Question: yes it means use the Net Present Worth method or analysis Complete the following problem and submit the files to the drop box by the

yes it means use the Net Present Worth method or analysis

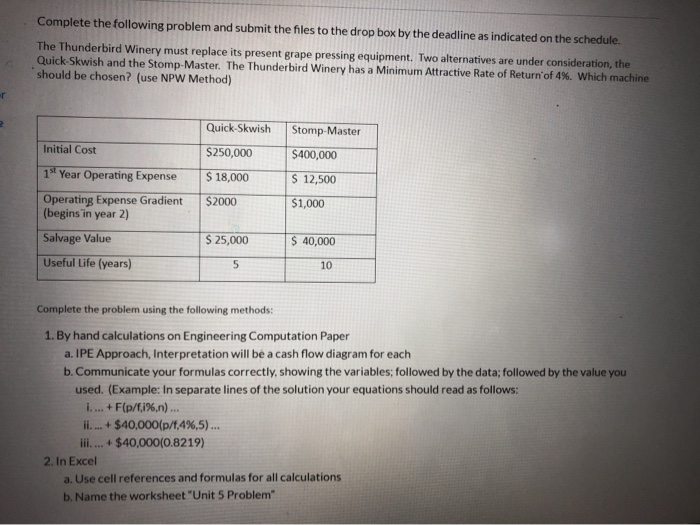

Complete the following problem and submit the files to the drop box by the deadline as indicated on the schedule. The Thunderbird Winery must replace its present grape pressing equipment. Two alternatives are under consideration, the Quick-Skwish and the Stomp-Master. The Thunderbird Winery has a Minimum Attractive Rate of Return of 4%. Which machine should be chosen? (use NPW Method) ar Stomp-Master Initial Cost Quick-Skwish $250,000 $ 18,000 $400,000 $ 12,500 19 Year Operating Expense Operating Expense Gradient (begins in year 2) Salvage Value $2000 $1,000 $ 25,000 $ 40,000 Useful Life (years) 5 10 Complete the problem using the following methods: 1. By hand calculations on Engineering Computation Paper a. IPE Approach, Interpretation will be a cash flow diagram for each b. Communicate your formulas correctly, showing the variables; followed by the data; followed by the value you used. (Example: In separate lines of the solution your equations should read as follows: i.... + F(p/f,1%,n)... ii.... + $40,000(p/f,4%,5)... iii.... + $40,000(0.8219) 2. In Excel a. Use cell references and formulas for all calculations b. Name the worksheet"Unit 5 Problem" Complete the following problem and submit the files to the drop box by the deadline as indicated on the schedule. The Thunderbird Winery must replace its present grape pressing equipment. Two alternatives are under consideration, the Quick-Skwish and the Stomp-Master. The Thunderbird Winery has a Minimum Attractive Rate of Return of 4%. Which machine should be chosen? (use NPW Method) ar Stomp-Master Initial Cost Quick-Skwish $250,000 $ 18,000 $400,000 $ 12,500 19 Year Operating Expense Operating Expense Gradient (begins in year 2) Salvage Value $2000 $1,000 $ 25,000 $ 40,000 Useful Life (years) 5 10 Complete the problem using the following methods: 1. By hand calculations on Engineering Computation Paper a. IPE Approach, Interpretation will be a cash flow diagram for each b. Communicate your formulas correctly, showing the variables; followed by the data; followed by the value you used. (Example: In separate lines of the solution your equations should read as follows: i.... + F(p/f,1%,n)... ii.... + $40,000(p/f,4%,5)... iii.... + $40,000(0.8219) 2. In Excel a. Use cell references and formulas for all calculations b. Name the worksheet"Unit 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts