You accepted a new job with starting salary of $52,000 per year. The salary is expected...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

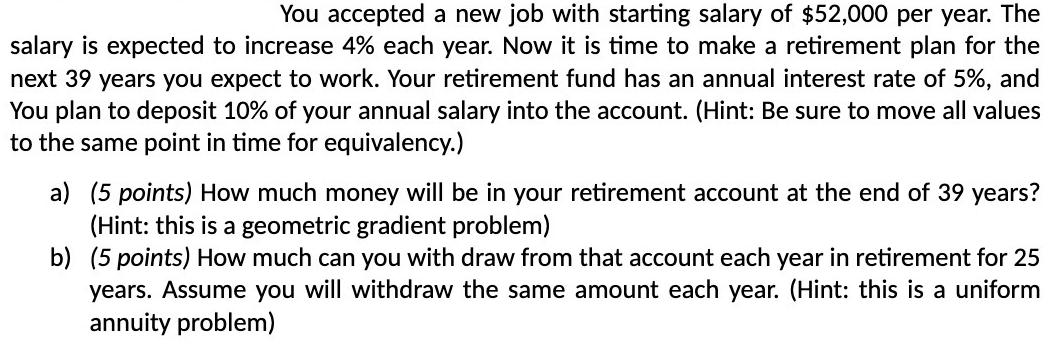

You accepted a new job with starting salary of $52,000 per year. The salary is expected to increase 4% each year. Now it is time to make a retirement plan for the next 39 years you expect to work. Your retirement fund has an annual interest rate of 5%, and You plan to deposit 10% of your annual salary into the account. (Hint: Be sure to move all values to the same point in time for equivalency.) a) (5 points) How much money will be in your retirement account at the end of 39 years? (Hint: this is a geometric gradient problem) b) (5 points) How much can you with draw from that account each year in retirement for 25 years. Assume you will withdraw the same amount each year. (Hint: this is a uniform annuity problem) You accepted a new job with starting salary of $52,000 per year. The salary is expected to increase 4% each year. Now it is time to make a retirement plan for the next 39 years you expect to work. Your retirement fund has an annual interest rate of 5%, and You plan to deposit 10% of your annual salary into the account. (Hint: Be sure to move all values to the same point in time for equivalency.) a) (5 points) How much money will be in your retirement account at the end of 39 years? (Hint: this is a geometric gradient problem) b) (5 points) How much can you with draw from that account each year in retirement for 25 years. Assume you will withdraw the same amount each year. (Hint: this is a uniform annuity problem)

Expert Answer:

Answer rating: 100% (QA)

a To calculate the total amount of money in the retirement account after 39 years we can use the formula for the future value of a geometric gradient ... View the full answer

Related Book For

Applied Equity Analysis and Portfolio Management Tools to Analyze and Manage Your Stock Portfolio

ISBN: 978-1118630914

1st edition

Authors: Robert A.Weigand

Posted Date:

Students also viewed these finance questions

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

This case study on project evaluation is applicable for beginning courses in corporate finance or finance strategy. Two alternative investment options are available to evaluate. Challenges are...

-

For each problem, show your work steps. A correct answer with no work shown gets half credit (which means you fail the assignment). An incorrect answer with no work receives 0 credit. With time value...

-

Skysong, Inc. sells products that carry a two-year warranty. Any defective product is replaced with a new item taken from inventory. Management believes that this is the most cost-effective way to...

-

Winnebago Industries, Inc. is a leading manufacturer of motor homes. Winnebago reported ending inventory at August 25, 2007, of $101,208,000 under the LIFO inventory method. In the notes to its...

-

Describe the x-values at which f is differentiable. f(x) = 3x/x + 1 -3-2 00 8 6 2 y 12 X

-

Can you present a graphic that presents the payroll disbursement amounts by date for the contact employee who has been terminated but has been paid after termination (i.e., ghost employees)?

-

The data that follow were taken from the CAFR of Chaseville, a mid-sized midwestern city with a population of 82,000. All dollar amounts are in thousands. Total assessed value of property .......

-

Describe a specific scenario, situation, or application where using a foreign key would be necessary. 2) Explain your reasons, including the characteristics of the data, that necessitate the foreign...

-

The adjusted trial balance columns of the worksheet for Auburn Company are as follows. Instructions Complete the worksheet. Auburn Company Worksheet (partial) For the Month Ended April 30, 2020...

-

For this task you will require an individualised plan for a client: Once you have your individualised plan, read and interpret the plan, and discuss the goals, required equipment, process and aids...

-

As a financial analyst, you are required to value a company which has expected earnings before interest and taxes (EBIT)of RM26 million every year beginning in one year. The depreciation is expected...

-

According to figures cited in Marketing 5.0: Technology for Humanity (Kotler et al., 2021) in 2020, there were close to 5 billion internet users and it is estimated that this number continues to grow...

-

1. Assuming the current inflation rate (see the latest CPI), what is the appropriate level of interest rates to quell inflation? 2. Should the Fed consider the effects of interest rate increases on...

-

Which of these are common fraud schemes involving the manipulation of long-term assets? Select all that apply. Question 6Select one or more: Improperly capitalizing inventory and startup costs...

-

To pay for a $23,200 fishing boat, Ashley made a down payment of $4200 and took out a loan for the rest. On the loan, she paid monthly payments of $341.42 for 5 years. (a) (b) What was the total...

-

1) What is f(0) ?-. 2) What is f(6) ? - 3) What are the x intercepts ? = 4) What is the Y intercept? = 5) Isf (3) positive or negative ? = 6) is f(-4) positive or negative ? 7) What is the maximum...

-

What do you think?

-

Calculate the 3-year compound average growth rate (CAGR) for UTX's total revenue, EBIT, EPS and DPS.

-

Describe the two ways relative valuation ratios are calculated, and provide examples of each.

-

Identify some typical quantitative signs of superior competitive advantage.

-

According to the static trade-off theory: A. debt should be used only as a last resort. B. companies have an optimal level of debt. C. the capital structure decision is irrelevant.

-

According to the pecking order theory: A. new debt is preferable to new equity. B. new debt is preferable to internally generated funds. C. new equity is always preferable to other sources of capital.

-

Leota Sage saw a local motorcycle dealers newspaper advertisement offering a MetroRider EZ electric scooter for \($1,699.\) When she went to the dealership, however, she learned that the EZ model had...

Study smarter with the SolutionInn App