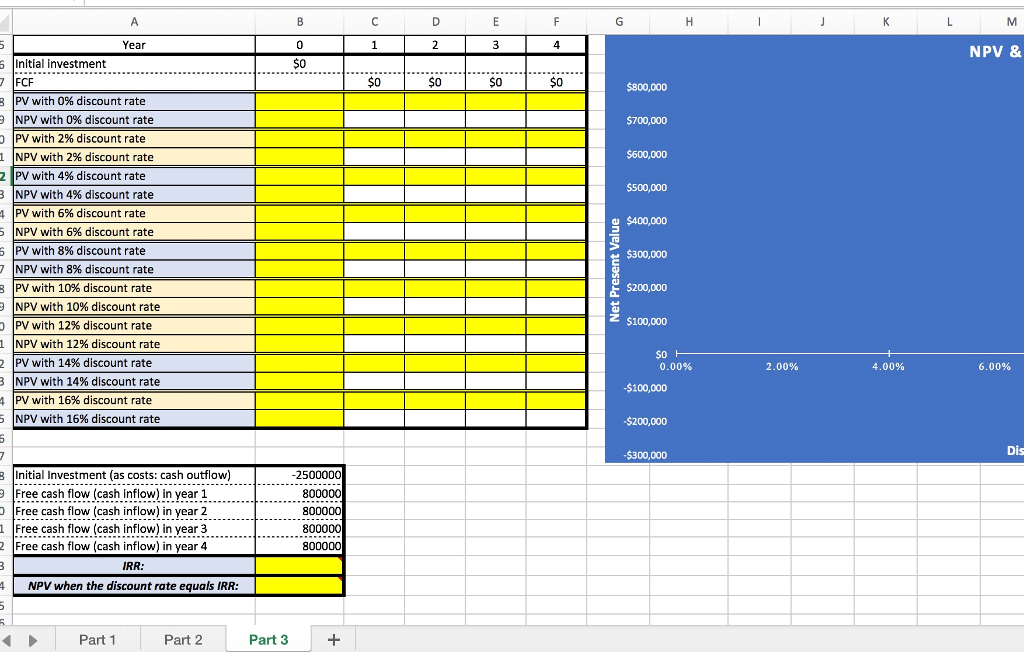

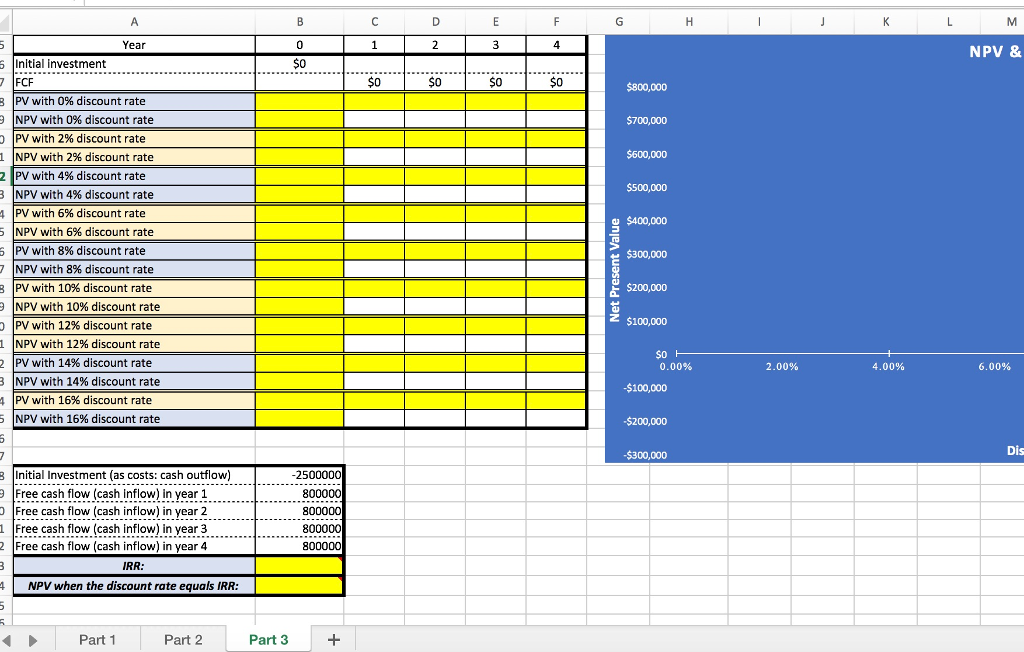

Question: Year 0 4 NPV & $0 Initial investment 7FCF B IPV with 0% discount rate S0 S0 $0 S0 $800,000 NPV with 0% discount rate

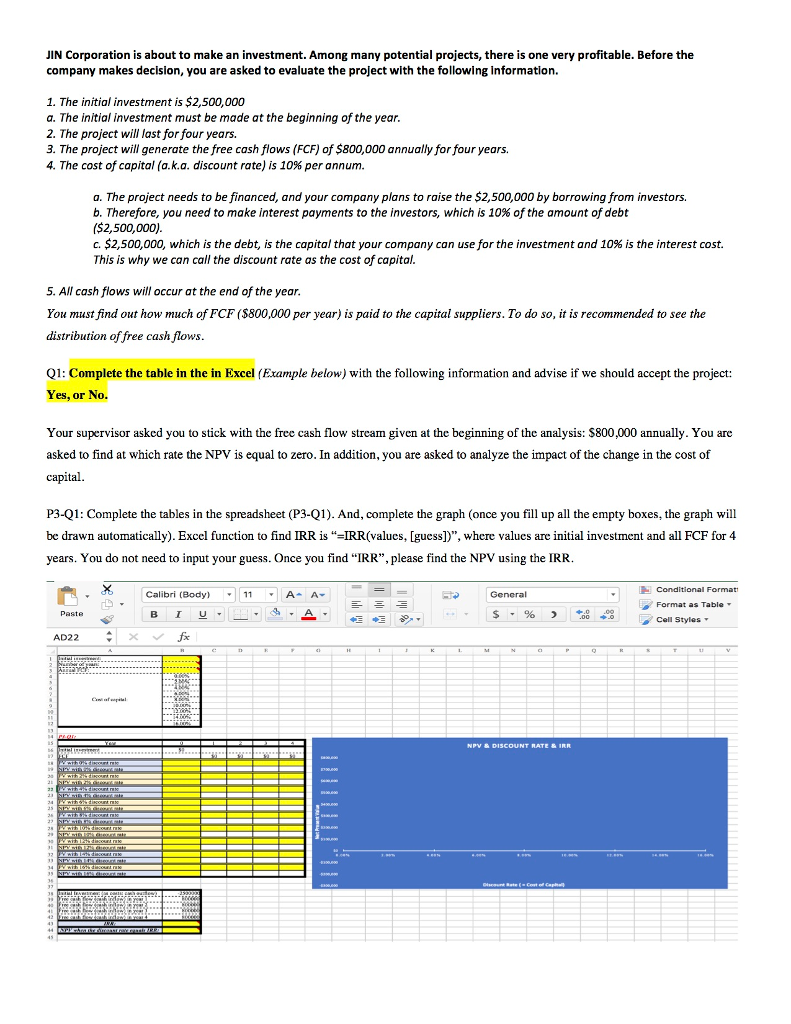

Year 0 4 NPV & $0 Initial investment 7FCF B IPV with 0% discount rate S0 S0 $0 S0 $800,000 NPV with 0% discount rate IPV with 2% discount rate |NPV with 2% discount rate $700,000 | $600,000 | PV with 4% discount rate $500,000 NPV with 4% discount rate IPV with 6% discount rate NPV with 6% discount rate IPV with 8% discount rate NPV with 8% discount rate PV with 10% discount rate 1 NPV with 10% discount rate PV with 12% discount rate |NPV with 12% discount rate PV with 14% discount rate NPV with 14% discount rate PV with 16% discount rate NPV with 16% discount rate $400,000 $300,000 &$200,000 Z $100,000 1 so 0.00% 2.00% 4.00% 6.00% $100,000 $200,000 Dis $300,000 8 Initial Investment (as costs: cash outflow) Free cash flow (cash inflow) in year 1... Free cash flow (cash inflow) in year 2 2500000 800000 800000 Free cash flow (cash inflow) in year 4 800000 NPV when the discount rate equals IRR: Part1Part 2Part 3+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts