Question: Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the table below. If the corporate tax rate

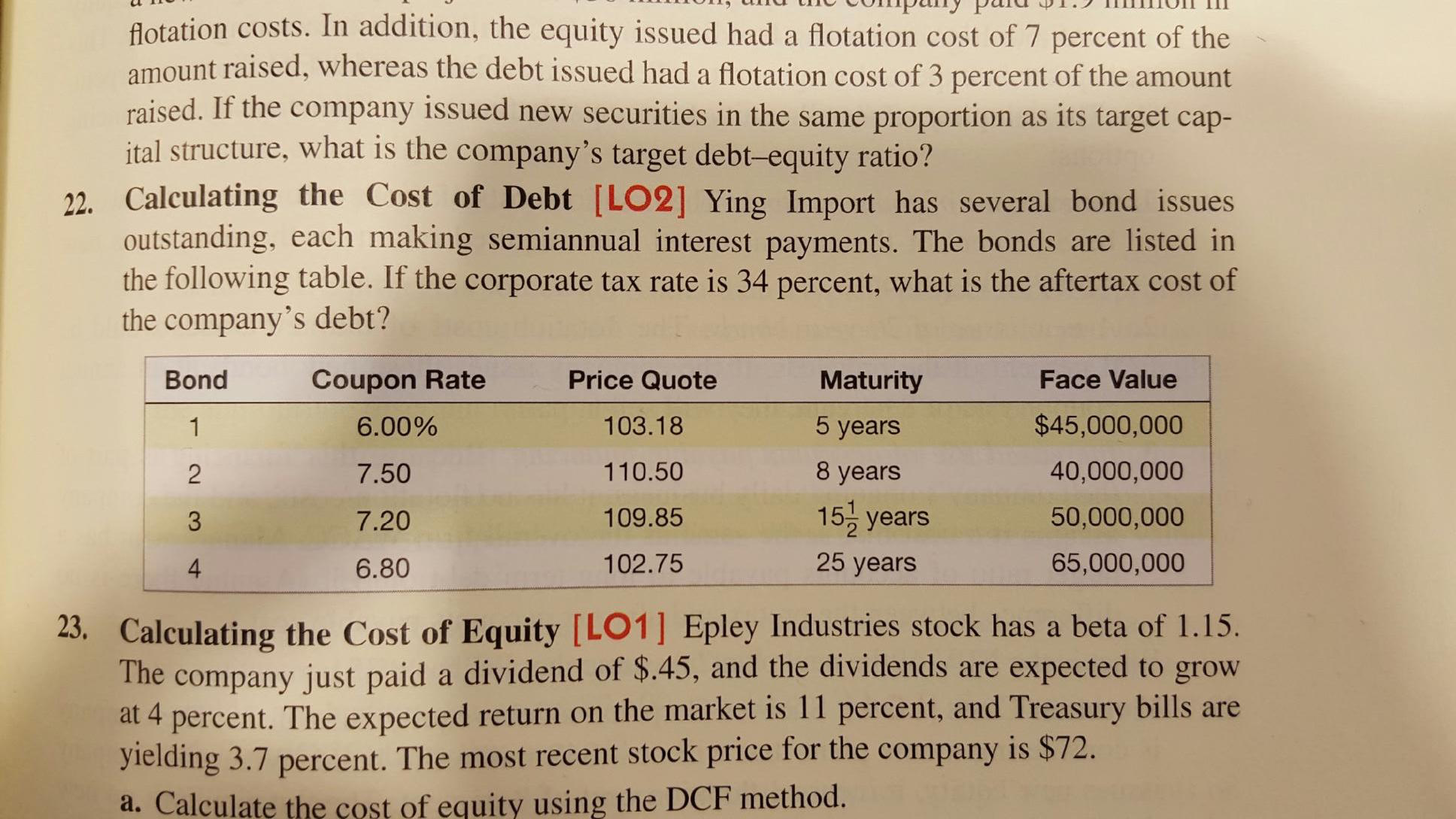

Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the table below.

If the corporate tax rate is 34 percent, what is the aftertax cost of the companys debt?

Ull LI flotation costs. In addition, the equity issued had a flotation cost of 7 percent of the amount raised, whereas the debt issued had a flotation cost of 3 percent of the amount raised. If the company issued new securities in the same proportion as its target cap ital structure, what is the company's target debt-equity ratio? 22. Calculating the Cost of Debt [LO2] Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the following table. If the corporate tax rate is 34 percent, what is the aftertax cost of the company's debt? 1 V 1.) TUIl II Bond Coupon Rate Price Quote Maturity Face Value 6.00% 103.18 5 years $45,000,000 7.50 110.50 8 years 40,000.000 7.20 109.85 15 , years 50,000,000 6.80 102.75 25 years 65,000,000 23. Calculating the Cost of Equity [LO1] Epley Industries stock has a beta of 1.15. The company just paid a dividend of $.45, and the dividends are expected to grow at 4 percent. The expected return on the market is 11 percent, and Treasury bills are yielding 3.7 percent. The most recent stock price for the company is $72. a. Calculate the cost of equity using the DCF method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts