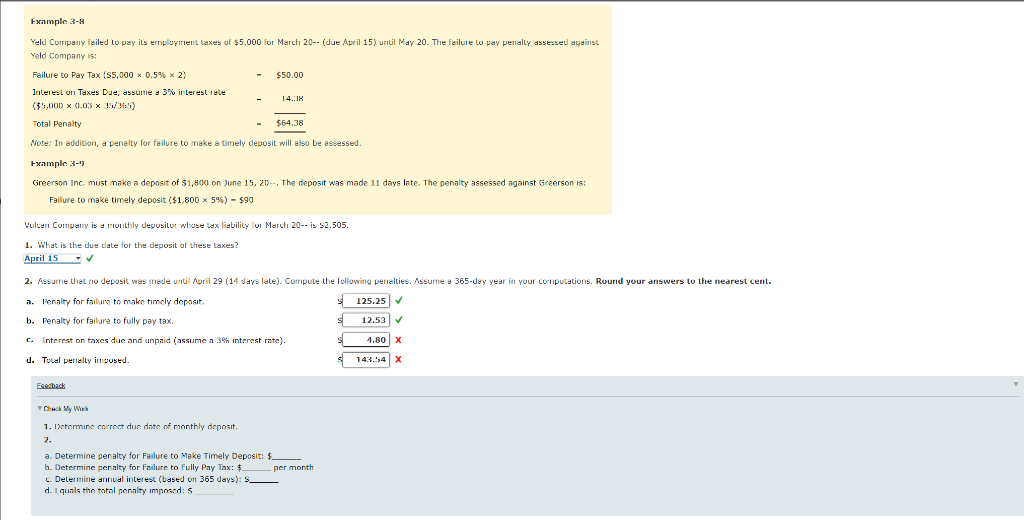

Question: year 2021 Example 3- Yeld Company failed to pay its employment taxes of $5,000 for March 20-- (due April 15) until May 20. The failure

year 2021

Example 3- Yeld Company failed to pay its employment taxes of $5,000 for March 20-- (due April 15) until May 20. The failure to pay penalty assesed against Yeld Company is: Failure to Pay Tax ($5,000 0.5% x 2) $50.00 Interest on Taxes Due, assume a 3% interest rate 14. IN ($5,000 X (1.03 X 15/365) Total Penalty $64.38 - Note: In addition, a penalty failure to make a timely deposit will also be assessed. Example 3-1) Greerson Inc. must make a deposit of $1,800 on June 15, 20--, The deposit was made 11 days late. The penalty assessed against Greerson is: Failure to make timely deposit ($1,800 x 5%) - $90 Vulcer Company is a monthly depositor whose tax liability for March 20-- is $2.505. 1. What is the due date for the deposit of these taxes? April 15 2. Assume that no deposit was made until April 29 (14 days late). Compute the following penalties. Assume a 365-day year in your computations. Round your answers to the nearest cent. a. Penalty for failure to make timely deposit. 125.25 b. Penalty for failure to fully pay tax. 12.53 Interest taxes due and unpaid (assume a 3% interest rate). 4.80 d. Tocal perally imposed. 143.54 x Eso bad Check My W 1. Determine correct due date of monthly deposit. 2. a. Determine penalty for Failure to Make Timely Deposit: $ b. Determine penalty for Failure to fully Pay Tax: $ per month c. Determine annual interest (based on 365 days): S_ d. I quals the tatal penalty imposed: S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts