Question: Year A Returns B Returns 2005 -3.9% 16.1% 2006 1.3% -8.5% 2007 -32.6% -27.2% 2008 -12.7% -4.5% 2009 30.1% 10.7% 2010 24.6% 9.8% 2011 23.6%

Year A Returns B Returns 2005 -3.9% 16.1% 2006 1.3% -8.5% 2007 -32.6% -27.2% 2008 -12.7% -4.5% 2009 30.1% 10.7% 2010 24.6% 9.8% 2011 23.6% 4.9% 2012 52.9% 43.6% 2013 35.7% 40.7% 2014 30.8% 40.4%

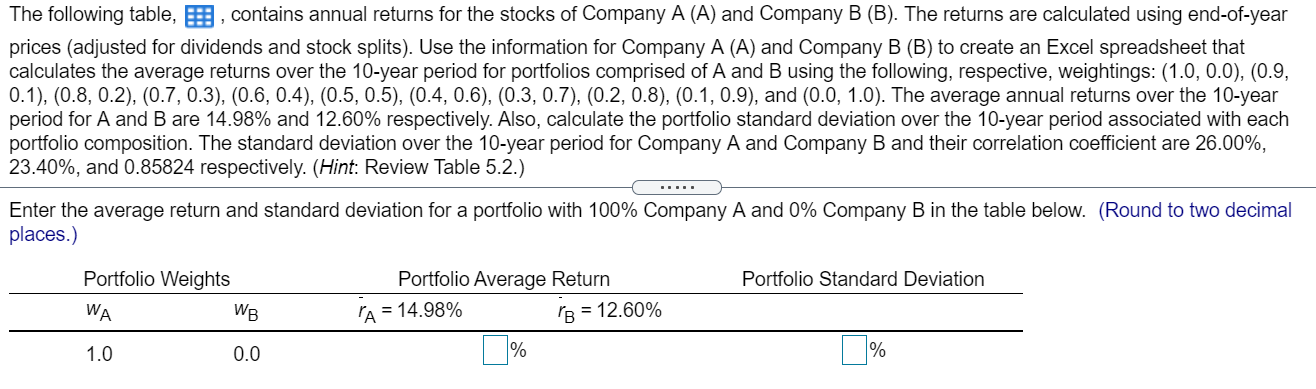

The following table, B, contains annual returns for the stocks of Company A (A) and Company B (B). The returns are calculated using end-of-year prices (adjusted for dividends and stock splits). Use the information for Company A (A) and Company B (B) to create an Excel spreadsheet that calculates the average returns over the 10-year period for portfolios comprised of A and B using the following, respective, weightings: (1.0, 0.0), (0.9, 0.1), (0.8, 0.2), (0.7, 0.3), (0.6, 0.4), (0.5, 0.5), (0.4, 0.6), (0.3, 0.7), (0.2, 0.8), (0.1, 0.9), and (0.0, 1.0). The average annual returns over the 10-year period for A and B are 14.98% and 12.60% respectively. Also, calculate the portfolio standard deviation over the 10-year period associated with each portfolio composition. The standard deviation over the 10-year period for Company A and Company B and their correlation coefficient are 26.00%, 23.40%, and 0.85824 respectively. (Hint: Review Table 5.2.) Enter the average return and standard deviation for a portfolio with 100% Company A and 0% Company B in the table below. (Round to two decimal places.) Portfolio Weights Portfolio Average Return Portfolio Standard Deviation WA WB 18 = 12.60% A = 14.98% 1.0 0.0 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts