Question: Year 1 2 3 4 5 PI Manufacturing is looking into buying two additional manufacturing lines. Both projects are independent. The cash outlay for

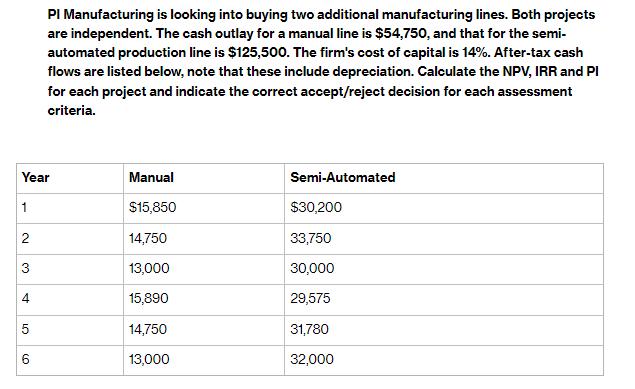

Year 1 2 3 4 5 PI Manufacturing is looking into buying two additional manufacturing lines. Both projects are independent. The cash outlay for a manual line is $54,750, and that for the semi- automated production line is $125,500. The firm's cost of capital is 14%. After-tax cash flows are listed below, note that these include depreciation. Calculate the NPV, IRR and PI for each project and indicate the correct accept/reject decision for each assessment criteria. 6 Manual $15,850 14,750 13,000 15,890 14,750 13,000 Semi-Automated $30,200 33,750 30,000 29,575 31,780 32,000

Step by Step Solution

There are 3 Steps involved in it

1 Calculate the NPV IRR and PI of Manual line as follows Given initial outlay is 54750 Cash flow as ... View full answer

Get step-by-step solutions from verified subject matter experts