Question: YESS THATS FINE. THANKS ! EXERCISE PROBLEMS Chapter 11: The Basies of Capital Budgeting 1. SuperLink Inc. is considering an investment that has the following

YESS THATS FINE. THANKS !

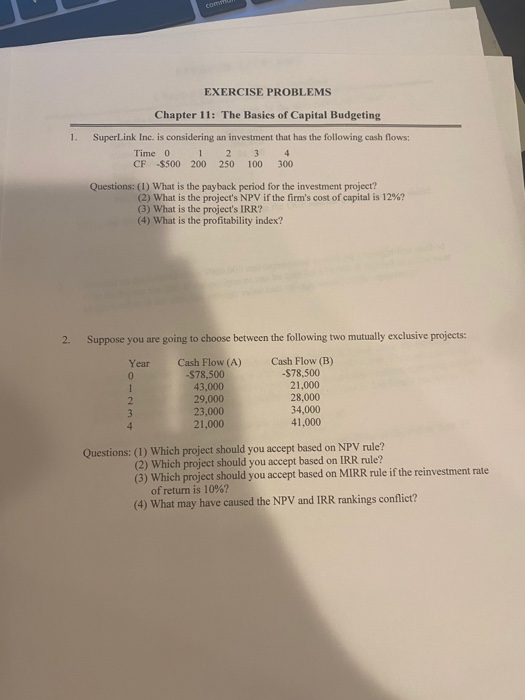

EXERCISE PROBLEMS Chapter 11: The Basies of Capital Budgeting 1. SuperLink Inc. is considering an investment that has the following cash flows: Time 0 1 2 3 4 CF $500 200 250 100 300 Questions: (1) What is the payback period for the investment project? (2) What is the project's NPV if the firm's cost of capital is 12%? (3) What is the project's IRR? (4) What is the profitability index? 2. Suppose you are going to choose between the following two mutually exclusive projects: Year Cash Flow (A) -$78,500 43,000 29,000 23,000 21,000 Cash Flow (B) -$78,500 21.000 28.000 34,000 41,000 Questions: (1) Which project should you accept based on NPV rule? (2) Which project should you accept based on IRR rule? (3) Which project should you accept based on MIRR rule if the reinvestment rate of return is 10%? (4) What may have caused the NPV and IRR rankings conflict

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts