Question: You and your management team are working to develop the strategic direction of your company for the next three years. Your company has averaged

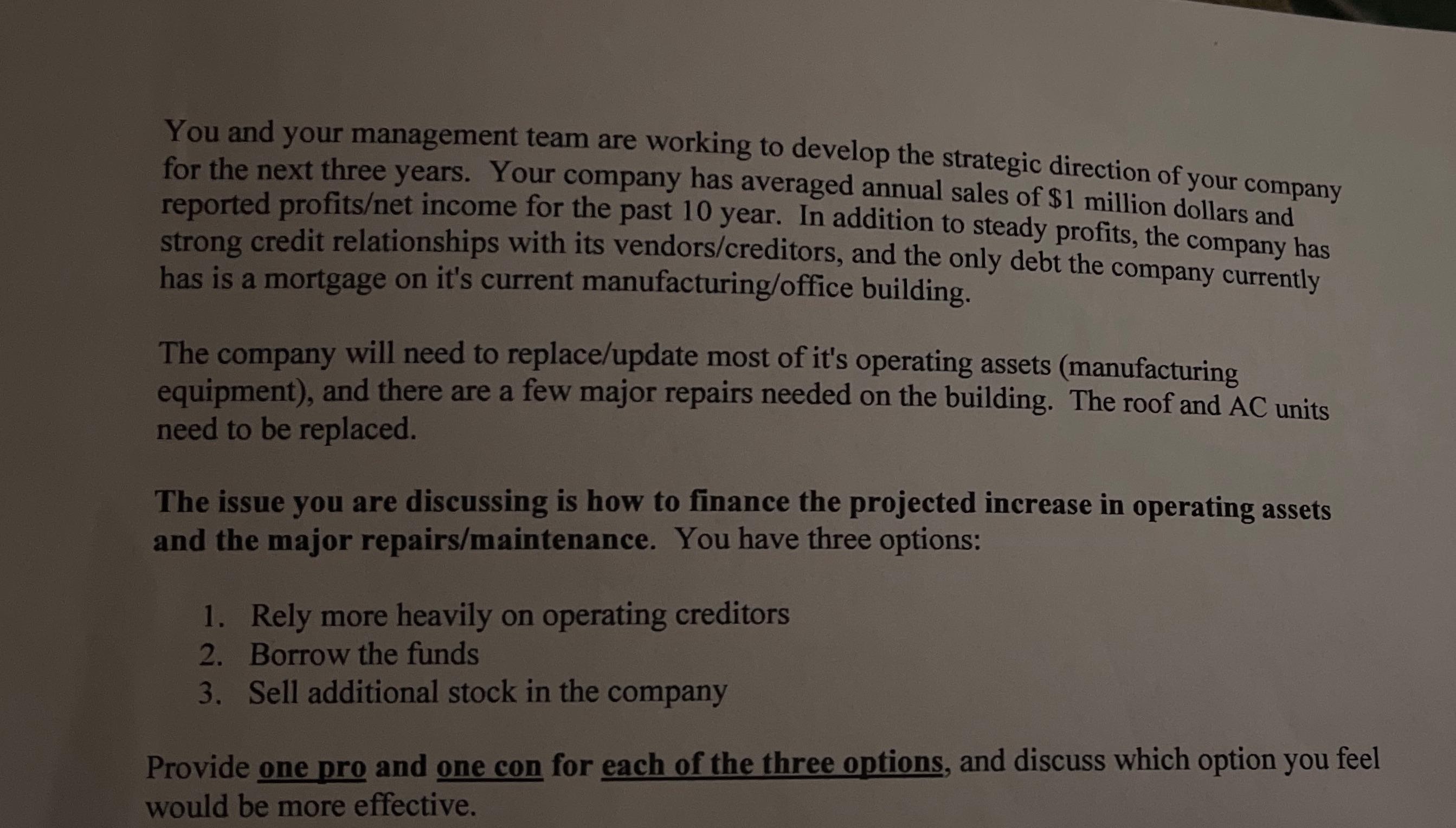

You and your management team are working to develop the strategic direction of your company for the next three years. Your company has averaged annual sales of $1 million dollars and reported profits/net income for the past 10 year. In addition to steady profits, the strong credit relationships with its vendors/creditors, and the only debt the company currently has is a mortgage on it's current manufacturing/office building. company has The company will need to replace/update most of it's operating assets (manufacturing equipment), and there are a few major repairs needed on the building. The roof and AC units need to be replaced. The issue you are discussing is how to finance the projected increase in operating assets and the major repairs/maintenance. You have three options: 1. Rely more heavily on operating creditors 2. Borrow the funds 3. Sell additional stock in the company feel Provide one pro and one con for each of the three options, and discuss which option you would be more effective.

Step by Step Solution

There are 3 Steps involved in it

Rely more heavily on operating creditors Pro Relying on operating creditors can provide a shortterm financing solution for the company without the nee... View full answer

Get step-by-step solutions from verified subject matter experts