Question: Yi Min started an engineering firm called Min Engineering. He began operations and completed seven transactions in May. which included his initial investment of $22,000

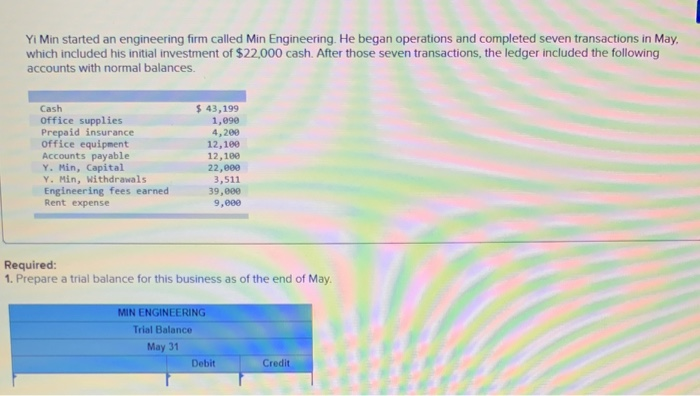

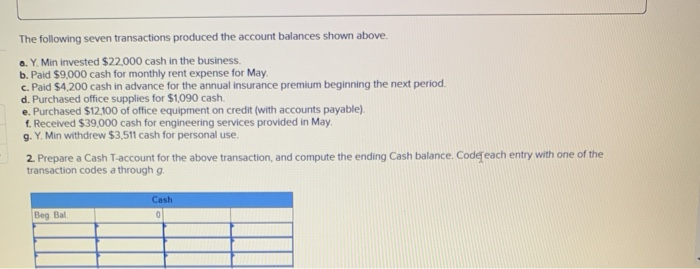

Yi Min started an engineering firm called Min Engineering. He began operations and completed seven transactions in May. which included his initial investment of $22,000 cash. After those seven transactions, the ledger included the following accounts with normal balances. Cash Office supplies Prepaid insurance office equipment Accounts payable Y. Min, Capital Y. Min, withdrawals Engineering fees earned Rent expense $ 43,199 1,090 4,200 12,180 12,100 22,000 3,511 39,000 9,000 Required: 1. Prepare a trial balance for this business as of the end of May. MIN ENGINEERING Trial Balance May 31 Debit Credit The following seven transactions produced the account balances shown above. a. Y. Min invested $22,000 cash in the business. b. Paid $9,000 cash for monthly rent expense for May. c. Paid $4,200 cash in advance for the annual insurance premium beginning the next period. d. Purchased office supplies for $1,090 cash. e. Purchased $12,100 of office equipment on credit (with accounts payable). f. Received $39,000 cash for engineering services provided in May. g. Y. Min withdrew $3,511 cash for personal use. 2. Prepare a Cash T-account for the above transaction, and compute the ending Cash balance. Code each entry with one of the transaction codes a through g. Cash 0 Beg Bal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts