Question: Year 1 Jan. 4. Nov. 2. Dec. 31. Year 2 Jan. 6. Apr. 1. June 11. Dec. 31. Year 3 July 1. Oct 2. Dec.

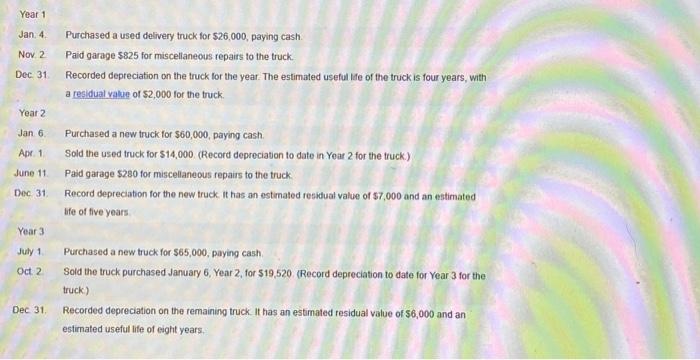

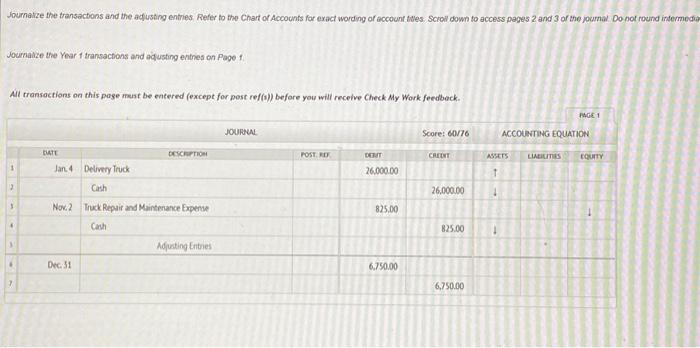

Jan, 4. Purchased a used delivery truck for $26,000, paying cash. Nov 2 Paid garage $825 for miscellaneous repairs to the truck. Dec. 31. Recorded depreciation on the truck for the year. The estimated useful lfe of the truck is four years, with a residual value of $2,000 for the truck. Year 2 Jan 6. Purchased a new truck for $60,000, paying cash. Apr 1 Sold the used truck for $14,000. (Record depreciation to date in Yoar 2 for the truck.) June 11. Paid garage \$280 for miscellaneous repairs to the truck. Dec 31. Record depreciation for the new truck. It has on estimated residual value of $7,000 and an estimated life of five years Year 3 July 1 Purchased a new truck for $65,000, paying cash. Oct 2 Sold the truck purchased January 6, Year 2, for $19,520. (Record depreciation to date for Year 3 for the truck) Dec 31. Recorded depreciation on the remaining truck. It has an estimated residual value of $6,000 and an estimated useful life of eight years. Journatize the transactions and the adusting entries, Reter to the Chart of Accounts for exact wording of account twes. Scroll down to access pages 2 and 3 of the journal. Do not rouind infermed Journaize the Year 1 transactions and aqusting entres on Page f Ail transoctions on this page mest be entered (except for post ref(s)) before you will recelve Check My Work feedback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts