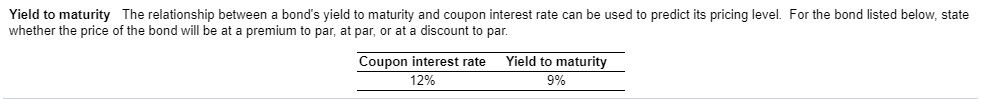

Question: Yield to maturity The relationship between a bond's yield to maturity and coupon interest rate can be used to predict its pricing level. For the

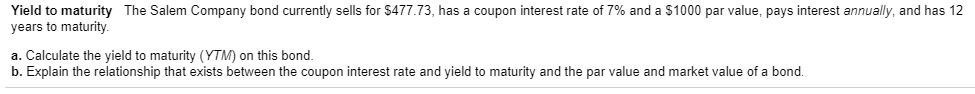

Yield to maturity The relationship between a bond's yield to maturity and coupon interest rate can be used to predict its pricing level. For the bond listed below, state whether the price of the bond will be at a premium to par, at par, or at a discount to par. Yield to maturity Coupon interest rate 12% Yield to maturity The Salem Company bond currently sells for $477.73, has a coupon interest rate of 7% and a $1000 par value, pays interest annually, and has 12 years to maturity. a. Calculate the yield to maturity (YTM) on this bond. b. Explain the relationship that exists between the coupon interest rate and yield to maturity and the par value and market value of a bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts