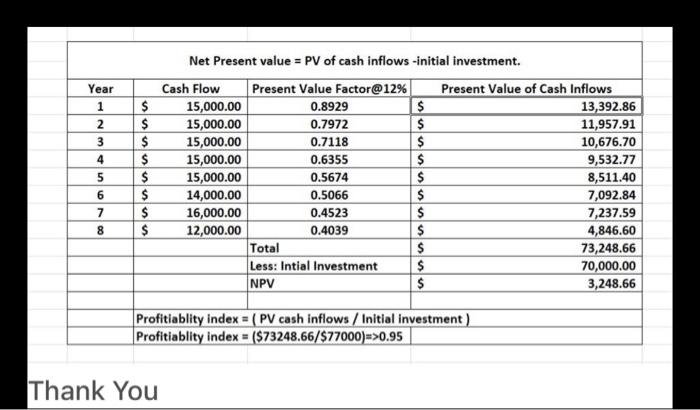

Question: Year 1 2 3 4 5 6 7 8 $ $ $ $ $ $ $ $ Net Present value = PV of cash inflows-initial

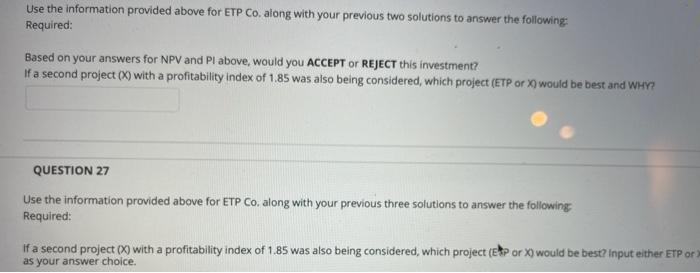

Year 1 2 3 4 5 6 7 8 $ $ $ $ $ $ $ $ Net Present value = PV of cash inflows-initial investment. Cash Flow Present Value Factor@12% Present Value of Cash Inflows 15,000.00 0.8929 $ 13,392.86 15,000.00 0.7972 $ 11,957.91 15,000.00 0.7118 $ 10,676.70 15,000.00 0.6355 $ 9,532.77 15,000.00 0.5674 $ 8,511.40 14,000.00 0.5066 $ 7,092.84 16,000.00 0.4523 $ 7,237.59 12,000.00 0.4039 $ 4,846.60 Total $ 73,248.66 Less: Intial Investment $ 70,000.00 NPV $ 3,248.66 Profitiablity index = ( PV cash inflows / Initial investment) Profitiablity index = ($73248.66/$77000)=>0.95 Thank You Use the information provided above for ETP Co. along with your previous two solutions to answer the following Required: Based on your answers for NPV and Pl above, would you ACCEPT or REJECT this investment? If a second project(x) with a profitability Index of 1.85 was also being considered, which project (ETP or XI would be best and WHY? QUESTION 27 Use the information provided above for ETP Co. along with your previous three solutions to answer the following Required: if a second project(X) with a profitability index of 1.85 was also being considered, which project (Ep or X) would be best? Input either ETP or> as your answer choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts