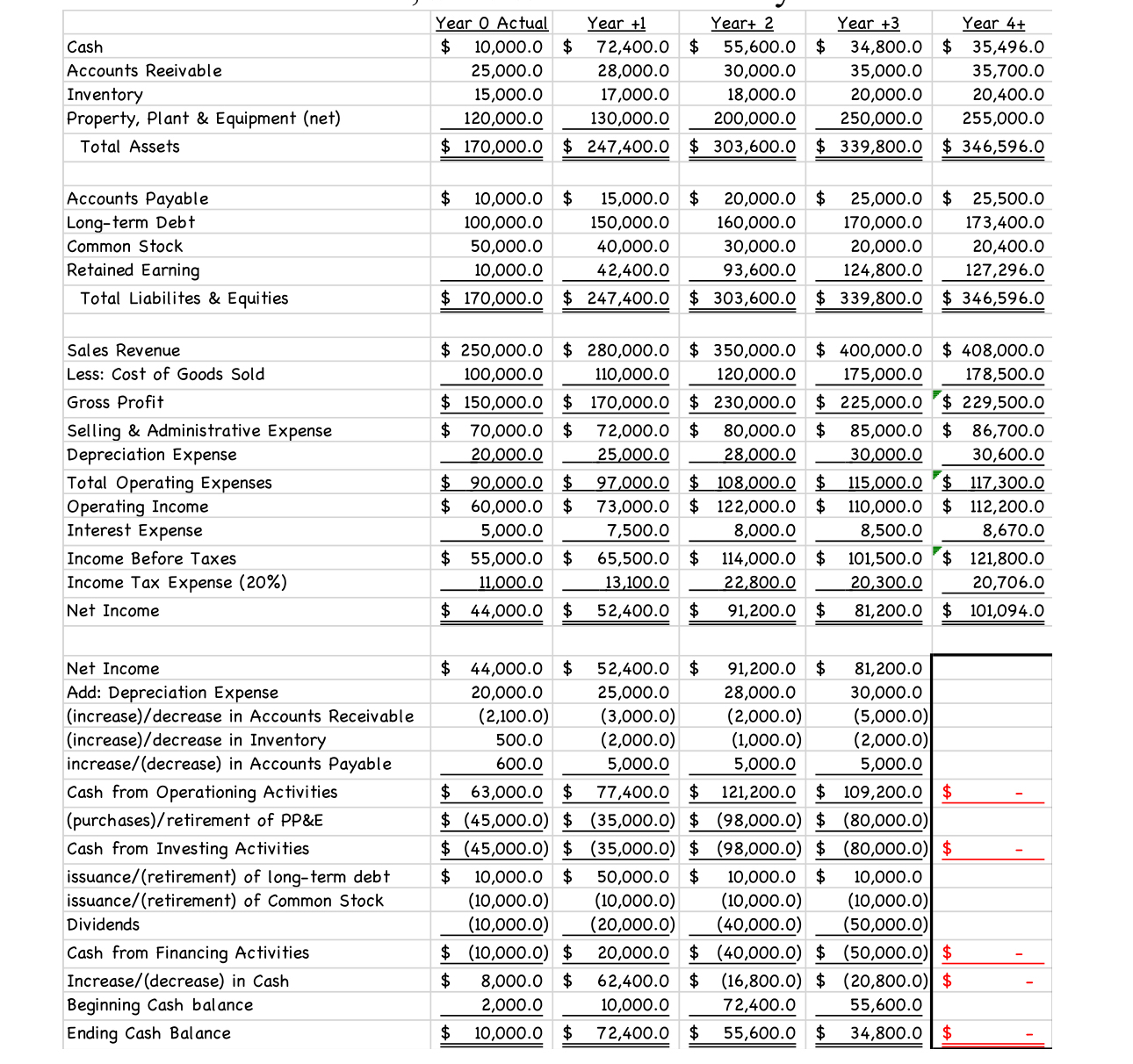

Question: Years + 1 , + 2 , and + 3 are forecasted amounts. Year 4 + reflects the balance sheet and income statement assuming a

Years and are forecasted amounts. Year reflects the balance sheet and income statement assuming a longterm growth rate.

Complete year by preparing the forecasted statement of cash flows. Your bottom line should reflect the ending cash balance of $

Assume the firm has outstanding shares of common stock and that the market expects a rate of return.

a Prepare for years and Year the dividend payout using clean surplus accounting. SHOW AND LABEL your calculations.

b Using the rate of return and the longterm growth rate, what is the value of one share of the shares outstanding?

c Prepare for years and Year the free cash flows for the firm. Your answers should match a above. Thus, SHOW AND LABEL your calculations.

tableCashYear Actual,Year Year Year Year t$$$$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock