Question: Yield to maturity The relationship between a bond's yield to maturity and coupon interest rate can be used to predict its pricing level. For each

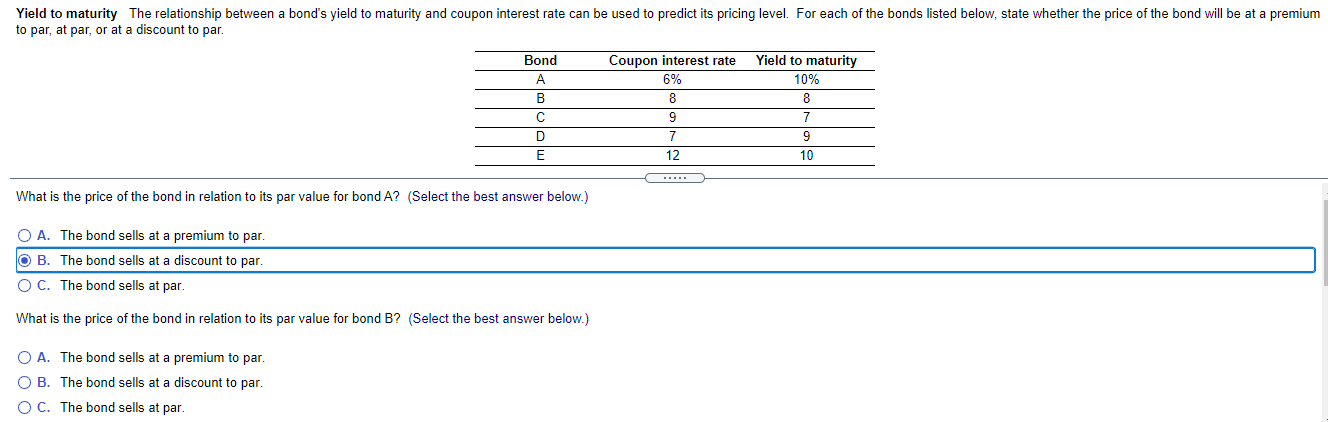

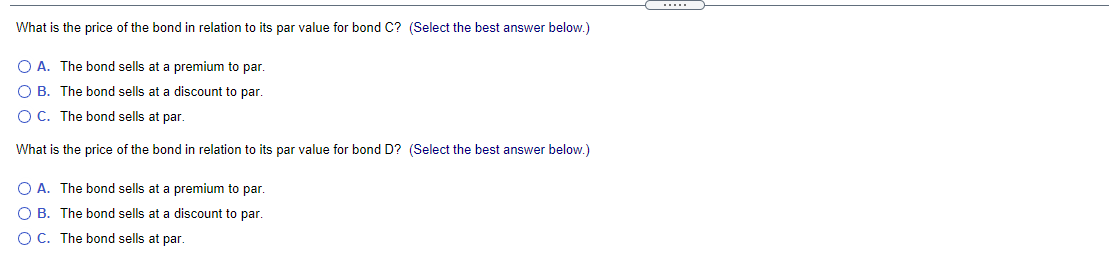

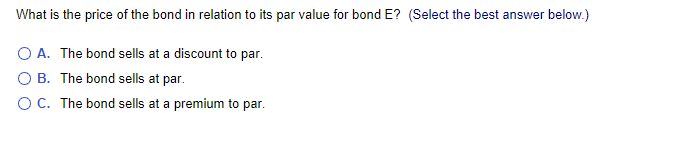

Yield to maturity The relationship between a bond's yield to maturity and coupon interest rate can be used to predict its pricing level. For each of the bonds listed below, state whether the price of the bond will be at a premium to par, at par, or at a discount to par. Bond B D E Coupon interest rate 6% 8 9 7 12 Yield to maturity 10% 8 7 9 10 What is the price of the bond in relation to its par value for bond A? (Select the best answer below.) O A. The bond sells at a premium to par. O B. The bond sells at a discount to par. O C. The bond sells at par. What is the price of the bond in relation to its par value for bond B? (Select the best answer below.) O A. The bond sells at a premium to par. OB. The bond sells at a discount to par. O C. The bond sells at par. What is the price of the bond in relation to its par value for bond C? (Select the best answer below.) O A. The bond sells at a premium to par. OB. The bond sells at a discount to par O C. The bond sells at par. What is the price of the bond in relation to its par value for bond D? (Select the best answer below.) O A. The bond sells at a premium to par OB. The bond sells at a discount to par. O C. The bond sells at par. What is the price of the bond in relation to its par value for bond E? (Select the best answer below.) O A. The bond sells at a discount to par. OB. The bond sells at par. OC. The bond sells at a premium to par

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts