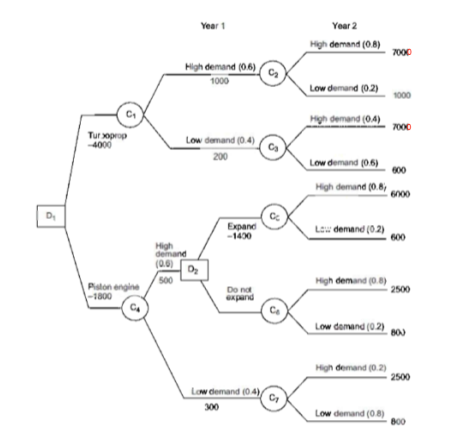

Question: Year 1 Year 2 High demand (0.8) 7000 High demand (06) 1000 Low demand (0:2) 1000 CH High demand (04) 7000 Tur prop 4000 Low

Year 1 Year 2 High demand (0.8) 7000 High demand (06) 1000 Low demand (0:2) 1000 CH High demand (04) 7000 Tur prop 4000 Low demand (0.4) 200 Low demand (06) 600 High demand (0.87 6000 D Expand -1400 Low demand (0:2) 600 High demand ( (0.6) 02 500 High demand (06) Pon engine -1800 CA Dond expand 2500 ce Low demand (0:2) 80) High demand (0.2) ( 2500 Low demand (04) 300 Low demand (08) 800 6. Kopala Airways is a new air transport company on the Copperbelt. The company is faced with two options of aircraft, turboprop aircraft and piston engine aircraft. The turbocraft aircraft costs K4 million and has a larger capacity. It will serve if the demand turns out to be high. The piston engine cost K18 million but has half the capacity of the turbocraft and so will not suffice if the demand is high. The chances of high demand in year one are 60% and if the demand is high in year one there is an 80% that it will be high in the second and subsequent years. If the company buys a smaller aircraft in year one and demand turns out high it can buy a second-hand piston-engine aircraft at the end of year 1 for K1.4 million. The cash flows for the different options are given in the decision tree below. Assume a discount rate of 10%. 2 i. What is the NPV of an investment in turbocraft? If the firm invested in the piston engine aircraft and demand at the end of year 1 was high a. What is the NPV if the firm expands b. What is the NPV if the firm does not expand c. Should the firm expand? Calculate the NPV of the piston engine option to the firm. iv. What is the NPV of the option to expand at the end of year one after investing in the piston engine? Now assume that Kopala Airlines has an option of abandoning the project at the end of year 1 provided it is profitable for them. Suppose the airline can sell off the turbocraft for K3.6 million and the piston engine at K14 million after 1 year. v. Calculate the pay-offs for the turbocraft and the piston engine when the demand turns out to be low if they a. continue b. discontinue the project Should the airline continue or abandon the project if the demand at the end of year 1 turns out low? vi. vii. Now calculate the NPV for the turbocraft and piston engine taking into account the value to abandon. which engine should the airline invest? vii. Year 1 Year 2 High demand (0.8) 7000 High demand (06) 1000 Low demand (0:2) 1000 CH High demand (04) 7000 Tur prop 4000 Low demand (0.4) 200 Low demand (06) 600 High demand (0.87 6000 D Expand -1400 Low demand (0:2) 600 High demand ( (0.6) 02 500 High demand (06) Pon engine -1800 CA Dond expand 2500 ce Low demand (0:2) 80) High demand (0.2) ( 2500 Low demand (04) 300 Low demand (08) 800 6. Kopala Airways is a new air transport company on the Copperbelt. The company is faced with two options of aircraft, turboprop aircraft and piston engine aircraft. The turbocraft aircraft costs K4 million and has a larger capacity. It will serve if the demand turns out to be high. The piston engine cost K18 million but has half the capacity of the turbocraft and so will not suffice if the demand is high. The chances of high demand in year one are 60% and if the demand is high in year one there is an 80% that it will be high in the second and subsequent years. If the company buys a smaller aircraft in year one and demand turns out high it can buy a second-hand piston-engine aircraft at the end of year 1 for K1.4 million. The cash flows for the different options are given in the decision tree below. Assume a discount rate of 10%. 2 i. What is the NPV of an investment in turbocraft? If the firm invested in the piston engine aircraft and demand at the end of year 1 was high a. What is the NPV if the firm expands b. What is the NPV if the firm does not expand c. Should the firm expand? Calculate the NPV of the piston engine option to the firm. iv. What is the NPV of the option to expand at the end of year one after investing in the piston engine? Now assume that Kopala Airlines has an option of abandoning the project at the end of year 1 provided it is profitable for them. Suppose the airline can sell off the turbocraft for K3.6 million and the piston engine at K14 million after 1 year. v. Calculate the pay-offs for the turbocraft and the piston engine when the demand turns out to be low if they a. continue b. discontinue the project Should the airline continue or abandon the project if the demand at the end of year 1 turns out low? vi. vii. Now calculate the NPV for the turbocraft and piston engine taking into account the value to abandon. which engine should the airline invest? vii

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts