Question: You answer question 5 by using information provided in question 4 QUESTION 5 20 MARKS REQUIRED Use the information provided in Question 4 to answer

You answer question 5 by using information provided in question 4

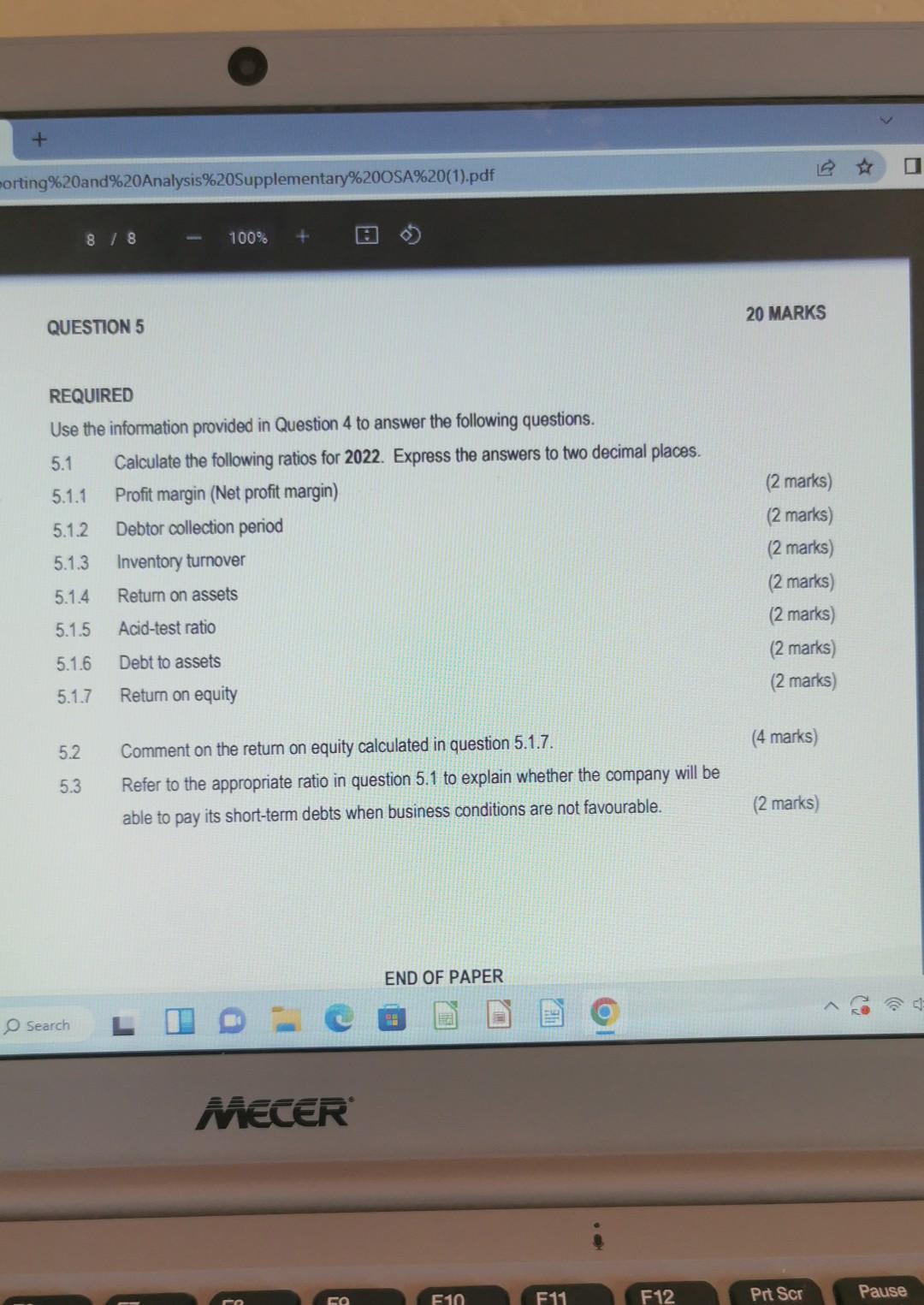

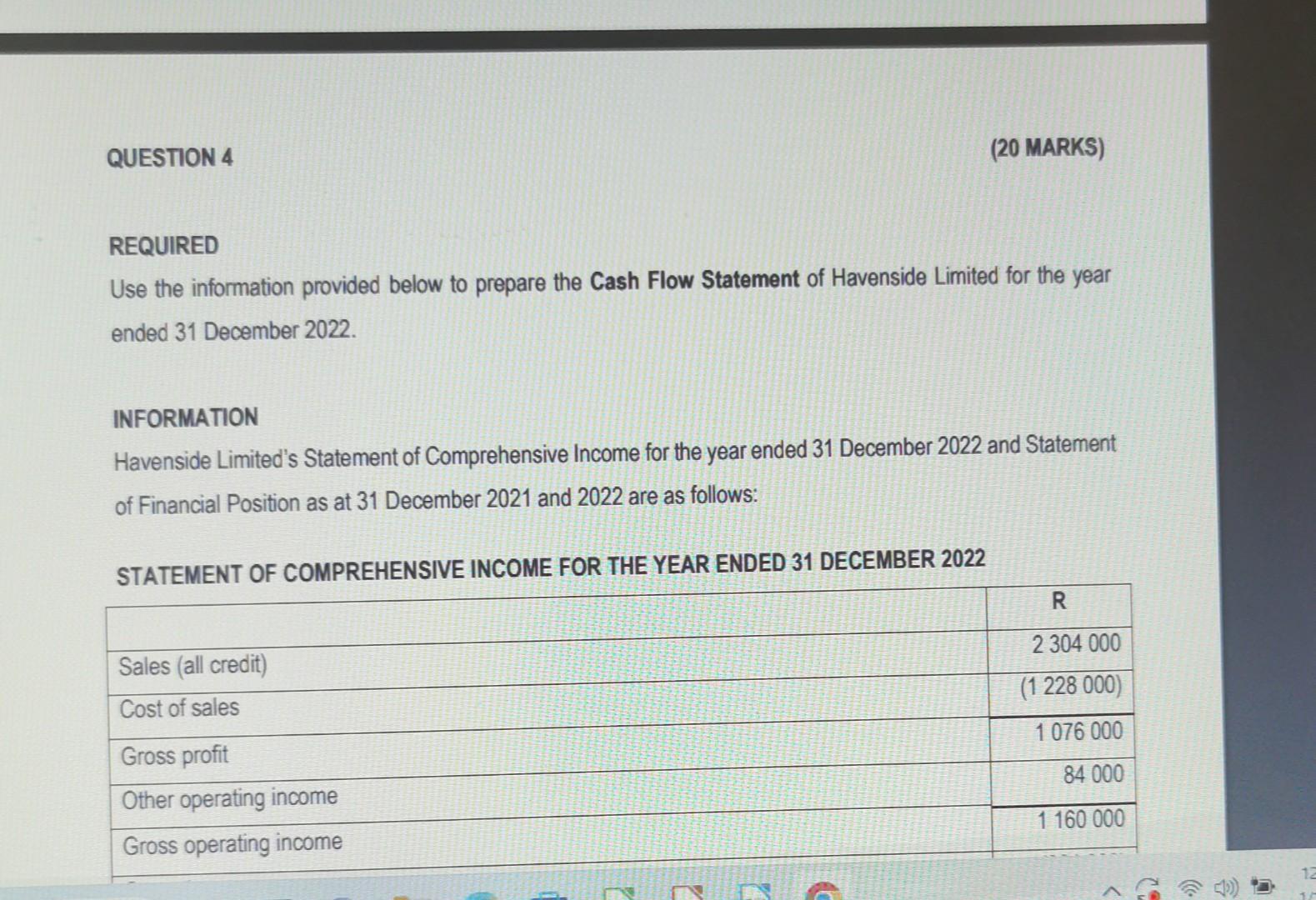

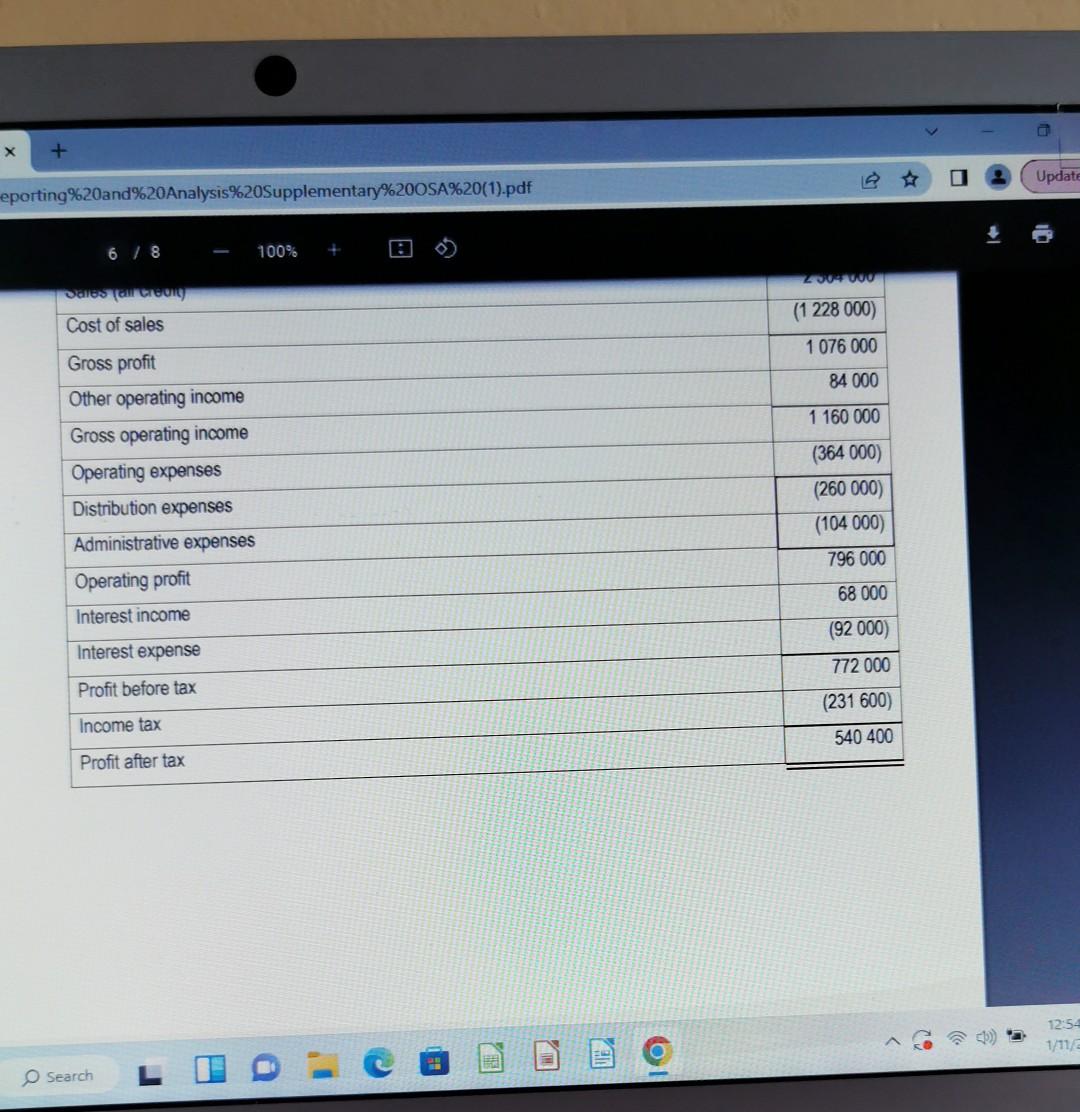

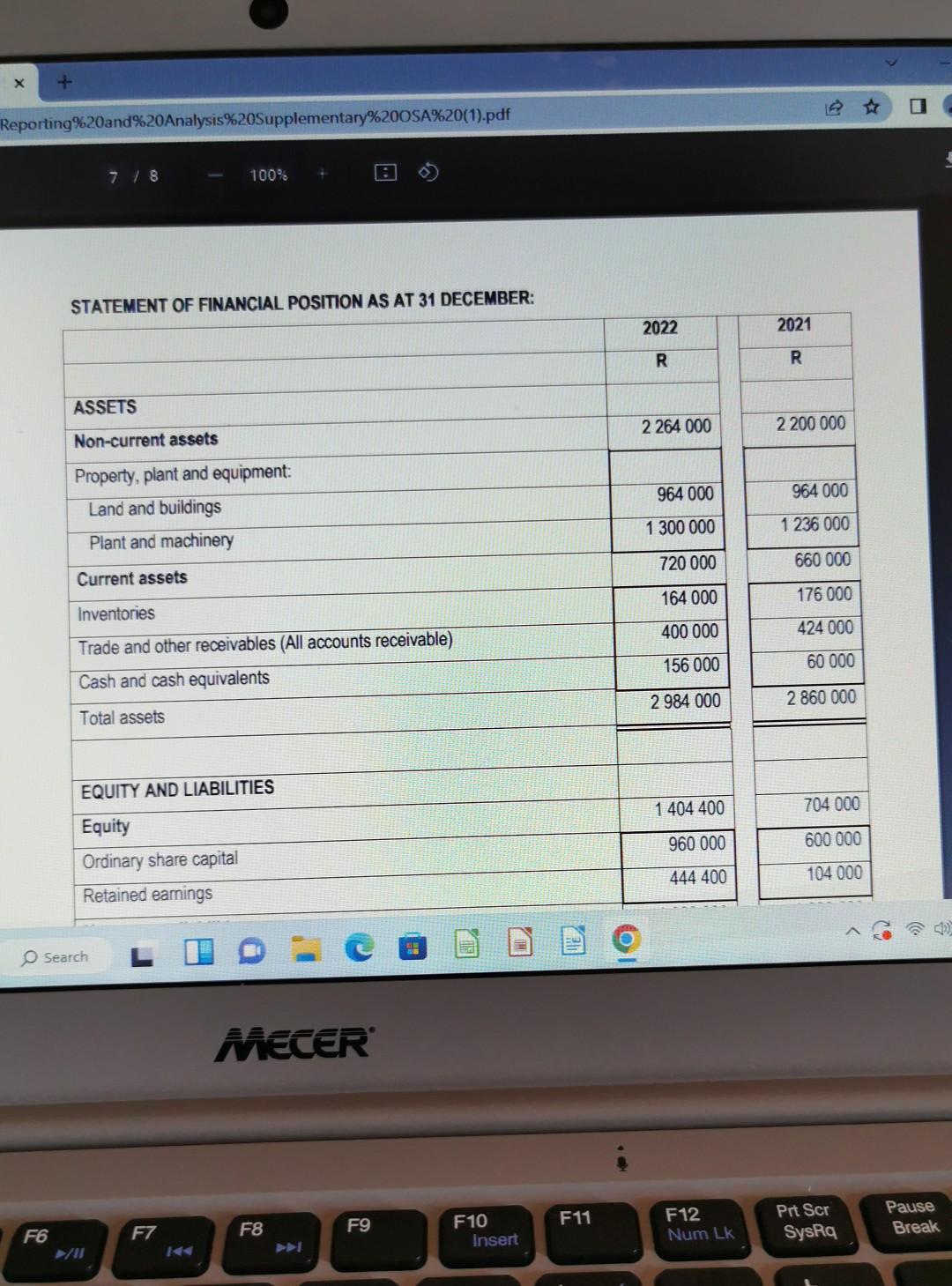

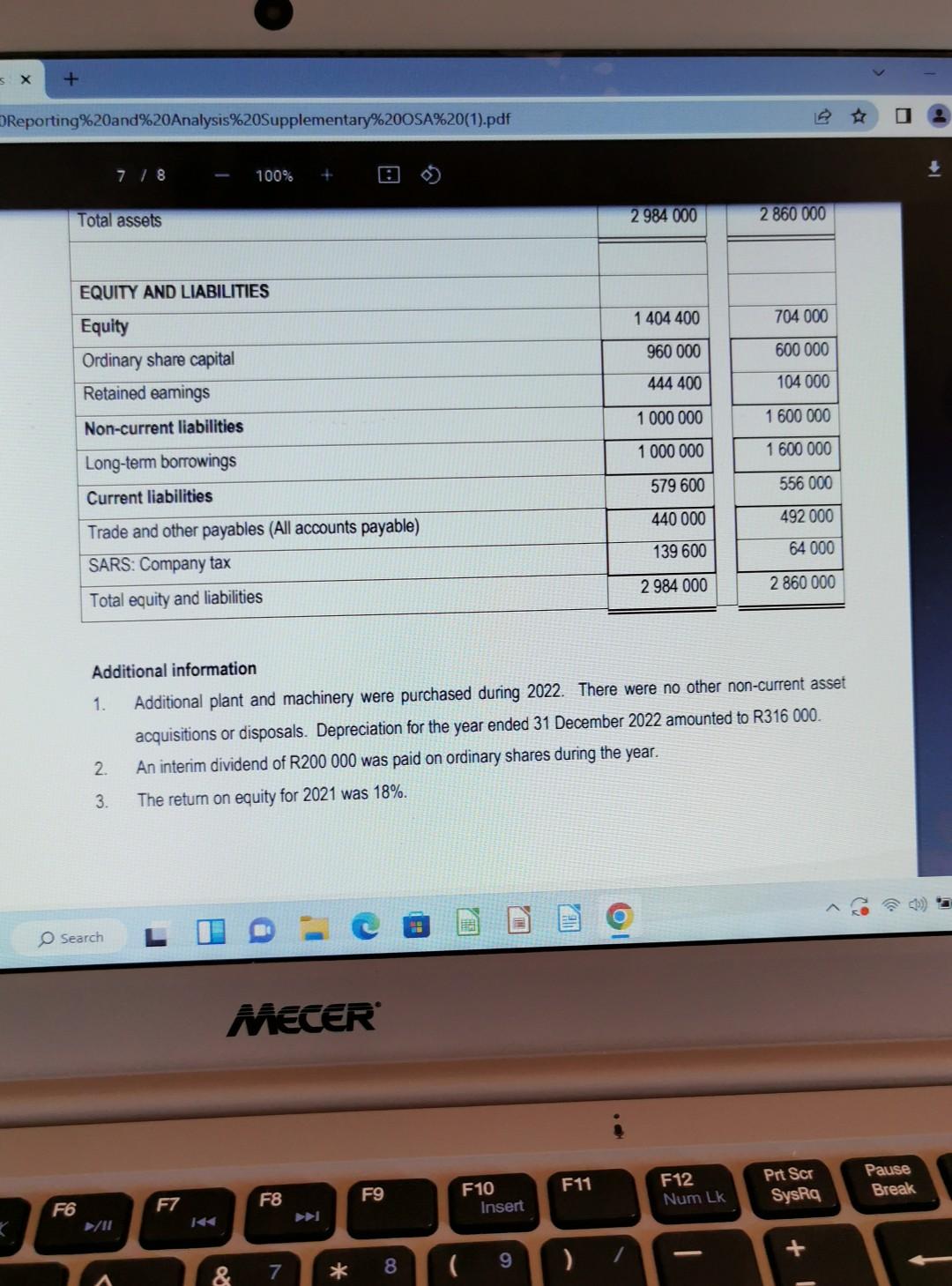

QUESTION 5 20 MARKS REQUIRED Use the information provided in Question 4 to answer the following questions. 5.1 Calculate the following ratios for 2022. Express the answers to two decimal places. 5.1.1 Profit margin (Net profit margin) (2 marks) 5.1.2 Debtor collection period (2 marks) 5.1.3 Inventory turnover (2 marks) 5.1.4 Return on assets (2 marks) 5.1.5 Acid-test ratio (2 marks) 5.1.6 Debt to assets (2 marks) 5.1.7 Return on equity (2 marks) 5.2 Comment on the return on equity calculated in question 5.1.7. (4 marks) 5.3 Refer to the appropriate ratio in question 5.1 to explain whether the company will be able to pay its short-term debts when business conditions are not favourable. (2 marks) END OF PAPER Search REQUIRED Use the information provided below to prepare the Cash Flow Statement of Havenside Limited for the year ended 31 December 2022. INFORMATION Havenside Limited's Statement of Comprehensive Income for the year ended 31 December 2022 and Statement of Financial Position as at 31 December 2021 and 2022 are as follows: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2022 eporting %20 and %20 Analysis\%20Supplementary \%200SA\%20(1).pdf STATEMFNT OF FINANCIAL POSITION AS AT 31 DECEMBER: Additional information 1. Additional plant and machinery were purchased during 2022. There were no other non-current asset acquisitions or disposals. Depreciation for the year ended 31 December 2022 amounted to R316 000 . 2. An interim dividend of R200000 was paid on ordinary shares during the year. 3. The return on equity for 2021 was 18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts