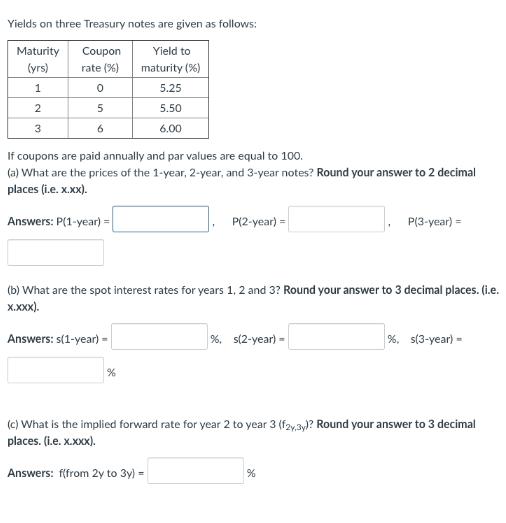

Question: Yields on three Treasury notes are given as follows: Coupon Yield to Maturity (yrs) rate (%) maturity (%) 1 0 5.25 2 5 5.50

Yields on three Treasury notes are given as follows: Coupon Yield to Maturity (yrs) rate (%) maturity (%) 1 0 5.25 2 5 5.50 6 6.00 3 If coupons are paid annually and par values are equal to 100. (a) What are the prices of the 1-year, 2-year, and 3-year notes? Round your answer to 2 decimal places (i.e.x.xx). Answers: P(1-year) = P(2-year) = % (b) What are the spot interest rates for years 1, 2 and 3? Round your answer to 3 decimal places. (i.e. x.xxx). Answers: s(1-year) - %, s(2-year) - P(3-year) = % %, s(3-year) - (c) What is the implied forward rate for year 2 to year 3 (f2y,3y)? Round your answer to 3 decimal places. (i.e. x.xxx). Answers: f(from 2y to 3y) =

Step by Step Solution

There are 3 Steps involved in it

ANSWER I The Solution to part a i Assuming Face value of all the bonds is the US 100 The price of a bond is the sum total of present values of all cou... View full answer

Get step-by-step solutions from verified subject matter experts