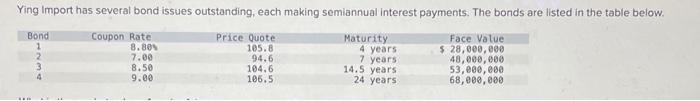

Question: Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the table below. begin{tabular}{crrrr} hline Bond & Coupon

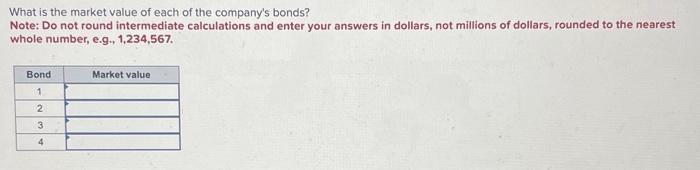

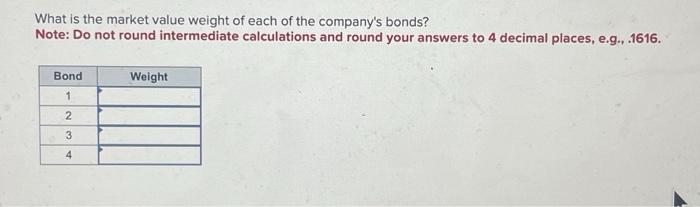

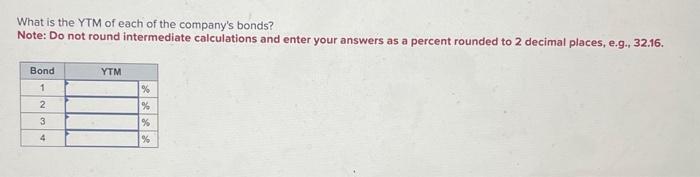

Ying Import has several bond issues outstanding, each making semiannual interest payments. The bonds are listed in the table below. \begin{tabular}{crrrr} \hline Bond & Coupon Rate & Price Quote & Maturity & Face Value \\ 1 & 8.801 & 105.8 & 4 years & $28,000,000 \\ 2 & 7.00 & 94.6 & 7 years & 48,000,000 \\ 3 & 8.50 & 104.6 & 14.5 years & 53,000,000 \\ 4 & 9.00 & 106.5 & 24 years & 68,000,000 \end{tabular} What is the market value of each of the company's bonds? Note: Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567. What is the market value weight of each of the company's bonds? Note: Do not round intermediate calculations and round your answers to 4 decimal places, e.g.,. 1616 . What is the YTM of each of the company's bonds? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. If the corporate tax rate is 23 percent, what is the aftertax cost of the company's debt? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.9., 32.16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts