Question: Year 1 2 3 4 5 6 7 A coal mining company is expanding its existing operation. The company expects that it will experience

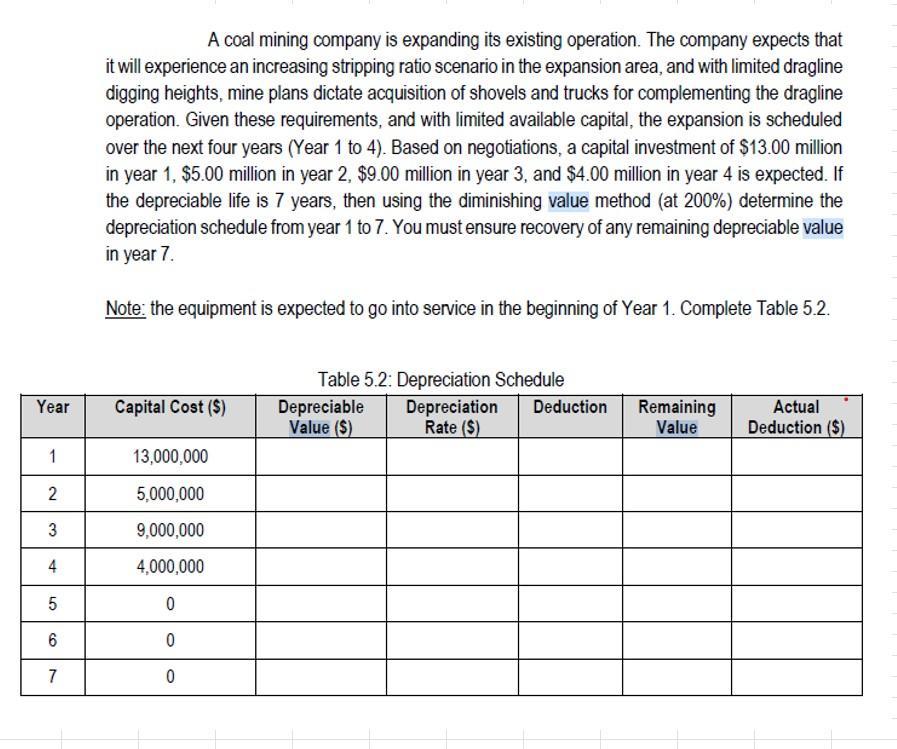

Year 1 2 3 4 5 6 7 A coal mining company is expanding its existing operation. The company expects that it will experience an increasing stripping ratio scenario in the expansion area, and with limited dragline digging heights, mine plans dictate acquisition of shovels and trucks for complementing the dragline operation. Given these requirements, and with limited available capital, the expansion is scheduled over the next four years (Year 1 to 4). Based on negotiations, a capital investment of $13.00 million in year 1, $5.00 million in year 2, $9.00 million in year 3, and $4.00 million in year 4 is expected. If the depreciable life is 7 years, then using the diminishing value method (at 200%) determine the depreciation schedule from year 1 to 7. You must ensure recovery of any remaining depreciable value in year 7. Note: the equipment is expected to go into service in the beginning of Year 1. Complete Table 5.2. Capital Cost ($) 13,000,000 5,000,000 9,000,000 4,000,000 0 0 0 Table 5.2: Depreciation Schedule Depreciation Rate ($) Depreciable Value ($) Deduction Remaining Value Actual Deduction ($)

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts