Question: YES EXCEL WILL WORK, I HAVE THE EXECEL FILES I JUST UPLOADED THEM PLEASE JUST POST THE ANSWER For all the relating questions Scenario #1:

YES EXCEL WILL WORK, I HAVE THE EXECEL FILES I JUST UPLOADED THEM PLEASE JUST POST THE ANSWER For all the relating questions

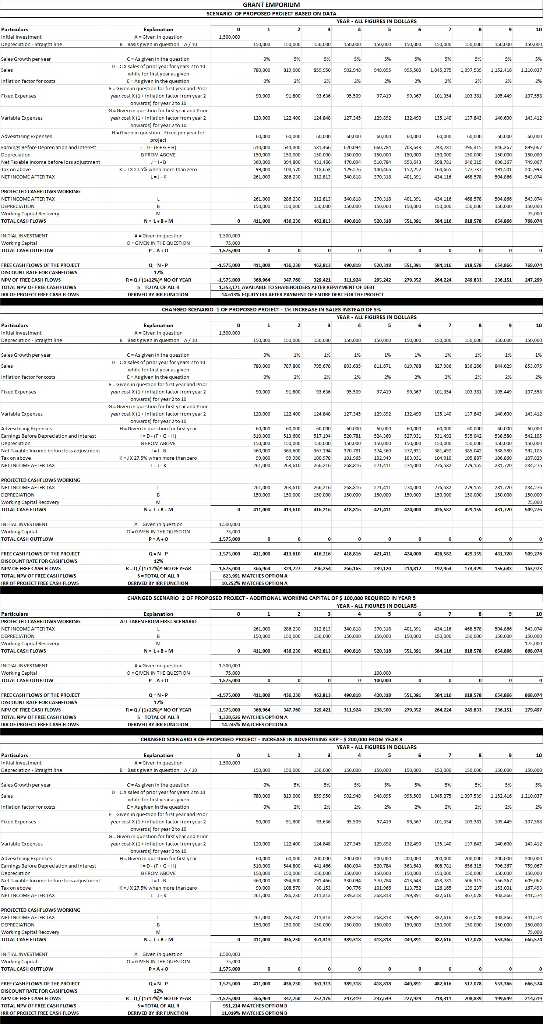

Scenario #1: Grants Emporium

You work for Dynamo Consulting Inc., a business consultancy, helping small to medium business owners make better financial decisions. W.T. runs Grants Emporium, a five and dime store. Hes thinking of opening another store. Your firm has analysed the problem and determined a number of key data inputs. This morning, you are meeting with W.T. to discuss your results and answer his questions. Based on some emails and prior meetings, you have a good idea what W.T. will ask, so you can prepare ahead. Your manager also has some suggestions about additional questions that he might ask. You will need to be prepared to answer these during the meeting.

Data: Opening Grants Emporium II

The capital investment required for opening a new store is $1,500,000, covering shop-fitting and other equipment such as cash registers etc. Additional working capital of $75,000 is also needed. The fixed costs of running a new store are $90,000 in the first year while variable costs, including labour costs, are $120,000. Both fixed and variable costs are expected to grow in line with inflation at 2 percent p.a. Forecast sales are $780,000 in the first year but can be expected to grow by 5 percent p.a. Advertising is important to this type of business and will cost $60,000 per year. The capital investment is to be depreciated straight-line to zero. W.T. hopes to keep the store running for 10 years. The discount rate that your team believes should be applied to the cash flows is 12 percent. The taxation rate is 27.5 percent (because this is a small-medium business in Australia). All working capital is returned at the end of the project. You intend to tell W.T. the NPV and IRR for this project idea and advise him on whether or not the idea will create market value for him and his family who own and operate the stores.

Your managers guidance: In addition to presenting the NPV and IRR (and associated advice), your manager, having worked with W.T. before, knows that he likes to scope out as many dimensions of a potential business decision as possible before committing. No doubt, W.T. will be interested in the sensitivity of the NPV and IRR to changes in forecast sales and the forecast growth rate. He might also be interested in knowing whether the project is viable if costs are greater (or grow faster) than expected or if additional working capital is required at different points. Being a bit of a finance buff, W.T. might also want to know more about the discount rate and how changes in it affect the viability of the project. You will need to make sure your spreadsheet analysis can cope with these adjustments so that you can quickly work out your answers during the meeting.

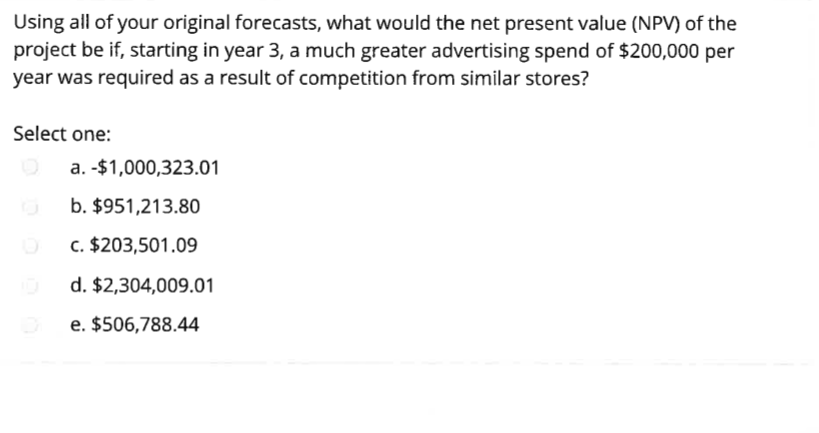

GHANT EMPORIUM VEAR-OLL FIGURES IN DOLLARS 0000FT 1000 B 43 1.426 24 Pa p er year 200.240 0 0CS 365,300 4045,27 -2022 20.4 12.0007 interessar for our bus PATAS PA) 2. 394 2003 2004 77.395 valables 12:30 12:02 13 0 CA2 WYWINNY Meble income before I STEET: L200 2042% 2.EL: 12.305 LX 340 13 ELS 320.005 904.2% 2L200 1940 42% DEL 3.30 U LX 1942 41421242X 1943 30.00 1 ULO 12% DAL 400 -20.303 LX. LE SUIS 24.04. 390.0041 FREGGHFLOWS OF THE PROJECT 50,21 SN 1816 158 CH .001 11215131.27 49.861241.894 222.222.222 1.250.000 1942 19 240 2400 1 94428240200120 Lahru 12079 xcro 2. E interessor for our bur 2.99 A 14300351 121122205 142 L.3200 1.100 2.000 150.000 150.000 12.000 1 ME 11TH 4.2. 11.2. 4 OBED.NTITETORGrows NIVO MSECAY HEWA TOTALNY OTROCCASITIONS IB3.0 PROIECT FREE CASH ROW 3 704121 A yu CHARGED SCENARIO 2 OF PROPOSED PROJECT - ADOMOKAL WORING CAPITAL OF 5 100,000 RECURED NYEAR! YEAR-ALL TOUTES IN DOLLAR Cealanson L 2X DI TOT DOTTO TOOTET t TTHE XER 1775 * *1 NSHINE now W Work Cuplal 0-CMXICO.no FECCIOTTICA -1.975,000 L 182X WALIO A4 1.6 13.21 1.5 1.12W NATCHESOFI OMA 120.) L. 1 2.0 222 5X1 20.00 42 213 221 27 TUTAN OFFRICLISHFLORS TOTAL OF LEDUSSKARKI CE PRISER PICT-X IR SIURISTOP-10 FROM YOR. YEAR - ALL FIGURES IN DOLLARS 19 ADX 200 1300 130,00 ZAD O W .. p arty 700.00 13.30 SEK 3.240 40.0 .50 945.9 .2! 1351.438 1330.007 Wir TIEK Peruar 2011 Der 13220 2 24 12T345 122 1229 5 372 3442 Cariple wo r lar. CET Tesonats CASIOWWONING LUX B X 180.000 120 COTECTION Wort Capallery 15000 exse 10 30 DJ WA INVIETENI TOTA.CASI GUTTON 21. ex 21 AMS .0478311 ADR .. KAT 2.1 21.4 Using all of your original forecasts, what would the net present value (NPV) of the project be if, starting in year 3, a much greater advertising spend of $200,000 per year was required as a result of competition from similar stores? Select one: a.-$1,000,323.01 b. $951,213.80 C. $203,501.09 d. $2,304,009.01 e. $506,788.44 GHANT EMPORIUM VEAR-OLL FIGURES IN DOLLARS 0000FT 1000 B 43 1.426 24 Pa p er year 200.240 0 0CS 365,300 4045,27 -2022 20.4 12.0007 interessar for our bus PATAS PA) 2. 394 2003 2004 77.395 valables 12:30 12:02 13 0 CA2 WYWINNY Meble income before I STEET: L200 2042% 2.EL: 12.305 LX 340 13 ELS 320.005 904.2% 2L200 1940 42% DEL 3.30 U LX 1942 41421242X 1943 30.00 1 ULO 12% DAL 400 -20.303 LX. LE SUIS 24.04. 390.0041 FREGGHFLOWS OF THE PROJECT 50,21 SN 1816 158 CH .001 11215131.27 49.861241.894 222.222.222 1.250.000 1942 19 240 2400 1 94428240200120 Lahru 12079 xcro 2. E interessor for our bur 2.99 A 14300351 121122205 142 L.3200 1.100 2.000 150.000 150.000 12.000 1 ME 11TH 4.2. 11.2. 4 OBED.NTITETORGrows NIVO MSECAY HEWA TOTALNY OTROCCASITIONS IB3.0 PROIECT FREE CASH ROW 3 704121 A yu CHARGED SCENARIO 2 OF PROPOSED PROJECT - ADOMOKAL WORING CAPITAL OF 5 100,000 RECURED NYEAR! YEAR-ALL TOUTES IN DOLLAR Cealanson L 2X DI TOT DOTTO TOOTET t TTHE XER 1775 * *1 NSHINE now W Work Cuplal 0-CMXICO.no FECCIOTTICA -1.975,000 L 182X WALIO A4 1.6 13.21 1.5 1.12W NATCHESOFI OMA 120.) L. 1 2.0 222 5X1 20.00 42 213 221 27 TUTAN OFFRICLISHFLORS TOTAL OF LEDUSSKARKI CE PRISER PICT-X IR SIURISTOP-10 FROM YOR. YEAR - ALL FIGURES IN DOLLARS 19 ADX 200 1300 130,00 ZAD O W .. p arty 700.00 13.30 SEK 3.240 40.0 .50 945.9 .2! 1351.438 1330.007 Wir TIEK Peruar 2011 Der 13220 2 24 12T345 122 1229 5 372 3442 Cariple wo r lar. CET Tesonats CASIOWWONING LUX B X 180.000 120 COTECTION Wort Capallery 15000 exse 10 30 DJ WA INVIETENI TOTA.CASI GUTTON 21. ex 21 AMS .0478311 ADR .. KAT 2.1 21.4 Using all of your original forecasts, what would the net present value (NPV) of the project be if, starting in year 3, a much greater advertising spend of $200,000 per year was required as a result of competition from similar stores? Select one: a.-$1,000,323.01 b. $951,213.80 C. $203,501.09 d. $2,304,009.01 e. $506,788.44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts