Question: You are a currency trader considering covered interest arbitrage between the U . S . dollar ( USD ) and the euro ( EUR )

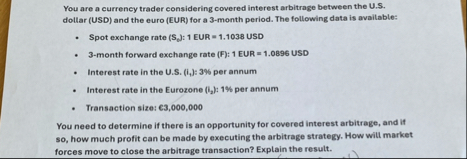

You are a currency trader considering covered interest arbitrage between the US dollar USD and the euro EUR for a month period. The following data is available:

Spot exchange rate : EUR USD

month forward exchange rate F: EUR USD

Interest rate in the USi: per annum

Interest rate in the Eurozone : per annum

Transaction size:

You need to determine if there is an opportunity for covered interest arbitrage, and if so how much profit can be made by executing the arbitrage strategy. How will market forces move to close the arbitrage transaction? Explain the result.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock