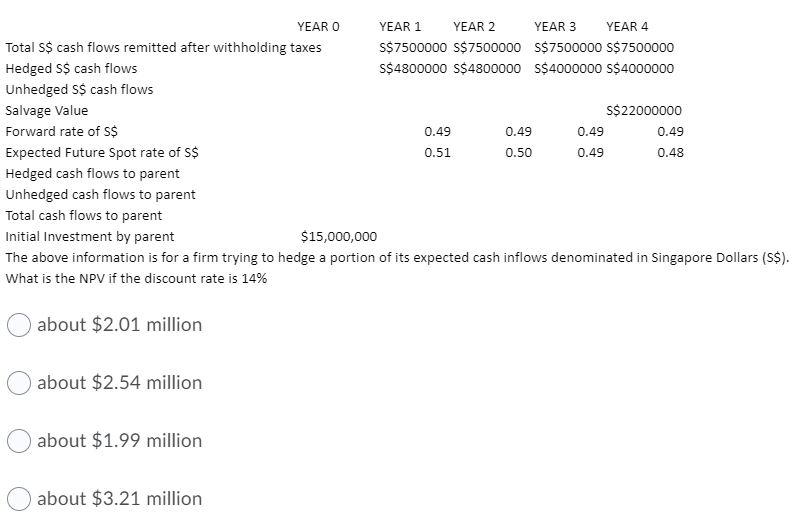

Question: YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 Total S$ cash flows remitted after withholding taxes S$7500000 S$7500000 $$7500000 5$7500000 Hedged S$ cash

YEAR O YEAR 1 YEAR 2 YEAR 3 YEAR 4 Total S$ cash flows remitted after withholding taxes S$7500000 S$7500000 $$7500000 5$7500000 Hedged S$ cash flows S$4800000 S$4800000 S$4000000 S$4000000 Unhedged S$ cash flows Salvage Value S$22000000 Forward rate of s$ 0.49 0.49 0.49 0.49 Expected Future Spot rate of $ 0.51 0.50 0.49 0.48 Hedged cash flows to parent Unhedged cash flows to parent Total cash flows to parent Initial Investment by parent $15,000,000 The above information is for a firm trying to hedge a portion of its expected cash inflows denominated in Singapore Dollars (5$). What is the NPV if the discount rate is 14% about $2.01 million about $2.54 million about $1.99 million about $3.21 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts