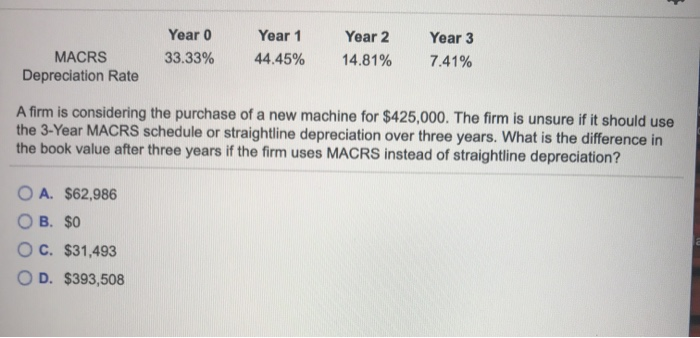

Question: Year 0 33.33% Year 1 44.45% Year 2 14.81% Year 3 7.41% MACRS Depreciation Rate Afirm is considering the purchase of a new machine for

Year 0 33.33% Year 1 44.45% Year 2 14.81% Year 3 7.41% MACRS Depreciation Rate Afirm is considering the purchase of a new machine for $425,000. The firm is unsure if it should use the 3-Year MACRS schedule or straightline depreciation over three years. What is the difference in the book value after three years if the firm uses MACRS instead of straightline depreciation? O A. $62,986 O B. $0 O c. $31,493 OD. $393,508

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock