Question: You are a financial planner. Your client's primary objective is to finance her undergraduate studies costs as follow: today is January 1, 2022 and your

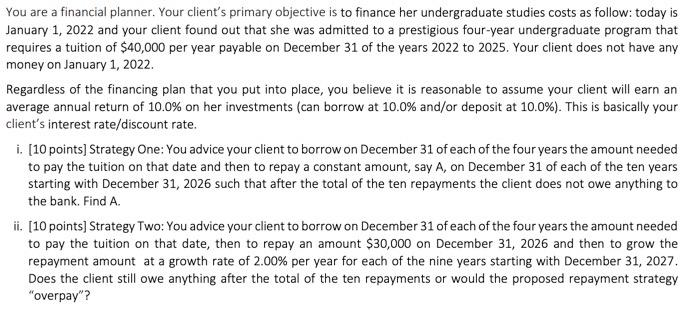

You are a financial planner. Your client's primary objective is to finance her undergraduate studies costs as follow: today is January 1, 2022 and your client found out that she was admitted to a prestigious four-year undergraduate program that requires a tuition of $40,000 per year payable on December 31 of the years 2022 to 2025. Your client does not have any money on January 1, 2022. Regardless of the financing plan that you put into place, you believe it is reasonable to assume your client will earn an average annual return of 10.0% on her investments (can borrow at 10.0% and/or deposit at 10.0%). This is basically your client's interest rate/discount rate. i. [10 points] Strategy One: You advice your client to borrow on December 31 of each of the four years the amount needed to pay the tuition on that date and then to repay a constant amount, say A, on December 31 of each of the ten years starting with December 31, 2026 such that after the total of the ten repayments the client does not owe anything to the bank. Find A. ii. [10 points] Strategy Two: You advice your client to borrow on December 31 of each of the four years the amount needed to pay the tuition on that date, then to repay an amount $30,000 on December 31, 2026 and then to grow the repayment amount at a growth rate of 2.00% per year for each of the nine years starting with December 31, 2027. Does the client still owe anything after the total of the ten repayments or would the proposed repayment strategy "overpay"? You are a financial planner. Your client's primary objective is to finance her undergraduate studies costs as follow: today is January 1, 2022 and your client found out that she was admitted to a prestigious four-year undergraduate program that requires a tuition of $40,000 per year payable on December 31 of the years 2022 to 2025. Your client does not have any money on January 1, 2022. Regardless of the financing plan that you put into place, you believe it is reasonable to assume your client will earn an average annual return of 10.0% on her investments (can borrow at 10.0% and/or deposit at 10.0%). This is basically your client's interest rate/discount rate. i. [10 points] Strategy One: You advice your client to borrow on December 31 of each of the four years the amount needed to pay the tuition on that date and then to repay a constant amount, say A, on December 31 of each of the ten years starting with December 31, 2026 such that after the total of the ten repayments the client does not owe anything to the bank. Find A. ii. [10 points] Strategy Two: You advice your client to borrow on December 31 of each of the four years the amount needed to pay the tuition on that date, then to repay an amount $30,000 on December 31, 2026 and then to grow the repayment amount at a growth rate of 2.00% per year for each of the nine years starting with December 31, 2027. Does the client still owe anything after the total of the ten repayments or would the proposed repayment strategy "overpay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts