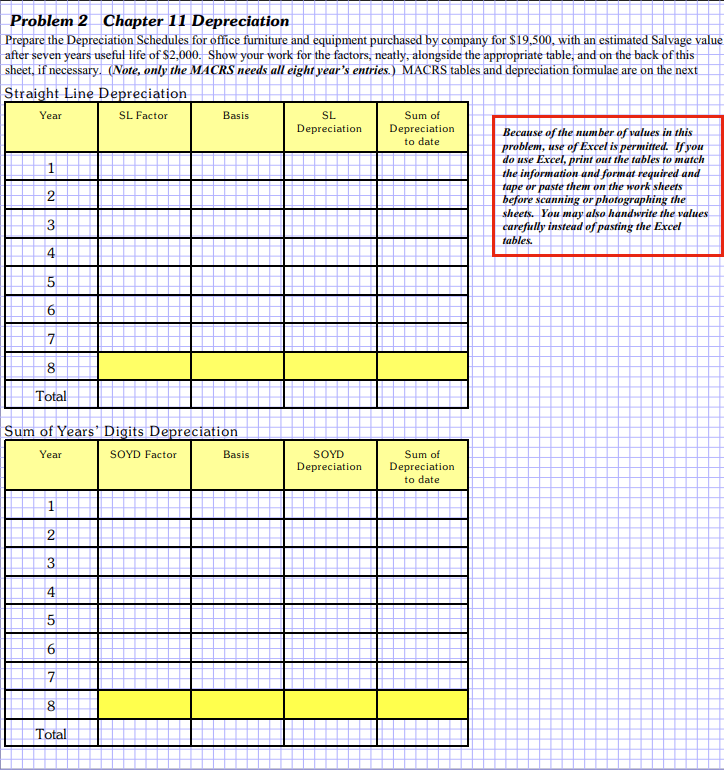

Question: Year Basis Problem 2 Chapter 11 Depreciation Prepare the Depreciation Schedules for office furniture and equipment purchased by company for $19.500, with an estimated Salvage

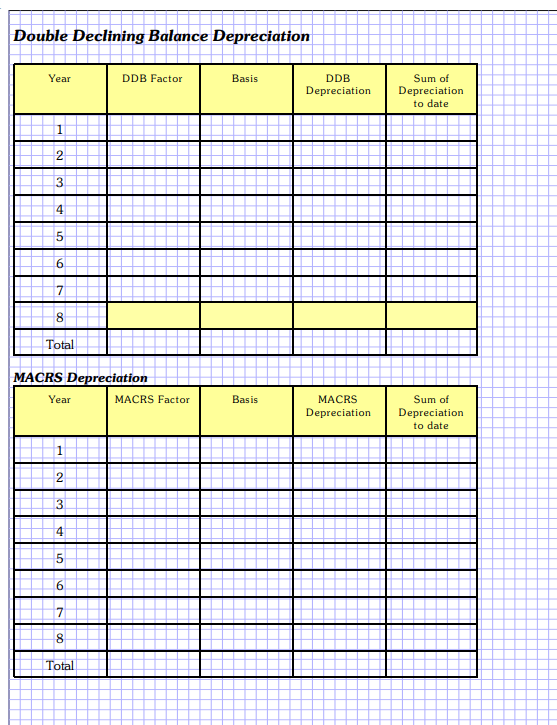

Year Basis Problem 2 Chapter 11 Depreciation Prepare the Depreciation Schedules for office furniture and equipment purchased by company for $19.500, with an estimated Salvage value after seven years useful life of $2,000. Show your work for the factors, neatly, alongside the appropriate table, and on the back of this sheet, if necessary. (Note, only the MACRS needs all eight year's entries.) MACRS tables and depreciation formulae are on the next Straight Line Depreciation SL Factor SL Sum of Depreciation Depreciation Because of the number of values in this to date problem, use of Excel is permitted. If you do use Excel, print out the tables to match the information and format required and 2 tape or paste them on the work sheets before scanning or photographing the sheets. You may also handwrite the values 3 carefully instead of pasting the Excel 4 tables. 5 6 7 8 Total Sum of Years' Digits Depreciation Year SOYD Factor Basis SOYD Depreciation Sum of Depreciation to date 1 2 3 5 6 7 8 Total Double Declining Balance Depreciation Year DDB Factor Basis DDB Depreciation Sum of Depreciation to date 2 3 4 5 6 8 Total MACRS Depreciation Year MACRS Factor Basis MACRS Depreciation Sum of Depreciation to date 2 3 4 5 6 8 Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts