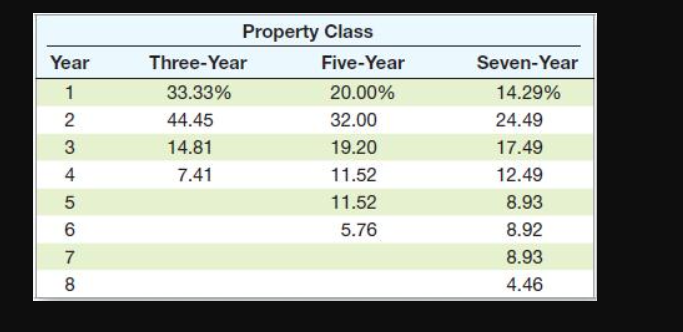

Question: Year 1 2 3 Property Class Three-Year Five-Year 33.33% 20.00% 44.45 32.00 14.81 19.20 7.41 11.52 11.52 5.76 4 Seven-Year 14.29% 24.49 17.49 12.49 8.93

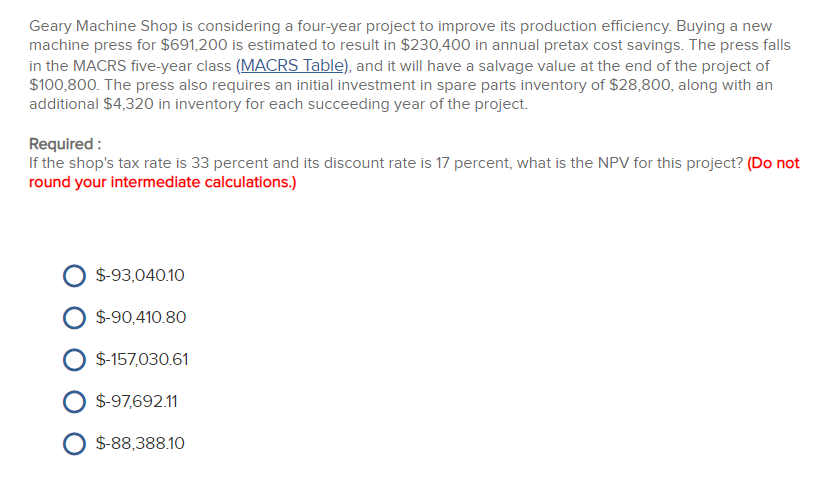

Year 1 2 3 Property Class Three-Year Five-Year 33.33% 20.00% 44.45 32.00 14.81 19.20 7.41 11.52 11.52 5.76 4 Seven-Year 14.29% 24.49 17.49 12.49 8.93 8.92 8.93 4.46 5 6 7 8 Geary Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $691,200 is estimated to result in $230,400 in annual pretax cost savings. The press falls in the MACRS five-year class (MACRS Table), and it will have a salvage value at the end of the project of $100,800. The press also requires an initial investment in spare parts inventory of $28,800, along with an additional $4,320 in inventory for each succeeding year of the project. Required: If the shop's tax rate is 33 percent and its discount rate is 17 percent, what is the NPV for this project? (Do not round your intermediate calculations.) $-93,040.10 $-90,410.80 $-157,030.61 $-97,692.11 $-88,388.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts