Question: Year 4 Year 5 Year 3 Question 5 Over the past three years Digit Ltd, a research and development company has developed a secure military

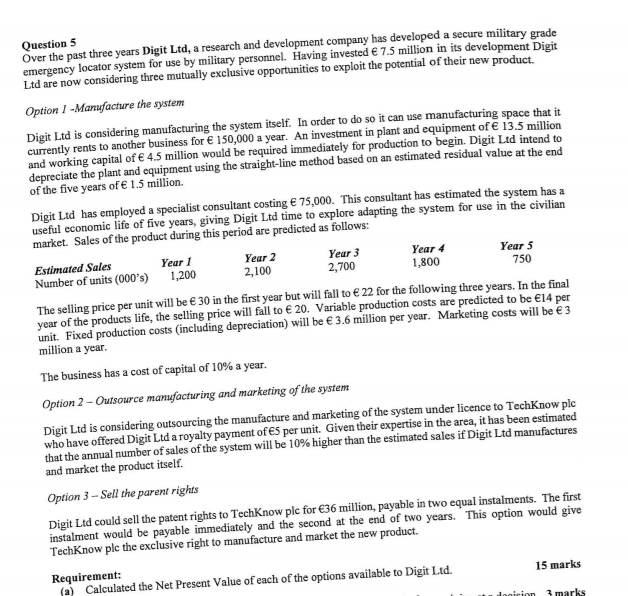

Year 4 Year 5 Year 3 Question 5 Over the past three years Digit Ltd, a research and development company has developed a secure military grade emergency locator system for use by military personnel. Having invested 7.5 million in its development Digit Ltd are now considering three mutually exclusive opportunities to exploit the potential of their new product. Option 1 - Manufacture the system Digit Ltd is considering manufacturing the system itself. In order to do so it can use manufacturing space that it currently rents to another business for 150,000 a year. An investment in plant and equipment of 13.5 million and working capital of 4.5 million would be required immediately for production to begin. Digit Ltd intend to depreciate the plant and equipment using the straight-line method based on an estimated residual value at the end of the five years of 1.5 million. Digit Ltd has employed a specialist consultant costing 75,000. This consultant has estimated the system has a useful economic life of five years, giving Digit Ltd time to explore adapting the system for use in the civilian market. Sales of the product during this period are predicted as follows: Estimated Sales Year 1 Year 2 Number of units (000's) 1,200 2,100 2,700 1,800 750 The selling price per unit will be 30 in the first year but will fall to 22 for the following three years. In the final year of the products life, the selling price will fall to 20. Variable production costs are predicted to be 14 per unit. Fixed production costs (including depreciation) will be 3.6 million per year. Marketing costs will be 3 million a year. The business has a cost of capital of 10% a year. Option 2 - Outsource manufacturing and marketing of the system Digit Ltd is considering outsourcing the manufacture and marketing of the system under licence to TechKnow plc who have offered Digit Ltd a royalty payment of 5 per unit. Given their expertise in the area, it has been estimated that the annual number of sales of the system will be 10% higher than the estimated sales if Digit Ltd manufactures and market the product itself. Option 3 - Sell the parent rights Digit Ltd could sell the patent rights to TechKnow plc for 36 million, payable in two equal instalments. The first instalment would be payable immediately and the second at the end of two years. This option would give TechKnow plc the exclusive right to manufacture and market the new product. Requirement: Calculated the Net Present Value of each of the options available to Digit Ltd. 15 marks nicion 3 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts