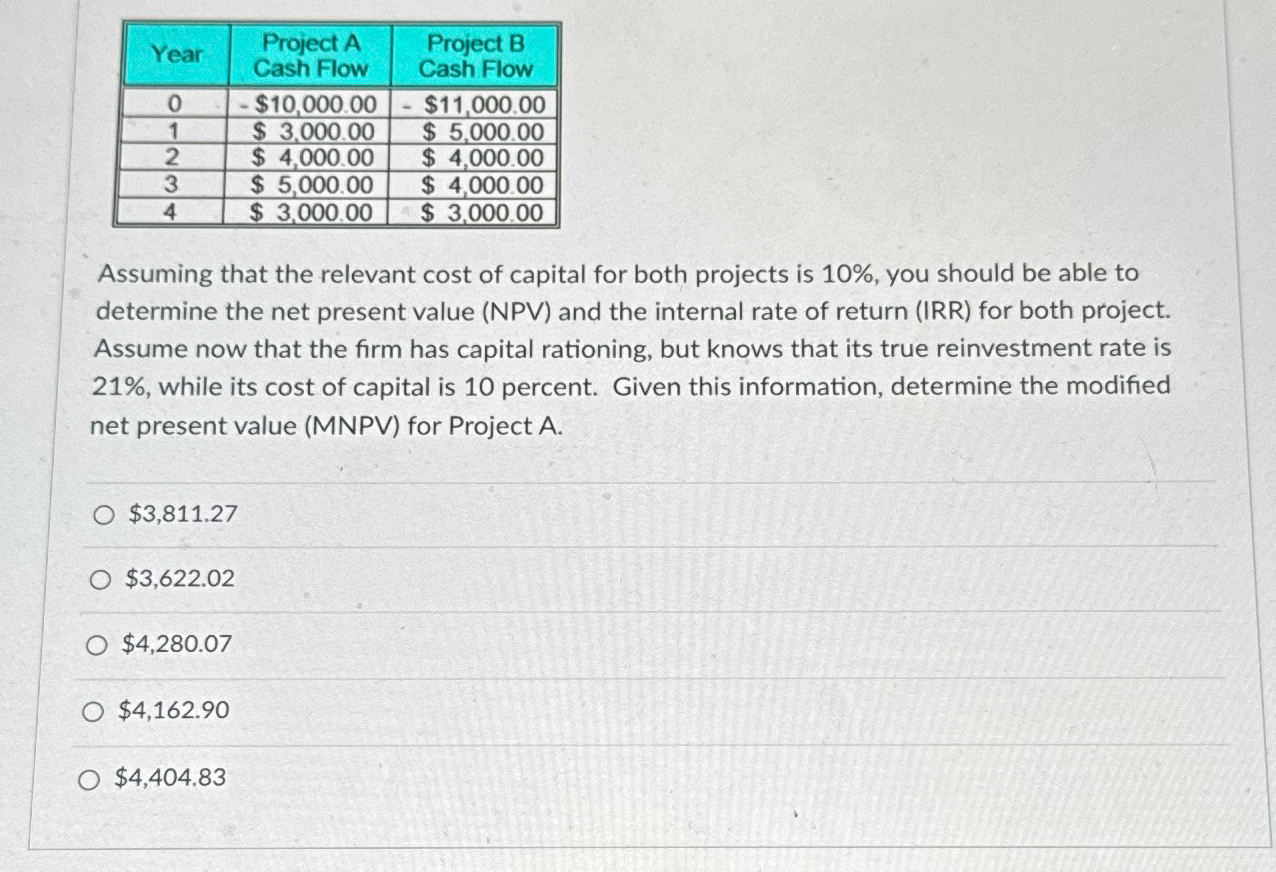

Question: Year 0 $10,000.00 1 $ 3,000.00 Project A Cash Flow Project B Cash Flow $11,000.00 $5,000.00 2 $ 4,000.00 $ 4,000.00 3 $ 5,000.00

Year 0 $10,000.00 1 $ 3,000.00 Project A Cash Flow Project B Cash Flow $11,000.00 $5,000.00 2 $ 4,000.00 $ 4,000.00 3 $ 5,000.00 $ 4,000.00 4 $3,000.00 $ 3,000.00 Assuming that the relevant cost of capital for both projects is 10%, you should be able to determine the net present value (NPV) and the internal rate of return (IRR) for both project. Assume now that the firm has capital rationing, but knows that its true reinvestment rate is 21%, while its cost of capital is 10 percent. Given this information, determine the modified net present value (MNPV) for Project A. $3,811.27 O $3,622.02 O $4,280.07 O $4,162.90 O $4,404.83

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts