Question: Yields on short-term bonds tend to be more volatile than yields on long-term bonds. Suppose that you have estimated that the yield on 20-year bonds

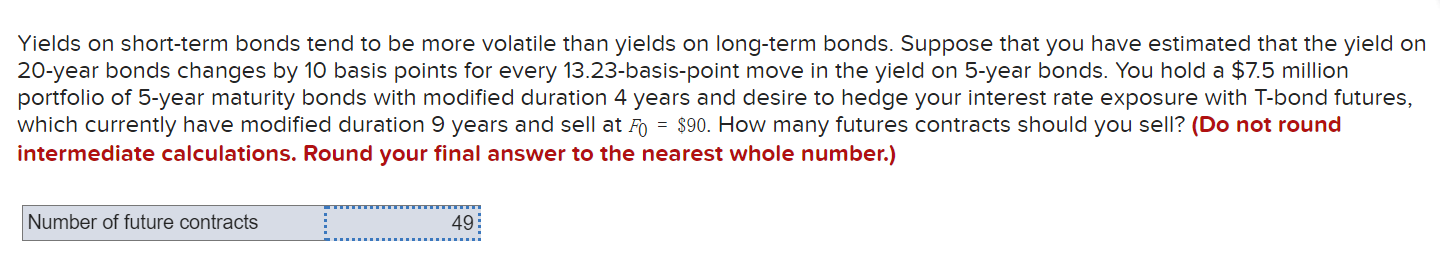

Yields on short-term bonds tend to be more volatile than yields on long-term bonds. Suppose that you have estimated that the yield on 20-year bonds changes by 10 basis points for every 13.23-basis-point move in the yield on 5-year bonds. You hold a $7.5 million portfolio of 5-year maturity bonds with modified duration 4 years and desire to hedge your interest rate exposure with T-bond futures, which currently have modified duration 9 years and sell at Fo = $90. How many futures contracts should you sell? (Do not round intermediate calculations. Round your final answer to the nearest whole number.) Number of future contracts 49

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock