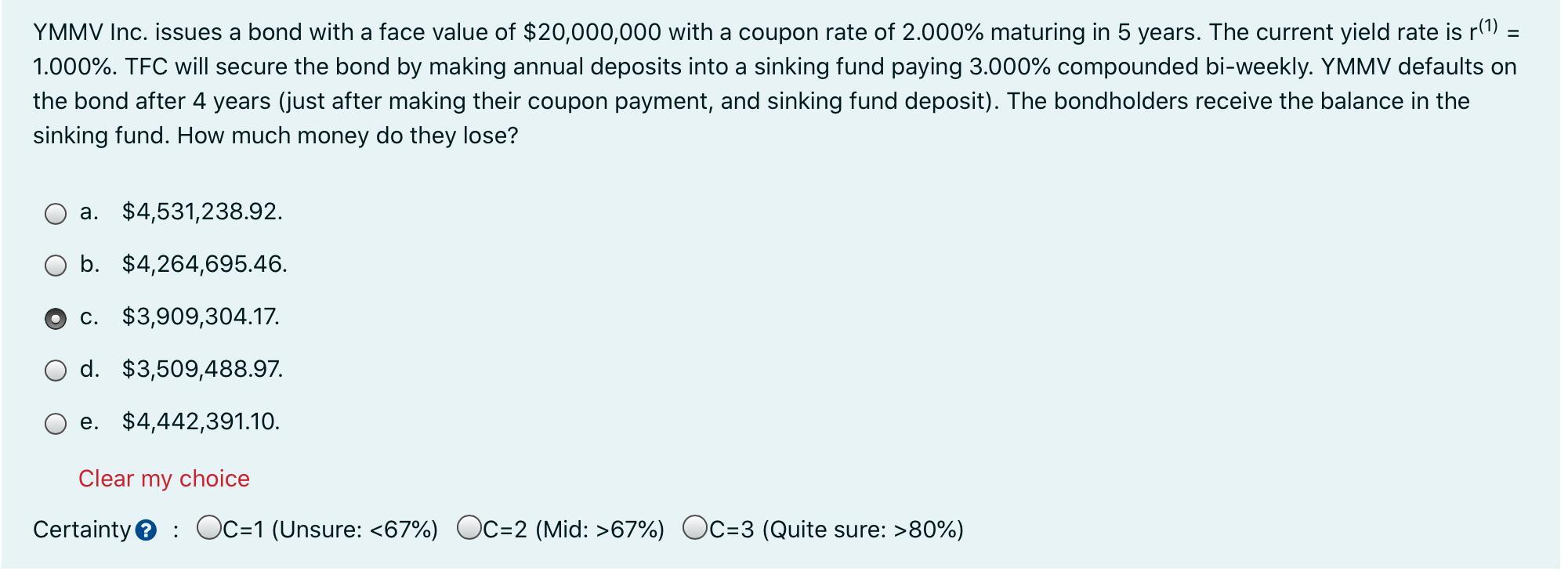

Question: = YMMV Inc. issues a bond with a face value of $20,000,000 with a coupon rate of 2.000% maturing in 5 years. The current

= YMMV Inc. issues a bond with a face value of $20,000,000 with a coupon rate of 2.000% maturing in 5 years. The current yield rate is r() = 1.000%. TFC will secure the bond by making annual deposits into a sinking fund paying 3.000% compounded bi-weekly. YMMV defaults on the bond after 4 years (just after making their coupon payment, and sinking fund deposit). The bondholders receive the balance in the sinking fund. How much money do they lose? a. $4,531,238.92. b. $4,264,695.46. c. $3,909,304.17. d. $3,509,488.97. e. $4,442,391.10. Clear my choice Certainty OC-1 (Unsure: 67%) OC-3 (Quite sure: >80%)

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Answer E 44423911 Calculations The an... View full answer

Get step-by-step solutions from verified subject matter experts