Question: Years: 2015, 2016 2017 Year: 2015 2016 2017 Use Attached Balance sheet and Income statement to answer questions 2) The Cash Conversion Cycle is an

Years: 2015, 2016 2017

Year: 2015 2016 2017

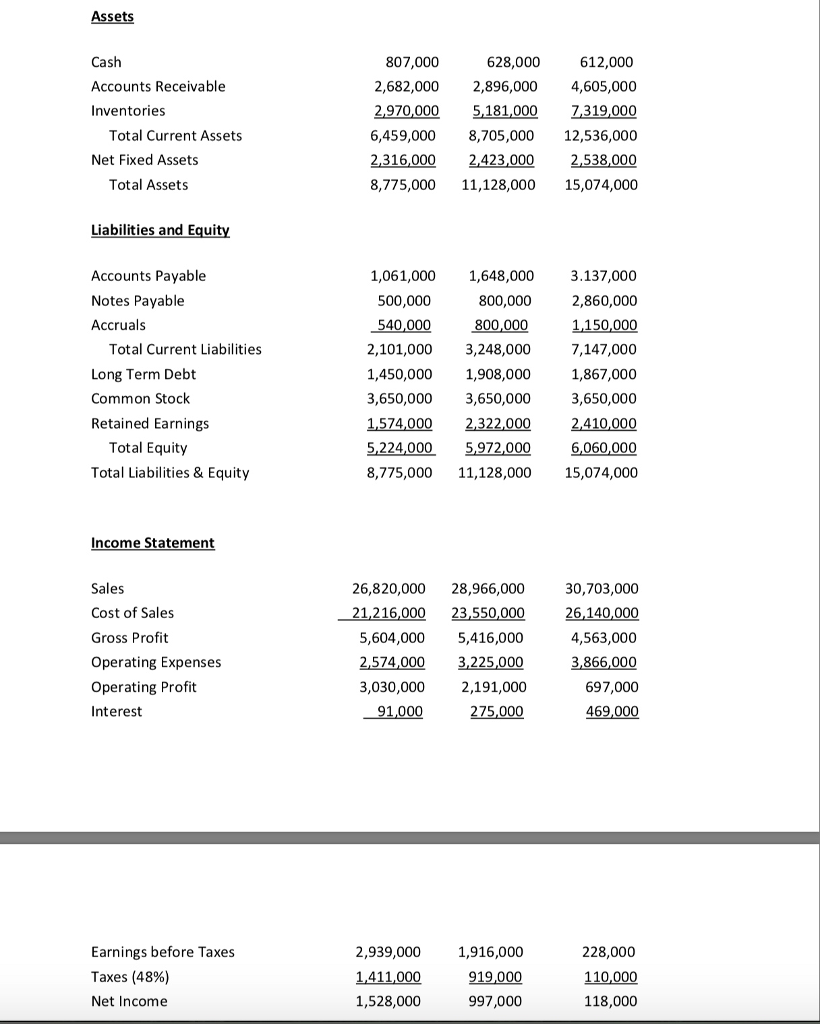

Use Attached Balance sheet and Income statement to answer questions

2) The Cash Conversion Cycle is an important management tool. a) Define the operating cycle. What does it tell us? b) Define the cash conversion cycle. What does it tell us? c) Calculate ABCs operating and cash conversion cycles for 3 years.

What do they tell you about ABCs cash management policies?

Assets 612,000 2,682,000 2,896,000 4,605,000 2,970,000 5,181,000Z319000 6,459,000 8,705,000 12,536,000 2423,000 2.538,000 8,775,000 11,128,000 15,074,000 Cash Accounts Receivable Inventories 807,000 628,000 Total Current Assets Net Fixed Assets Total Assets Liabilities and Equity Accounts Payable Notes Payable Accruals 1,061,000 1,648,000 800,000 800,000 2,101,000 3,248,000 1,450,000 1,908,000 3,650,000 3,650,000 3.137,000 2,860,000 1150,000 7,147,000 1,867,000 3,650,000 1,574 000 2322,000 2410,000 6,060,000 15,074,000 500,000 540,000 Total Current Liabilities Long Term Debt Common Stock Retained Earnings Total Equity Total Liabilities & Equity 5,224.000 5.972000 8,775,000 11,128,000 Income Statement Sales Cost of Sales Gross Profit Operating Expenses Operating Profit Interest 26,820,000 28,966,000 30,703,000 21,216,000 23,550,000 26,140,000 4,563,000 3866,000 697,000 469,000 5,604,000 5,416,000 2,574,000 3,225,000 3,030,000 2,191,000 . 31.000 25.000 Earnings before Taxes Taxes (48%) Net Income 2,939,000 1,411,000 1,528,000 1,916,000 919,000 997,000 228,000 110,000 118,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts