Question: You are a 28-year-old computer systems engineer and you just accepted your hrst job in New York. Before going back to school, you worked as

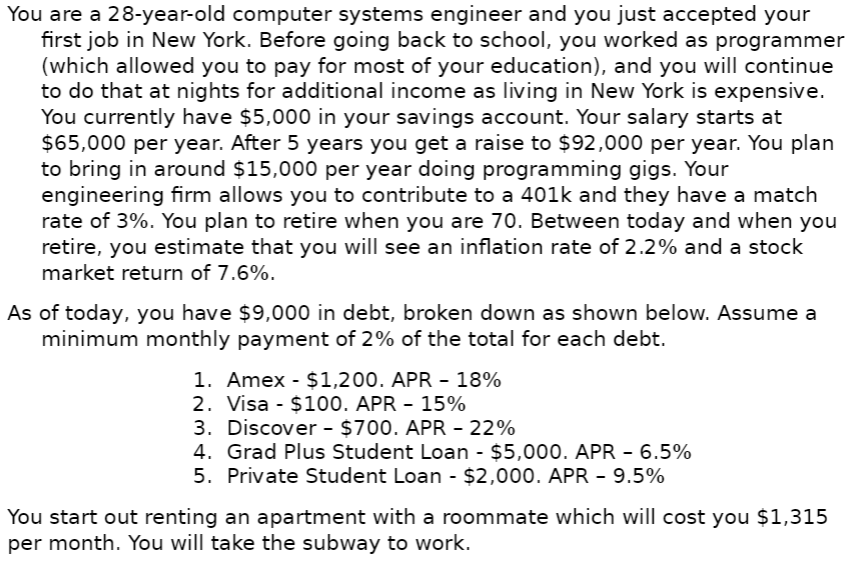

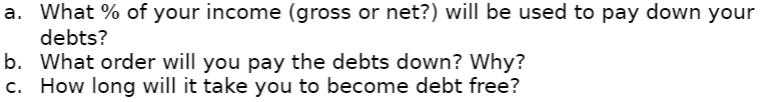

You are a 28-year-old computer systems engineer and you just accepted your hrst job in New York. Before going back to school, you worked as programmer (which allowed you to pay for most of your education), and you will continue to do that at nights for additional income as living in New York is expensive You currently have $5,000 in your savings account. Your salary starts at $65,000 per year. After 5 years you get a raise to $92,000 per year. You plan to bring in around $15,000 per year doing programming gigs. Your engineering firm allows you to contribute to a 401k and they have a match rate of 3%. You plan to retire when you are 70, Between today and when you retire, you estimate that you will see an inflation rate of 2.2% and a stock market return of 7.6%. As of today, you have $9,000 in debt, broken down as shown below. Assume a minimum monthly payment of 2% of the total for each debt. 1, Amex-$1,200. APR-18% 2. Visa-$100. APR-15% 3. Discover-$700. APR-22% 4. Grad Plus Student Loan-$5,000. APR-6.5% 5, Private Student Loan-$2,000. APR-9.5% You start out renting an apartment with a roommate which will cost you $1,315 per month. You will take the subway to work. a. What % of your income (gross or net?) will be used to pay down your debts? b. What order will you pay the debts down? Why? c. How long will it take you to become debt free? You are a 28-year-old computer systems engineer and you just accepted your hrst job in New York. Before going back to school, you worked as programmer (which allowed you to pay for most of your education), and you will continue to do that at nights for additional income as living in New York is expensive You currently have $5,000 in your savings account. Your salary starts at $65,000 per year. After 5 years you get a raise to $92,000 per year. You plan to bring in around $15,000 per year doing programming gigs. Your engineering firm allows you to contribute to a 401k and they have a match rate of 3%. You plan to retire when you are 70, Between today and when you retire, you estimate that you will see an inflation rate of 2.2% and a stock market return of 7.6%. As of today, you have $9,000 in debt, broken down as shown below. Assume a minimum monthly payment of 2% of the total for each debt. 1, Amex-$1,200. APR-18% 2. Visa-$100. APR-15% 3. Discover-$700. APR-22% 4. Grad Plus Student Loan-$5,000. APR-6.5% 5, Private Student Loan-$2,000. APR-9.5% You start out renting an apartment with a roommate which will cost you $1,315 per month. You will take the subway to work. a. What % of your income (gross or net?) will be used to pay down your debts? b. What order will you pay the debts down? Why? c. How long will it take you to become debt free

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts