Question: year end should be 30 june while doing calculation I Q22 On 1 June 2018, Toby purchased a new truck to use in his business

year end should be 30 june while doing calculation

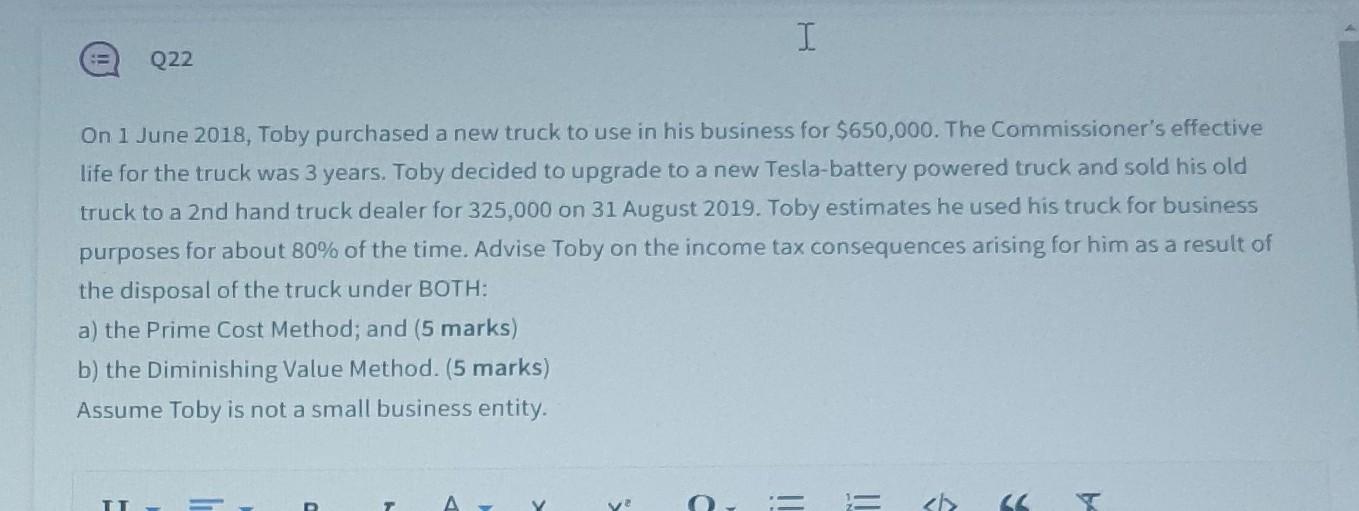

I Q22 On 1 June 2018, Toby purchased a new truck to use in his business for $650,000. The Commissioner's effective life for the truck was 3 years. Toby decided to upgrade to a new Tesla-battery powered truck and sold his old truck to a 2nd hand truck dealer for 325,000 on 31 August 2019. Toby estimates he used his truck for business purposes for about 80% of the time. Advise Toby on the income tax consequences arising for him as a result of the disposal of the truck under BOTH: a) the Prime Cost Method; and (5 marks) b) the Diminishing Value Method. (5 marks) Assume Toby is not a small business entity. C || || Y be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts