Question: Year HD Returns LOW Returns 2 0 0 5 - 4 . 3 % 1 6 . 1 % 2 0 0 6 1 .

Year HD Returns LOW Returns

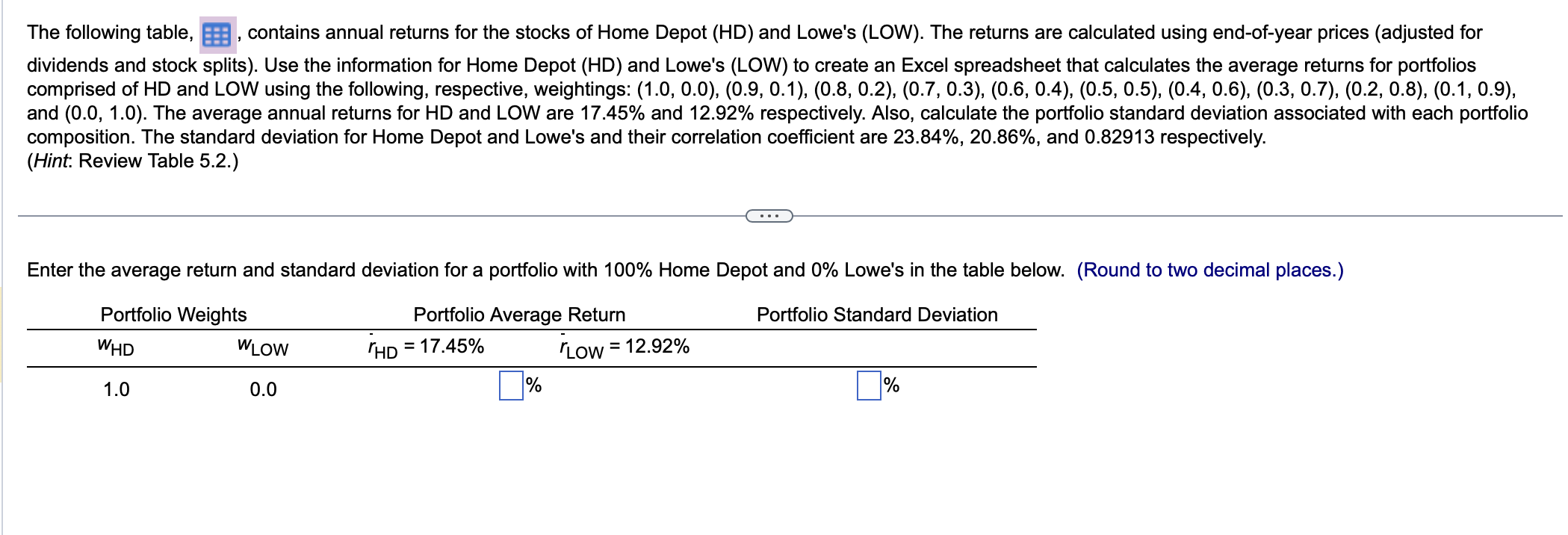

The following table, contains annual returns for the stocks of Home Depot HD and Lowe's LOW The returns are calculated using endofyear prices adjusted for

dividends and stock splits Use the information for Home Depot HD and Lowe's LOW to create an Excel spreadsheet that calculates the average returns for portfolios

comprised of HD and LOW using the following, respective, weightings:

and The average annual returns for HD and LOW are and respectively. Also, calculate the portfolio standard deviation associated with each portfolio

composition. The standard deviation for Home Depot and Lowe's and their correlation coefficient are and respectively.

Hint: Review Table

Enter the average return and standard deviation for a portfolio with Home Depot and Lowe's in the table below. Round to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock