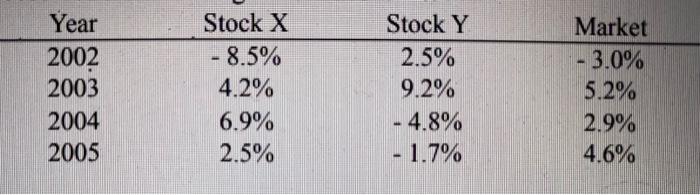

Question: - Year 2002 2003 2004 2005 Stock X - 8.5% 4.2% 6.9% 2.5% Stock Y 2.5% 9.2% - 4.8% - 1.7% Market - 3.0% 5.2%

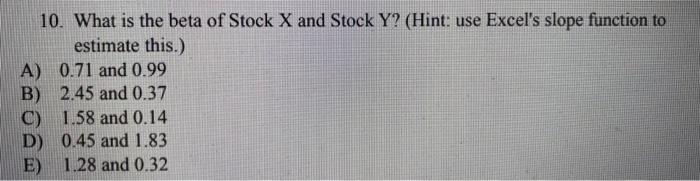

- Year 2002 2003 2004 2005 Stock X - 8.5% 4.2% 6.9% 2.5% Stock Y 2.5% 9.2% - 4.8% - 1.7% Market - 3.0% 5.2% 2.9% 4.6% 10. What is the beta of Stock X and Stock Y? (Hint: use Excel's slope function to estimate this.) A) 0.71 and 0.99 B) 2.45 and 0.37 C) 1.58 and 0.14 D) 0.45 and 1.83 E) 1.28 and 0.32 11. Suppose a portfolio has 40% allocated to Stock X and 60% allocated to Stock Y. The weights remain unchanged during these years. What is the portfolio beta? A) 0.72 B) 1.51 C) 0.25 D) 1.67

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock