Question: yield curve with these data. Is your yield curve consistent with the three term structure theories? Computer-Related Problem Work the problem in this section only

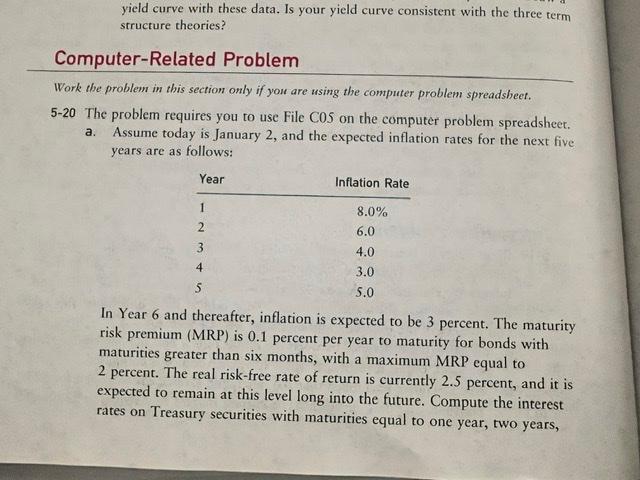

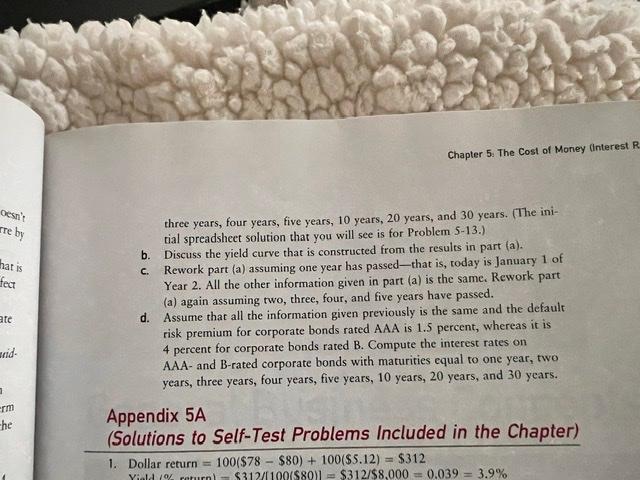

yield curve with these data. Is your yield curve consistent with the three term structure theories? Computer-Related Problem Work the problem in this section only if you are using the computer problem spreadsheet. 5-20 The problem requires you to use File C0S on the computer problem spreadsheet. a. Assume today is January 2, and the expected inflation rates for the next five years are as follows: In Year 6 and thereafter, inflation is expected to be 3 percent. The maturity risk premium (MRP) is 0.1 percent per year to maturity for bonds with maturities greater than six months, with a maximum MRP equal to 2 percent. The real risk-free rate of return is currently 2.5 percent, and it is expected to remain at this level long into the future. Compute the interest rates on Treasury securities with maturities equal to one year, two years, three years, four years, five years, 10 years, 20 years, and 30 years. (The initial spreadsheet solution that you will see is for Problem 5-13.) b. Discuss the yield curve that is constructed from the results in part (a). c. Rework part (a) assuming one year has passed-that is, today is January 1 of Year 2. All the other information given in part (a) is the same. Rework part (a) again assuming two, three, four, and five years have passed. d. Assume that all the information given previously is the same and the default risk premium for corporate bonds rated AAA is 1.5 percent, whereas it is 4 percent for corporate bonds rated B. Compute the interest rates on AAA- and B-rated corporate bonds with maturities equal to one year, two years, three years, four years, five years, 10 years, 20 years, and 30 years. Appendix 5A (Solutions to Self-Test Problems Included in the Chapter) 1. Dollar return =100($78$80)+100($5.12)=$312 Yiald 1% coturn $312/[100($80)]=$312/$8,000=0.039=3.9% yield curve with these data. Is your yield curve consistent with the three term structure theories? Computer-Related Problem Work the problem in this section only if you are using the computer problem spreadsheet. 5-20 The problem requires you to use File C0S on the computer problem spreadsheet. a. Assume today is January 2, and the expected inflation rates for the next five years are as follows: In Year 6 and thereafter, inflation is expected to be 3 percent. The maturity risk premium (MRP) is 0.1 percent per year to maturity for bonds with maturities greater than six months, with a maximum MRP equal to 2 percent. The real risk-free rate of return is currently 2.5 percent, and it is expected to remain at this level long into the future. Compute the interest rates on Treasury securities with maturities equal to one year, two years, three years, four years, five years, 10 years, 20 years, and 30 years. (The initial spreadsheet solution that you will see is for Problem 5-13.) b. Discuss the yield curve that is constructed from the results in part (a). c. Rework part (a) assuming one year has passed-that is, today is January 1 of Year 2. All the other information given in part (a) is the same. Rework part (a) again assuming two, three, four, and five years have passed. d. Assume that all the information given previously is the same and the default risk premium for corporate bonds rated AAA is 1.5 percent, whereas it is 4 percent for corporate bonds rated B. Compute the interest rates on AAA- and B-rated corporate bonds with maturities equal to one year, two years, three years, four years, five years, 10 years, 20 years, and 30 years. Appendix 5A (Solutions to Self-Test Problems Included in the Chapter) 1. Dollar return =100($78$80)+100($5.12)=$312 Yiald 1% coturn $312/[100($80)]=$312/$8,000=0.039=3.9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts